Daily Fix: Traders unnerved despite warning signs in global economics

Market moves

In terms of price moves, it’s fair to say the session was an uninspiring one. The S&P 500 cash session saw the index open on its lows of 2982, before grinding to a high of 2999 (05:21 AEST) and ultimately tailing off to close unchanged on the day at 2991.8. Breadth has given us little to work with, with 53% of stocks higher, while volumes were 19.6% below the 30-day average. By way of leads for Asia we see S&P 500 futures -0.1% from 16:10 AEST (i.e., the ASX 200 official close), while Aussie SPI futures are -8p in the same period, indicative of an open in the ASX 200 closer to 6741. A move lower through 6717 (Fridays low) in the days ahead would be a bit of a concern for me.

S&P 500 implied vols are largely unchanged, with the VIX index sitting down 0.41 vols at 14.91%, while high-yield credit has narrowed a couple of basis points versus investment grade. We’ve seen some vol in German bunds, with the 10-year -6bp to -58.1bp, but this didn’t resonate for too long in US fixed-income markets, with UST twos and 10s unchanged at 1.68% and 1.72%, respectively. Gold has gained USD $5 into USD $1522, although, if you want precious metal exposure (in USDs), you’ve headed to silver. That’s rallied 3.7% on the day.

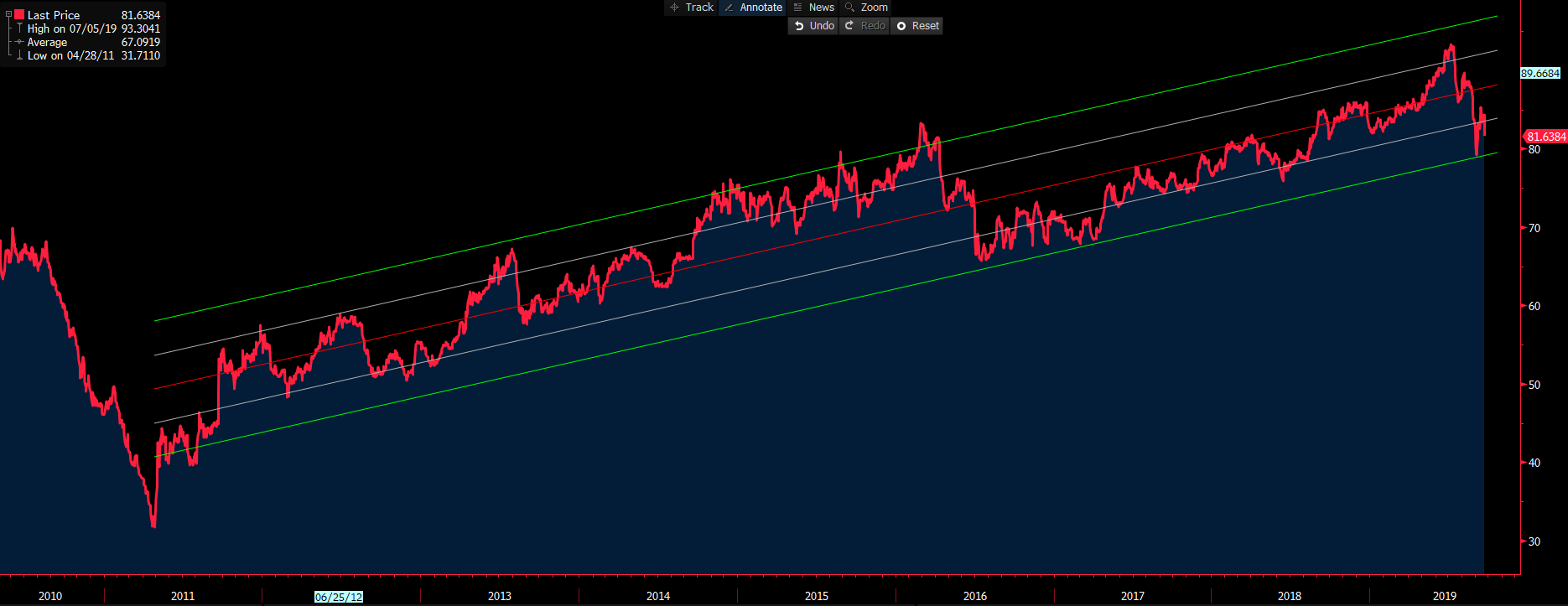

For those trading long/short (or pairs strategies), the gold/silver ratio looks interesting. While the primary trend is higher and the ratio contained in the regression from the bull move that started in 2011, the preference is we see a near-term test of the lower two standard deviation level (from the line of best fit).

"Source: Bloomberg"

WTI crude sits up +0.7% at USD $58.49, and Brent +0.3%, with traders eyeing narrative on the pace of Saudi Arabia to restore lost production amid headlines from the United Nations Council, specifically from the UK and France, on Iran’s involvement in the attack on the two oil-processing facilities.

Economic data concerns

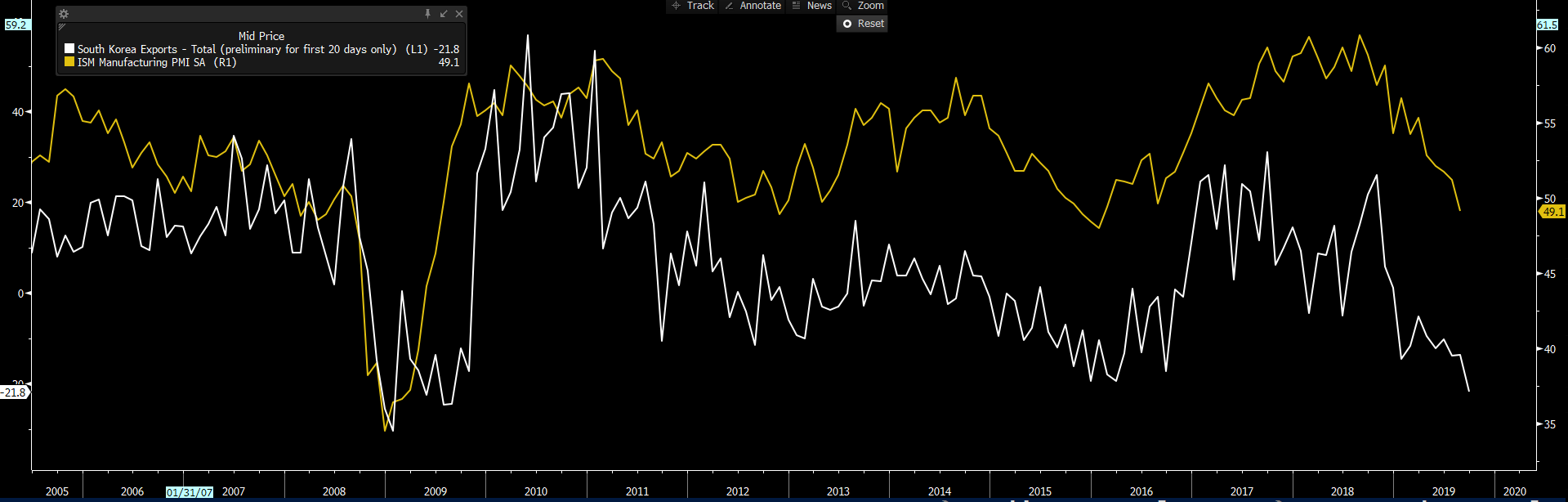

On the data front, there was much talk yesterday about South Korean exports falling 21.8% — the worst showing here since 2009, even if this was partly affected by changes to the scheduling of Chuseok Harvest Festival. Considering the similar path mapped out versus the US ISM manufacturing (yellow) over the years, we can see why traders have seen South Korean exports as a red flag for other geographies. We understand that US manufacturing is some 11% of its GDP. But if the market wants to see it, along with business investment and trade volumes as a true consideration when allocating capital, then it’s important to traders, too.

US ISM manufacturing vs South Korean exports

With US manufacturing on the mind, considering we saw the Markit US manufacturing report come in at 51.0 vs 50.4 eyed, with the Chicago Federal Reserve activity index at 0.1 vs -0.03. How does this play into the far more influential ISM manufacturing (due 2 October), which at this stage is expected to improve from 49.1 to 50.5, and could be quite influential in a market that’s seeing US data consistently beating expectations of late? Markets become sensitive to economic data when you have a data-dependent central bank — especially a market that’s focused on the idea that we could see the Fed organically growing its balance sheet again and cutting rates at the October FOMC meeting.

Of course, “QE lite,” as it’s being framed, is aimed at increasing liquidity due to depilation of reserves (rather than broad reflation). But one feels QE subtracts from the need for the Fed to cut rates on 30 October — a probability the market ascribes a 51.7% chance.

Event risk in the period ahead

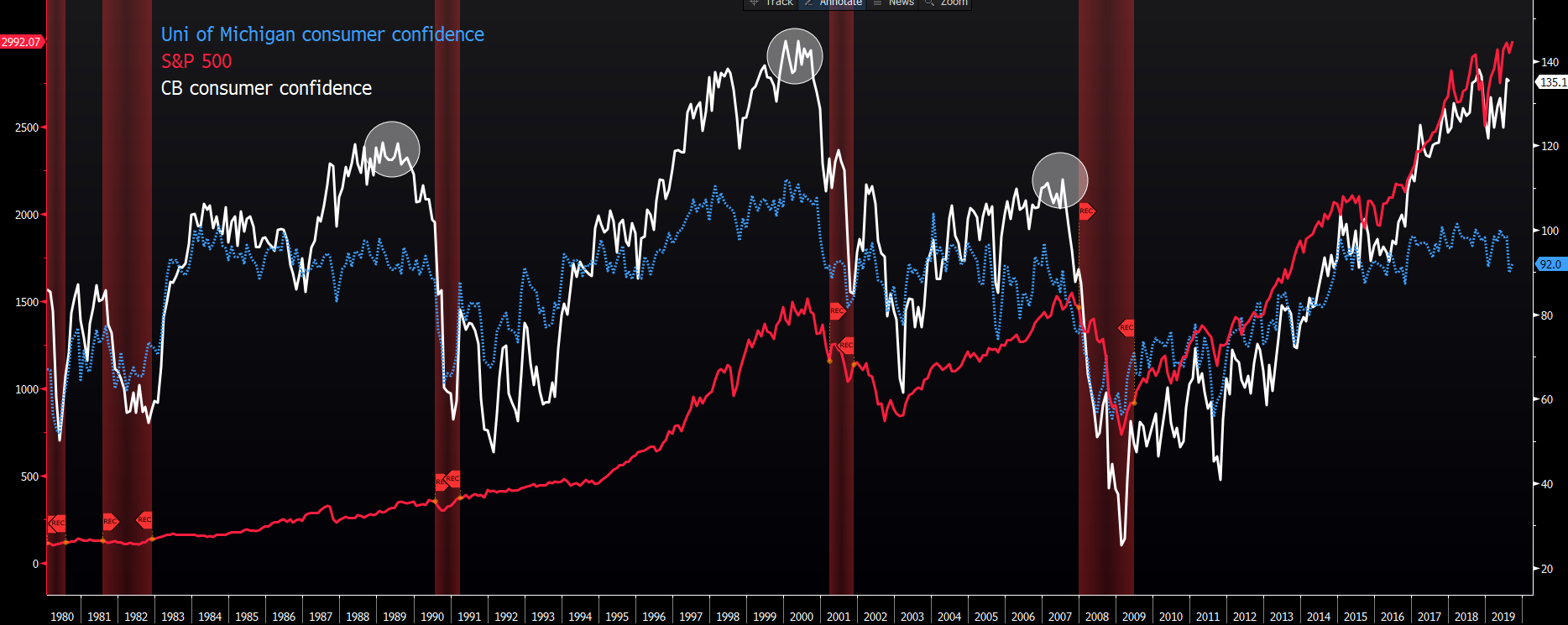

Looking ahead, we see the US Conference Board consumer confidence print (due 00:00 AEST) with expectations for a slight decline to 133.0 (from 135.1). This data point is still one of my preferred US recession trigger points even if it’s one of the more lagging indicators. As we can see, sharp pivots in consumer confidence haven’t just preceded recessions but have had a decent correlation with equity performance, too.

If US data is okay, the same can’t be said for Europe, which has gone on a similar path as South Korea. We’ve seen a warming to EUR longs of late, certainly against the AUD, NZD and NOK, but we see that call revisited. That said, EURUSD has lost a mere 0.2%, and is just holding under 1.1000, despite a suite of incredibly poor data points. German manufacturing printed 41.4 vs 44.0 eyed, which is obviously woeful, with the eurozone (preliminary) manufacturing PMI coming in at 45.6 — the lowest in 81 months. Services PMI came in at an eight-month low.

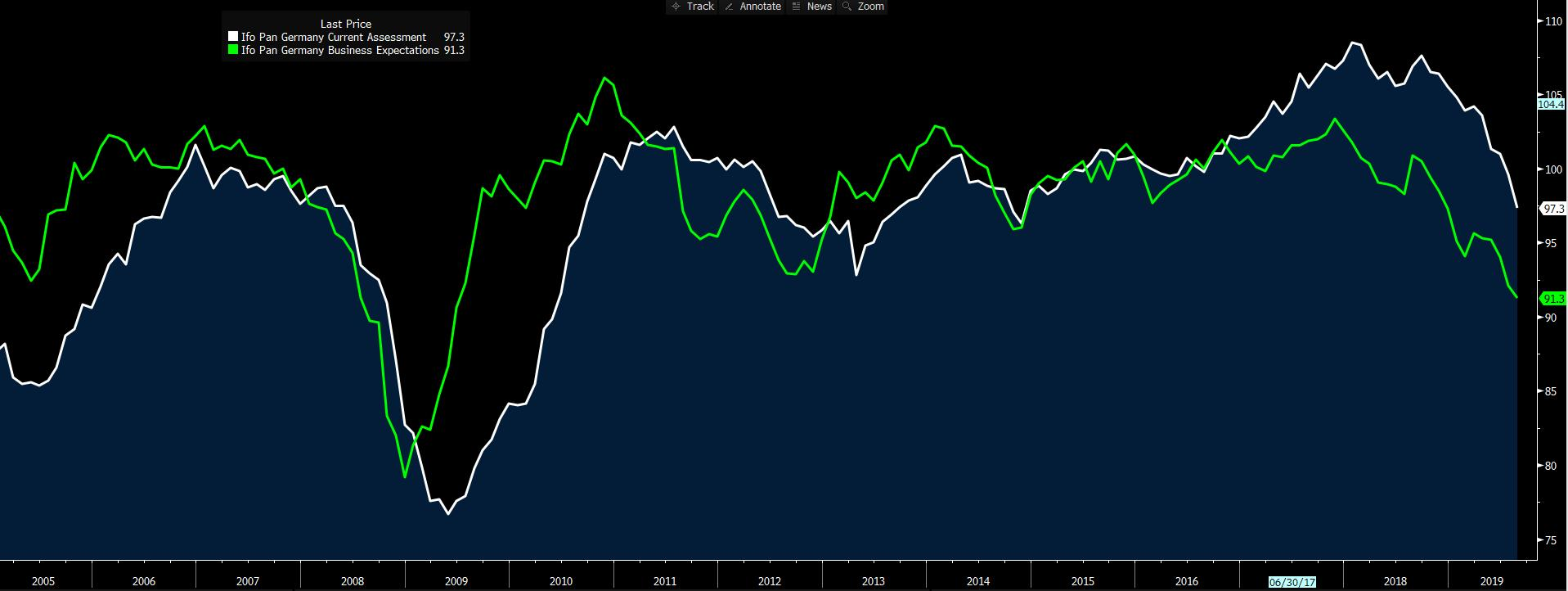

For those holding EUR exposures, consider today's IFO survey (18:00 AEST) to see if there’s an improvement here, which, if we look at the current consensus, is what’s expected. Poor numbers here. And we should see a retest of the 1.0960 to 1.0930 support zone.

Consider the correlation between the IFO business expectations (green) and German GDP. The survey is clearly influential, although if I look at the previous two releases we hardly saw a move in asset prices.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.