- English

- 中文版

Catastrophic CPI Poses BoE and GBP A Headache

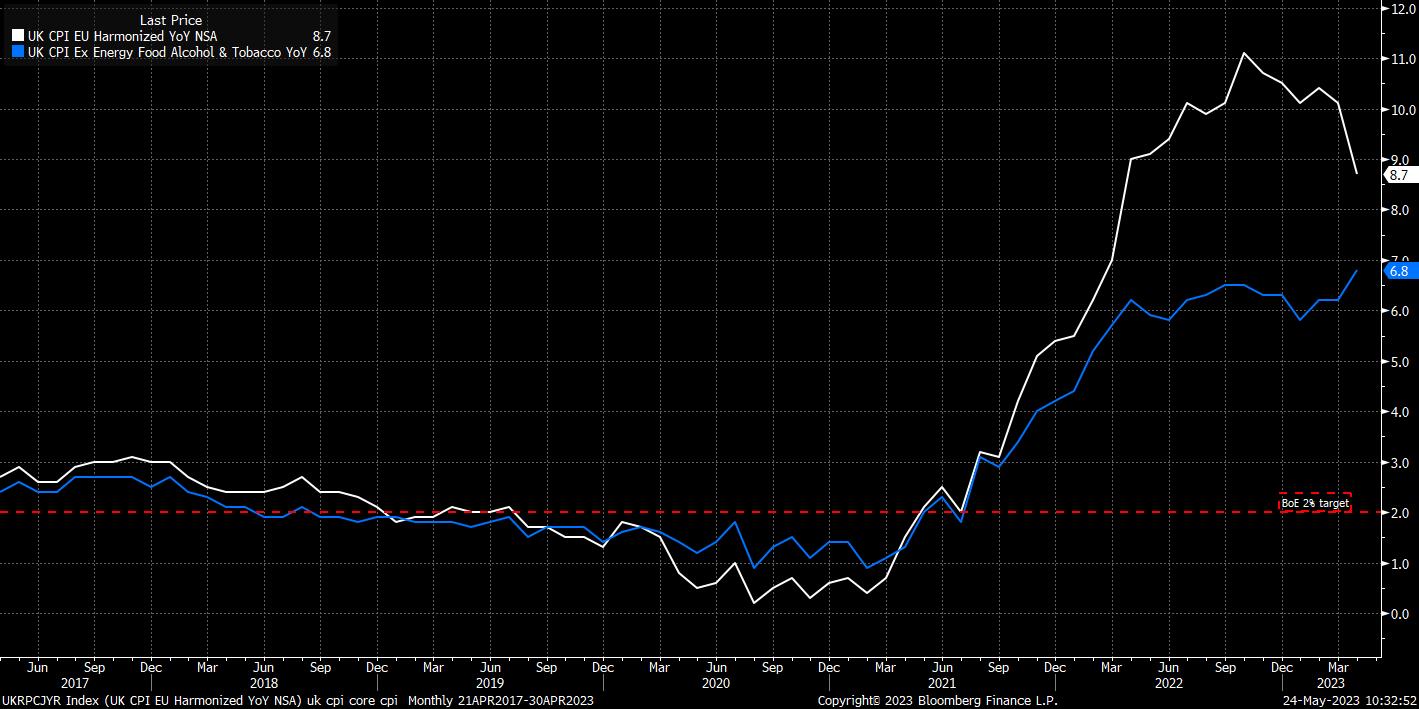

Headline CPI rose by 8.7% YoY in April. While lower than the 10.1% seen a month prior, the figure was considerably above the 8.2% consensus, and even more disappointing when one considers that almost the entire decline came by virtue of the base effects from last year’s sharp rise in energy prices, rather than any disinflationary forces currently within the economy. Food inflation remains the primary issue, rising a whopping 19.3% YoY.

Stripping out energy and food prices, however, paints no better a picture. Core CPI surged 6.8% YoY last month, the fastest pace since the early-90s, and above all estimates submitted to both Bloomberg and Reuters.

Furthermore, both metrics are considerably above the BoE’s own forecasts; Governor Bailey’s Tuesday comments that “inflation has turned a corner” are now looking very premature indeed.

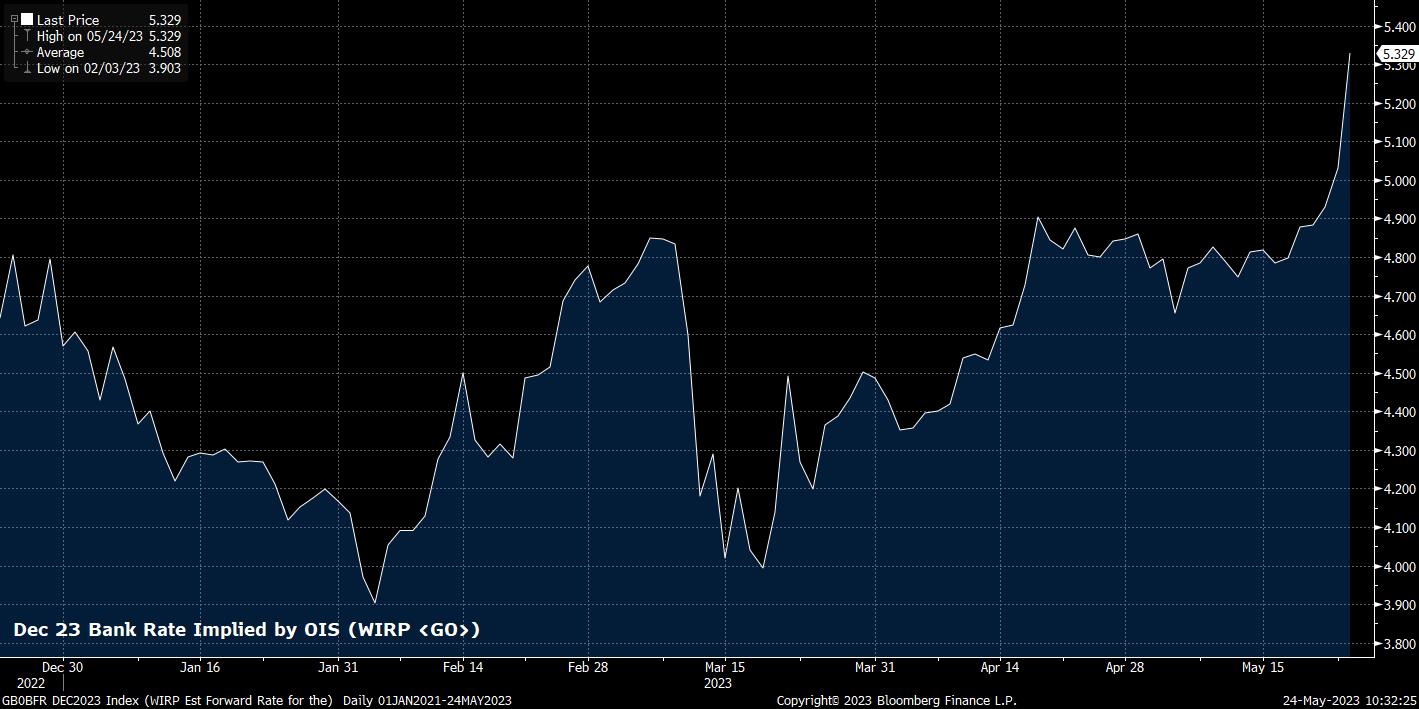

Unsurprisingly, the market has undergone a significant hawkish repricing since the data dropped. Money markets now price 30bps of tightening for the June MPC decision, fully expecting another 25bps move, plus assigning a roughly 1-in-5 chance that the BoE plump for a larger 50bps hike. Looking further ahead, markets now envisage Bank Rate peaking at 5.35% at the end of the year, up from around 5% a week ago.

Of course, the last time that markets were expecting a terminal rate around these levels was during the fall-out from PM Truss’ disastrous ‘mini-budget’. In contrast to then, the pricing feels a lot more realistic this time around, though it’s important to consider that with the BoE set to continue hiking in 25bp clips, the economy is likely to lose momentum rather too quickly to permit such a degree of tightening. Expecting a peak rate around 5% may be more realistic.

It's also important not to jump to conclusions digesting the disastrous inflation figures. There is another inflation report due before the next MPC, which will likely have a more significant impact on the decision that the Committee take.

Despite this, it is hard to argue against the UK economy being in ‘stagflation’ at this point – inflation remains high, and rising; signs of softness are beginning to emerge in the labour market; and, incoming activity data pointing to, at best, anaemic economic growth. This poses a significant headache for the BoE, one largely of their own making, and leaves few good options.

Doing nothing from here on in will only serve to make the inflation problem worse; modest further tightening would likely have little-to-no impact on inflation, but will dent economic growth; a significant degree of additional hikes, in line with market pricing, would likely have an impact on inflation, but also destroy the demand side of the economy. In short, the ‘Old Lady’ is stuck between a rock and a hard place.

Laying things out like this, it’s tough to be bullish on the GBP over the medium-term.

_2023-05-24_10-31-18.jpg)

Cable’s recent rally has rather run out of steam, with the 1.27 handle proving too much of a stretch for the quid. Since, price has fallen back into the broad 1.19 – 1.25 range which has been in place since the end of 2022, having also closed below the 50-day moving average for two days running, flipping momentum in the bears’ favour.

Shorts will be targeting a break of the recent lows at 1.2380 in order to continue recent downside momentum; a move towards the mid-1.22s seems plausible, particularly considering the hawkish Fed repricing that continues to act as a tailwind for the USD.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.