- English

- 中文版

China PMI and Aussie Q2 CPI in play

Of course, it’s all about the FOMC meeting. But traders have had to deal with Aussie Q2 CPI and China’s July PMI data through Asia today. The China data is a small risk positive but only in so much that it wasn’t worse than last month. At this juncture, there’s been no impact on markets. To say these numbers inspire is a stretch. Manufacturing PMI contracted at a slower pace to 49.7 (versus 49.6 eyed), although, if we look at the subcomponents, we saw improvements in new orders, as well as new export orders and output.

"Source: Bloomberg"

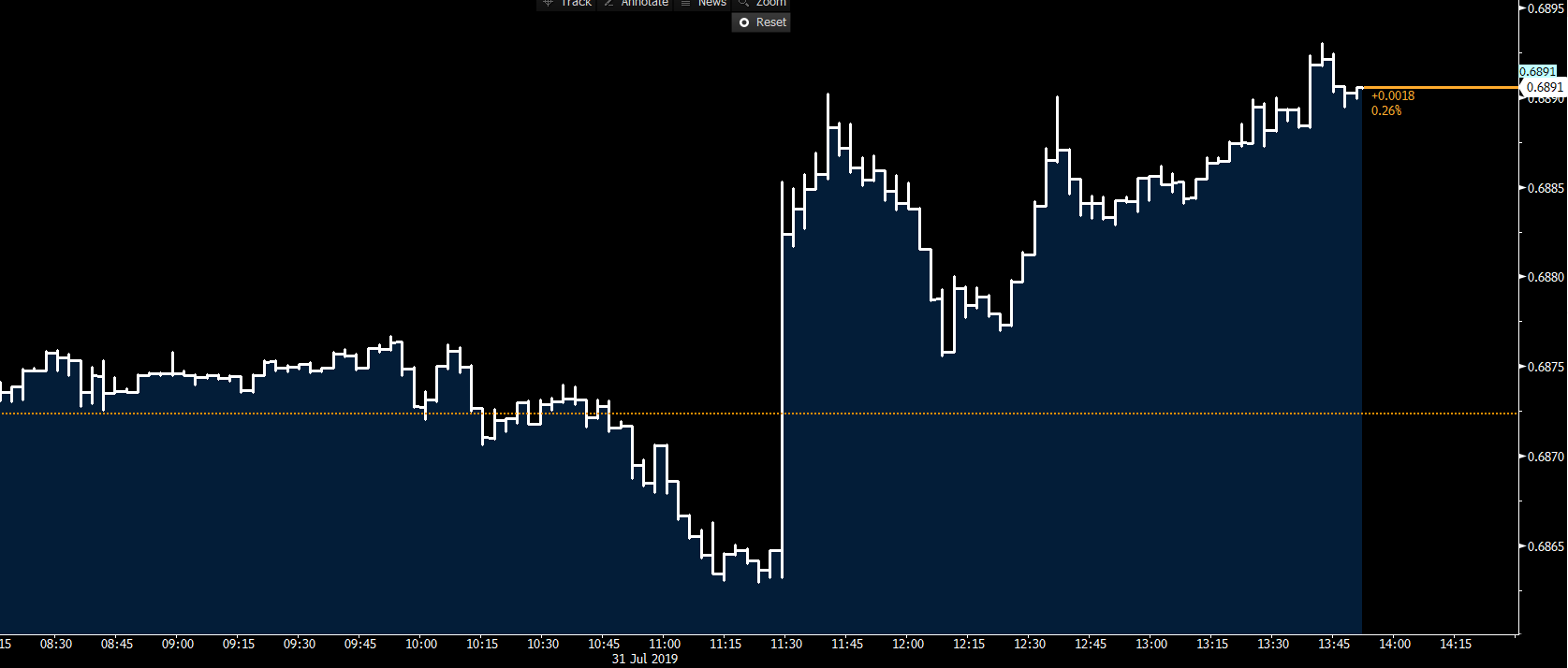

The Aussie Q2 CPI came out 30 minutes after the China data, with AUDUSD spiking 25 pips into .6890. As we can see from the interday chart, there seems to be a supply barrier here.

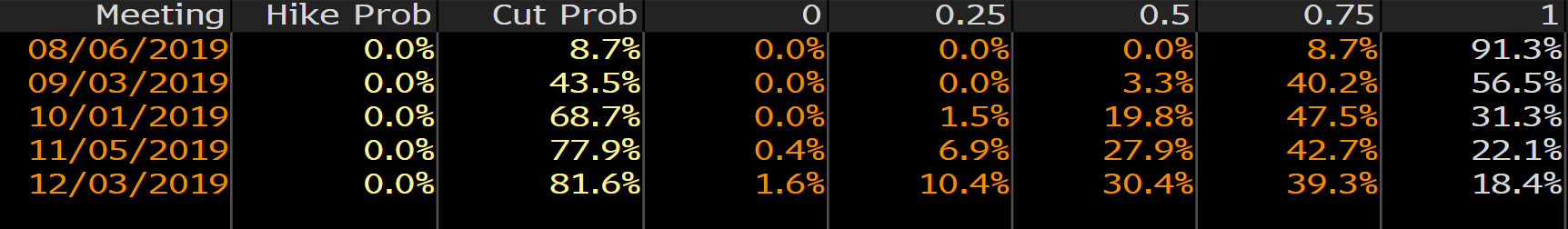

The fact core CPI remained unchanged at 1.6% (versus 1.5% expectations) doesn’t change the view we should get another rate cut this year. But it certainly fails to provide the RBA scope to go twice this year, and we’ve seen a slight repricing in rate-cut expectations for 2019. Given the moves, it’s clear traders went into the data very long Aussie Treasuries and short AUD into the release.

"Rate cut probability in Australia"

The calm before the storm?

One way I can look at traders anticipated price moves is through FX implied volatility (IV). Take USDJPY one-day IV; this sits at 11.38%, which, to put context on this level, 11.38% is the 53 percentile of the 12-month range. So, given we’re talking about an event that so many have talked about for weeks, if not months, it probably seems a tad low. We can apply this IV into the Black-Scholes model (with other variables) to understand the market sees, with a 68.2% degree of confidence, a 50-pip move on the session (higher or lower) from the current spot price of 108.5. I can increase this confidence factor to 90%, and see the market feels moves won’t exceed 70 pips. We can effectively use this as a guide for risk and position sizing.

Levels to watch in USDJPY

I’m not one to advocate trading over this sort of event risk; the variance in the playbook is just too diverse that a high-probability trade is unclear. However, in G10 FX, USDJPY is probably the purest play on the Federal Reserve meeting as it tracks two- and five-year US Treasuries the closest. With the sort of move expected, it feels like fading rallies into 109.10/20 or buying pullbacks into 108.00/107.90 is the more compelling trade — adopting a mean reversion strategy. Of course, we’ll be watching gold, US equities and USD pairs more broadly, not to mention EM assets that are going to be very sensitive to the language.

Maybe the market is wrong with its view that the Fed meeting won't cause too great a stir. But this is why traders buy volatility. It feels as though everyone’s positioned for a 25bp cut, however, and this will be sold as an insurance cut predominantly to meet the market and keep the dream alive. Of course, we may see 50bp and, subsequently, we may see a short, sharp burst of USD selling, with the yield curve steepening, and gold and equities going on a bullish run. But for a sustained reaction, the Fed would need to offer insight that they plan to go again.

A more simplistic approach

Don’t underestimate the fact that fed fund futures are pricing in 66bp of cuts by December. So, two cuts and a 65% chance of a third. At a very simplistic level, therefore, for the Fed to get ahead of market pricing, they’d need to go 50bp and offer a view they’re prepared, if needed, to go again this year. Anything less won’t meet the market.

The disaster situation

Of course, they could leave the fed funds rate unchanged — a fate some 11 of 86 economists (polled by Bloomberg) feel is possible. And, of course, there’s logic here given US GDP is growing around trend, consumption rosy, with the consumer feeling fairly content. We can even see housing is fine and labour market in rude health. We also saw a slight uptick in core PCE, although it's still too low at 1.6%. But it’s the supply side that’s concerning; it’s the notion that falling business investment is going to feed into hard data, at a time when global trade volumes are looking uninspiring.

The question of whether a 25bp cut actually achieves anything other than meeting market pricing, and risks having the market throw a wobbly should they not go at all, has come up a few times today. I feel the answer’s no, and this measure certainly doesn’t feed into Fed Chair Jerome Powell’s recent comment that “an ounce of prevention is worth a pound of cure” — where one’d argue a 50bp cut is more suited to meet this statement, married with an outlook that gives us a belief we may see another cut in September.

Ex-New York Fed President Bill Dudley caused a stir overnight, detailing in an op-ed piece for Bloomberg that he thinks it’s a one-and-done. That marries with the view of former Fed Chair Janet Yellen.

After the wait, all the hype and speculation, we finally get a chance to hear the aggregated views of the central bank and see if they’re prepared to set policy as the markets have priced. While implied volatility is unsurprisingly elevated, the market is convinced it’ll hear what it wants to hear. That’s no glaring surprises. Let’s see.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.