Australia Market Outlook: Key Risks, RBA Cuts, and Election Impac

Key Event Risks in Play:

• 25 March – The FY2026 Federal Budget

• 26 March – Aus Monthly (Feb) CPI

• 1 April – RBA Meeting

• 2 April - Trump's reciprocal tariff announcement ('Liberation Day)

• 17 April – Aus employment report

• 30 April – Q1 CPI

• 14 May – Q1 Wage Price Index

• Australia Federal Election - 3, 10 or 17 May

• Westpac, ANZ and NAB 1H25 earnings (reports due 5-8 May)

• 15 May - Aus employment report

• 20 May – RBA Meeting and Statement on Monetary Policy

Modelling the Impact of Trump Tariffs on Australia

Trump’s suite of tariff announcements (due on 2 April) is arguably the dominant near-term macro risk for global markets and has the potential to become a highly disruptive affair.

Trump has signalled that sweeping tariffs are set to be announced in the form of reciprocal (both on import tariffs and VAT/GST), universal, and country-specific tariffs (China). Trump has coined this as the US’s “Liberation Day” and when announced will set off a period of intense negotiations.

In the case of Australia, we’ve already seen 25% tariffs implemented on steel and aluminium exports, and reports (source: AFR) suggest Australia could face further tariffs of between 2% and 8% on around $30b of exports to the US. That is unless Anthony Albanese can win a reprieve.

With Australia imposing comparatively lower tariff weights on US imports and with a low share of exports as a % of GDP to the US, the Australian economy should be in a relatively better position to withstand any tariff increases than many other DM economies, even adjusting for the GST.

Given the potential for limited direct economic damage from tariffs, perhaps the bigger influence on Aussie equity and the AUD will stem from more deep-reaching tariffs placed on China and the impact on commodity prices and Australia’s terms of trade – subsequently, if we were to see increased volatility in the yuan or Chinese equities then that could spill over into volatility and even trends in the AUD too.

Will Australia’s Federal Election be a Volatility Event for the AUD or ASX200?

With a focus on domestic risk, on 25 March the government lays down its FY 2026 Federal Budget – not likely a market mover for the AUD or Aus equity given we could feasibly get a change of government by May, who will then lay out a new budget of their own.

With the ALP currently behind in the polls, the budget will need to hit the sweet spot with swing and undecided voters, and we therefore expect another stimulatory budget heavily targeted towards the cost-of-living concerns. Childcare assistance, an extension of the electricity rebate, as well as housing supply, migration and infrastructure will be front of mind.

The date of the Federal election has not yet been officially called, but we can assume that it will fall on either the 3, 10, or 17 May. Australian elections are seldom volatility events for markets – however, this election does have real significance for the AUD, Aussie interest rates and equities.

With the significant increase in government spending over the past 12 months explaining all of Australia’s GDP and the bulk of job creation, fiscal largess has been instrumental in shaping Australia’s headline GDP and unemployment rate. Private sector growth and job creation, however, is not as rosy and holds anaemic levels. Subsequently, should we get an election outcome that increases the perception of a sharp slowdown in government spending – such as we saw in 2010 with the Gillard-led minority govt – then market players would see increased downside risk to Australia’s growth, which would ultimately mean the RBA would be tasked to do more with monetary policy to boost demand and support business confidence.

A minority government is a possibility, and should it materialise could increase expectations of future RBA rate cuts and a scenario that underprices the election as a volatility event for the AUD and ASX200 equities.

Is the RBA set to cut Rates Days After the Election?

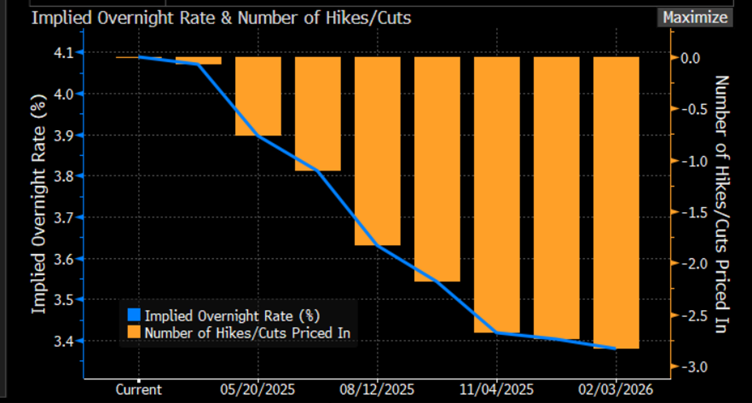

Just a few days after the Federal election traders navigate the May RBA meeting, where market pricing (in AU interest rate swaps) currently implies a 76% of a second 25bp cut in this cycle. This implied pricing is dynamic, with expectations of RBA policy change massaged in line with supply and demand that comes from changes in financial conditions (if equity heads lower the market will increase the probability of a rate cut), as well as the upcoming employment reports (released 17 April & 15 May), Q1 CPI (30 April) and Q1 Wage Price Index (15 May).

It's the Aus Q1 CPI report that could well be the deciding factor for a 25bp rate cut in May, where a headline CPI print below 2.2% and a trimmed mean CPI print at 3.0% likely cementing the cut in the eyes of the market.

How Low Can RBA Rates Go?

Another core factor that will drive the AUD and interest rate-sensitive ASX200 equities is the degree of cumulative cuts priced into swaps pricing for the full easing cycle. Current expectations are that we could see 70bp of cuts by December, taking us to a ‘terminal’ cash rate of 3.5% to 3.25%. The breakdown is for the RBA to cut in either May or July (there is no June RBA meeting), followed by another 25bp cut in September and possibly one more 25bp cut in November or December.

This implied pricing can and will likely change dynamically and we could be looking at fewer implied cuts priced if equities undergo a sharp relief rally and/or the domestic data comes in hotter. However, to see the market price in an implied RBA terminal (or trough) cash rate below 3% we may well need to see recession risk increase – and should recession risk increase we’ll see this reflected in a far weaker picture in the AUS200 and AUD.

ASX200 Bank Earnings to Get Trader Attention

Also leading into the election and May RBA meeting we get 1H25 earnings from NAB, Westpac and ANZ, with the three banks having a different reporting calendar than CBA. Share price returns for these three banks have historically been poor in May, where in the past 15 years, Westpac has seen an average return in May of -5.1%, NAB -4.9% ANZ -4.1%.

While the reporting banks will steer clear of commentating on the election, details on asset quality, non-performing loans and volumes, as well as their outlooks on property and economic trends could offer trading opportunities for equity CFD and AUS200 traders and offer good colour for macro heads too. Put Australia on Your Radar So, the wash-up is that the impending Trump tariff risk, married with the Australian Federal election, the potential for further RBA rate cuts, as well as insights from three of the big four ASX200 bank earnings, make the period through April to May a very important one, and a period where we could feasibly see some big moves in the AUD and ASX200 equities.

It's time to put Australia back on your radar.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.