- English

- 中文版

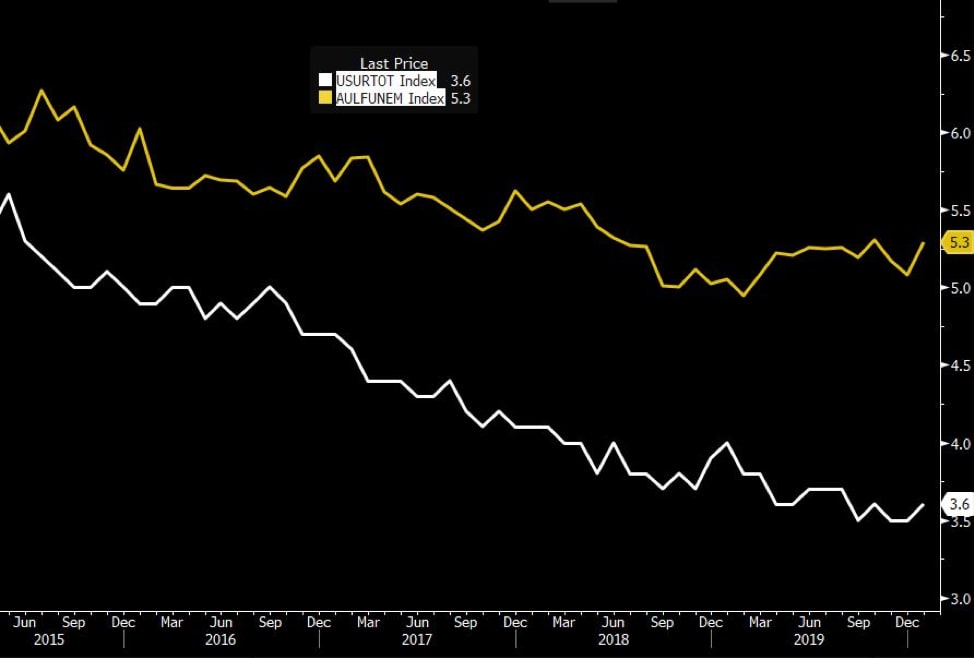

The Reserve Bank of Australia (RBA) has made clear their concerns about the Australian labour market, which they have struggled to keep a lid on. Unemployment has been rising since the beginning of 2019, printing higher at 5.3% this morning, despite a constant increase in jobs numbers.

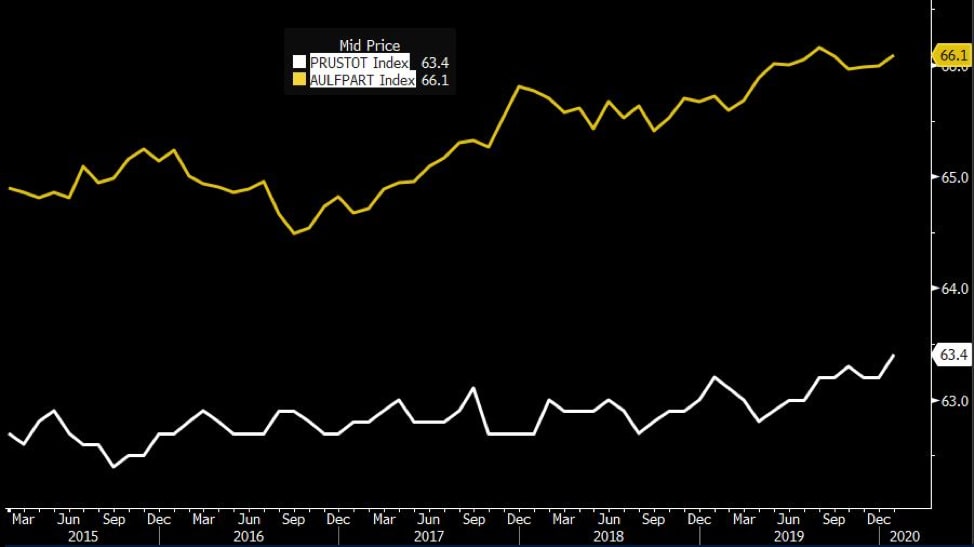

The consensus was for an increase of 10k jobs and the data printed at 13.5k. Sounds good, right? The concern here is the participation rate, which has pushed up yet again, hitting 66.1%.

The participation rate is the percentage of the population that considers themselves in the labour market: working or looking for work. This number has tracked higher over the last five years, increasing at a faster rate than any jobs increases. It’s this widening discrepancy that keeps the unemployment rate bubbling

See below the difference between the Australian participation rate (yellow) and that of the US (white). In five years, the Australian labour force participation rate has increased 140 basis points from 64.7% to 66.1%; the US a smaller 50 basis points (bp) from 62.9% to 63.4%.

Source: Bloomberg

RBA Governor Phillip Lowe is faced with an increasing unemployment rate as the participation rate continues to climb. Meanwhile his US counterpart Fed Chair Jerome Powell is ruling over a mostly steady participation rate, keeping the unemployment rate near 50-year lows.

AU unemployment (yellow) vs US unemployment (white).

Source: Bloomberg

The RBA will also be concerned by the underemployment rate (white), which moved higher to 8.6% above last year’s high of 8.5%. Wage growth (orange, inverted) has a strong correlation with the underemployment rate, so an increase here suggests increasing slack in the labour market.

As the Australian underemployment rate (white) increases, wage growth (orange, inverted) tends to slow.

Source: Bloomberg

Initially mixed movements on the news, AUDUSD pushed below the 10 February low of 0.6665, trading as low as 0.6634.

AUDUSD 15 minute chart. The AUD moved considerably lower on the jobs numbers.

So now we ask: is an increasing participation rate a good thing? Sure it means the unemployment rate is being dragged higher, but more people wanting to work reflects confidence in the economy and a willingness to work. How markets contemplate this will determine whether the AUD holds around 66.5c or pushes even lower into the unknown.

Market pricing of rate cut expectations have moved forward slightly. A full rate cut is now priced by September instead of October. If unemployment continues to trend higher over the next couple of months, the RBA could make a 25bp rate cut as soon as May.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.