- English

- 中文版

Bitcoin Price Outlook: Confidence Falters After Flash Crash as Key $100K Level Holds

Market Confidence Shaken After the Flash Crash

The crypto “flash crash” on 10 October rattled sentiment across the digital asset landscape, leaving many in the crypto trading ecosystem hesitant to re-enter the market. Restoring real confidence will take time — though a Bitcoin price rebound and lower levels of realized volatility could help improve sentiment and attract increased buying flows.

Currently, Bitcoin’s daily chart shows rallies capped at the 5-day EMA, with buyers showing little enthusiasm to push the price back above the former breakdown point near $107K. Bulls continue to defend the psychological $100K level, and whether this area becomes a sustainable floor — forming a platform for a future move higher as liquidity improves — remains the central question.

However, traders must remain vigilant: a daily or weekly close below $100K would carry significant technical implications.

Key Technical Levels: $100K Support vs. 50-Week SMA

The weekly timeframe offers a clearer perspective on Bitcoin’s recent breakdown. Price action looks set to close the week below horizontal support at $107K, drawing attention to the 50-week simple moving average (SMA) - a key trend filter that has guided the uptrend since 2023.

Pullbacks to this long-term moving average have previously marked powerful upside reversals — notably in October 2023, August 2024, and April 2025. While the historical sample size is small, these past rebounds highlight the SMA’s significance as a trend-defining support zone.

A weekly close below the 50-week SMA would serve as confirmation that institutional and “whale” participants remain on the sidelines, raising the risk of a deeper decline through the June lows around $98,141. Despite a deep-seated trader bias toward buying Bitcoin dips, it’s worth remembering that momentum and trend can cut both ways — downside momentum can feed on itself just as powerfully as rallies do.

Liquidity, Confidence, and Institutional Flow

Bitcoin remains a liquidity-sensitive, high-beta momentum asset — but above all, it is a confidence trade. Right now, confidence is notably lacking.

Volatility and erratic price action are dictating terms, and spot and derivatives flows remain too thin to suggest an imminent, sustained bullish reversal.

ETF data reinforces this narrative: we’ve now seen six consecutive days of outflows across major Bitcoin ETFs, confirming that institutional investors and fund managers continue to rotate capital toward the higher-quality end of the investment universe.

On-Chain and Derivatives Signals

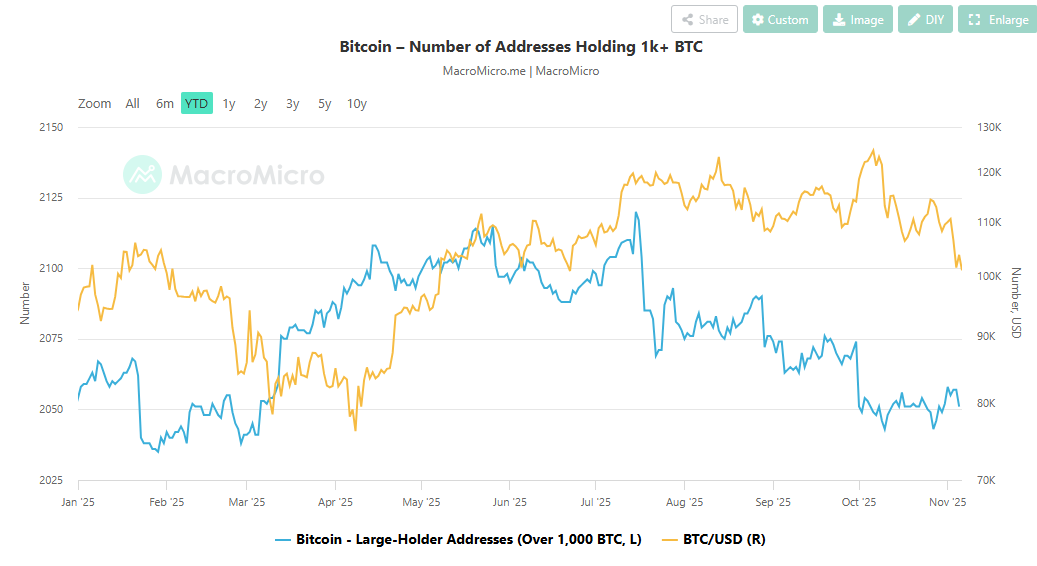

On-chain data provides additional insight into waning confidence. The number of large wallet holders — addresses holding over 1,000 BTC — has fallen from 2,117 in July to 2,057, underscoring reduced whale participation.

Meanwhile, funding rates in perpetual futures have declined, reflecting a flush-out of leveraged long positions and a reset in speculative appetite.

Publicly listed Bitcoin treasury entities are also feeling the heat. Notably, MicroStrategy’s equity — often seen as a leveraged proxy for BTC exposure — is down 48% from its July highs, amplifying pressure on sentiment.

The Road Ahead: Key Catalysts for a Reversal Higher

The stage is set for a decisive move

• A downside break and close below $100K, coupled with a weekly close under the 50-week SMA, would likely accelerate the drawdown, forcing more potential buyers to the sidelines.

• Conversely, a rebound above $107K–$110K, supported by ETF inflows, an improving BTC/gold ratio, and 30-day realized volatility falling toward 30%, would signal a renewed risk-on environment.

A potential macro catalyst could come from improved liquidity conditions, particularly if the U.S. Treasury runs down its Treasury General Account (TGA) — injecting fresh reserves into the system. For now, however, Bitcoin remains range-bound, sentiment-driven, and liquidity-conditions a headwind for risky assets— and until confidence returns to the crypto markets, rallies are likely to be sold rather than sustained.

Bottom Line:

Bitcoin’s post-crash landscape is defined by fragile confidence, key technical inflection points, and a cautious institutional tone. The $100K and $107K levels are critical — holding one could restore stability, losing the other could reignite the selloff.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.