CBA FY 2025 Earnings Preview: Key Expectations for Traders and Market Impact

For more information on trading Australian share CFDs head to the website.

Overview

- Market Impact: CBA, with a market cap of $296.6 billion, holds significant weight in the ASX200, making it a major player in the Australian equity market. It commands a 11.2% weight in the ASX200, meaning CBA’s earnings report and subsequent share price movements can significantly impact the broader market, especially as other banks report later in the year.

Why CBA’s Earnings Matter for CFD Traders

- Influence on AUS200: With such a large market cap and weight in the ASX200, any significant price movement in CBA can lead to notable fluctuations in the index.

- Future NIM (Net Interest Margin) Concerns: Traders will be closely watching CBA’s guidance on NIMs, especially in light of expected rate cuts by the RBA (Reserve Bank of Australia). The market expects NIM to peak in 2026, with cost pressures impacting overall earnings.

- Dividends & Cash Earnings: The market anticipates CBA’s cash earnings to rise by 4.6%, with a final dividend of $2.60, bringing the total FY dividend to $4.84 (79% payout ratio).

- Implied Volatility The options market is pricing in a -/+2.3% move for CBA’s earnings announcement, which could influence the ASX200 by 0.3%. While CBA doesn’t typically experience massive volatility on earnings days, the high implied move is linked to its lofty valuation and positioning.

With ANZ, NAB and WBC only putting out a quarterly trading update and not reporting FY2025 numbers until November, it’s possible that if CBA were to have an outsized move on Wednesday, the reaction could feed into similar moves in the other 3 banks – this is where the real risk for traders in AUS200 exposures kicks in.

What to Look for in the Earnings Report

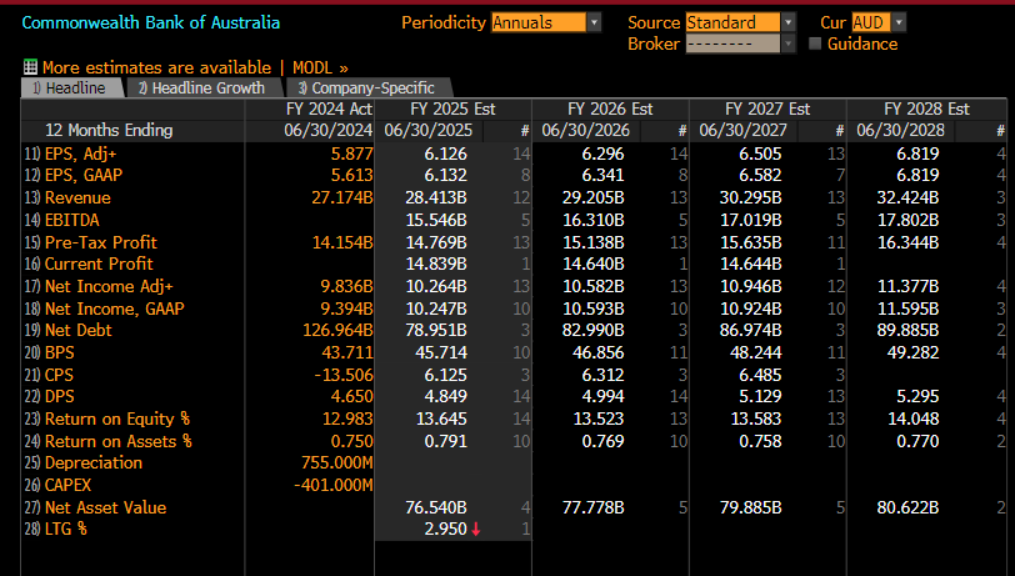

This table (source: Bloomberg) shows the median estimate, or essentially the consensus expectations from the analysts who cover CBA.

- Cash Earnings: Expected to increase by 4.6% to $10.26 billion.

- Net Interest Margin (NIM): Expected to remain stable at 2.08%, with FY2025 NIM up by 9 basis points to 2.08%.

- Return on Equity (ROE): Expected to be 13.65%.

- Dividend: A final dividend of $2.60, for a total dividend of $4.84.

- Bad and Doubtful Debts: Expected to remain low at 0.07% of gross loans.

The Valuation Premium

CBA trades on a 28x forward P/E ratio, one of the highest among global banks. Given its valuation, there are high expectations for the bank to meet or exceed its earnings targets, or face potential downside pressure.

Asset Quality

- CET1 Ratio: Expected to be 12.4%, indicating an incredibly strong capital position.

- Asset Quality: CBA’s asset quality remains strong, with bad and doubtful debts expected to be 0.07% of gross loans and provisions at 1.4%.

Conclusion

Traders should expect a solid performance from CBA, but with the bank's large market cap and impact on the ASX200, any major surprise or deviation from expectations could have widespread implications for the Australian financial sector and broader equities.

With a lofty valuation and elevated expectations, CBA’s FY2025 earnings will be a key event to monitor this week.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.