Another Reluctant Hike from the ‘Old Lady’ – Playbook for Trading the BoE

Despite this, the meeting nor the market reaction is likely to be straightforward.

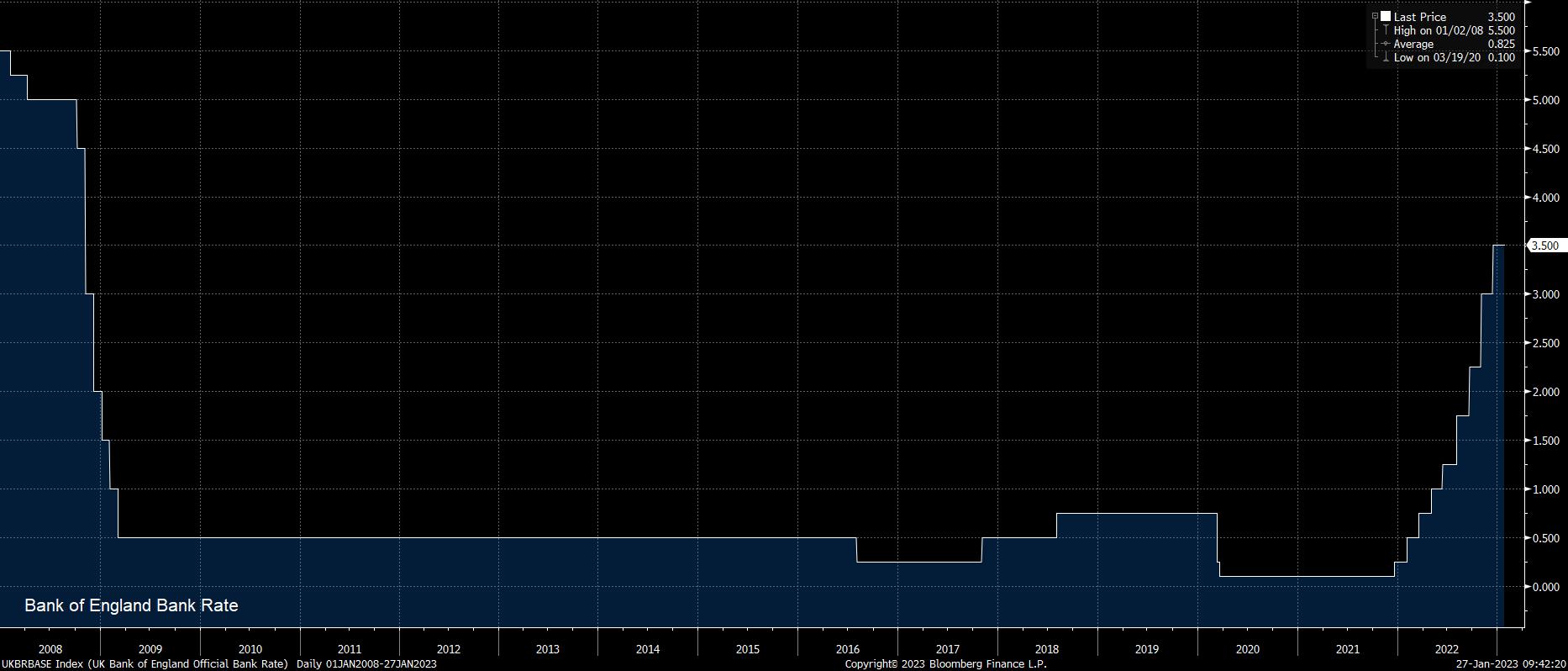

At the final MPC meeting of 2022, two of the most dovish Committee members – Tenreyro and Dhingra – dissented in favour of leaving rates unchanged. Even with inflation considerably north of 10% at said meeting, the two dissenters flagged the “weak…real economy” and lags associated with policy transmission as reasons for preferring to leave rates unchanged. It would be logical, since activity data has continued to soften since this decision, to expect at least two further dissents in favour of standing pat on policy this time around.

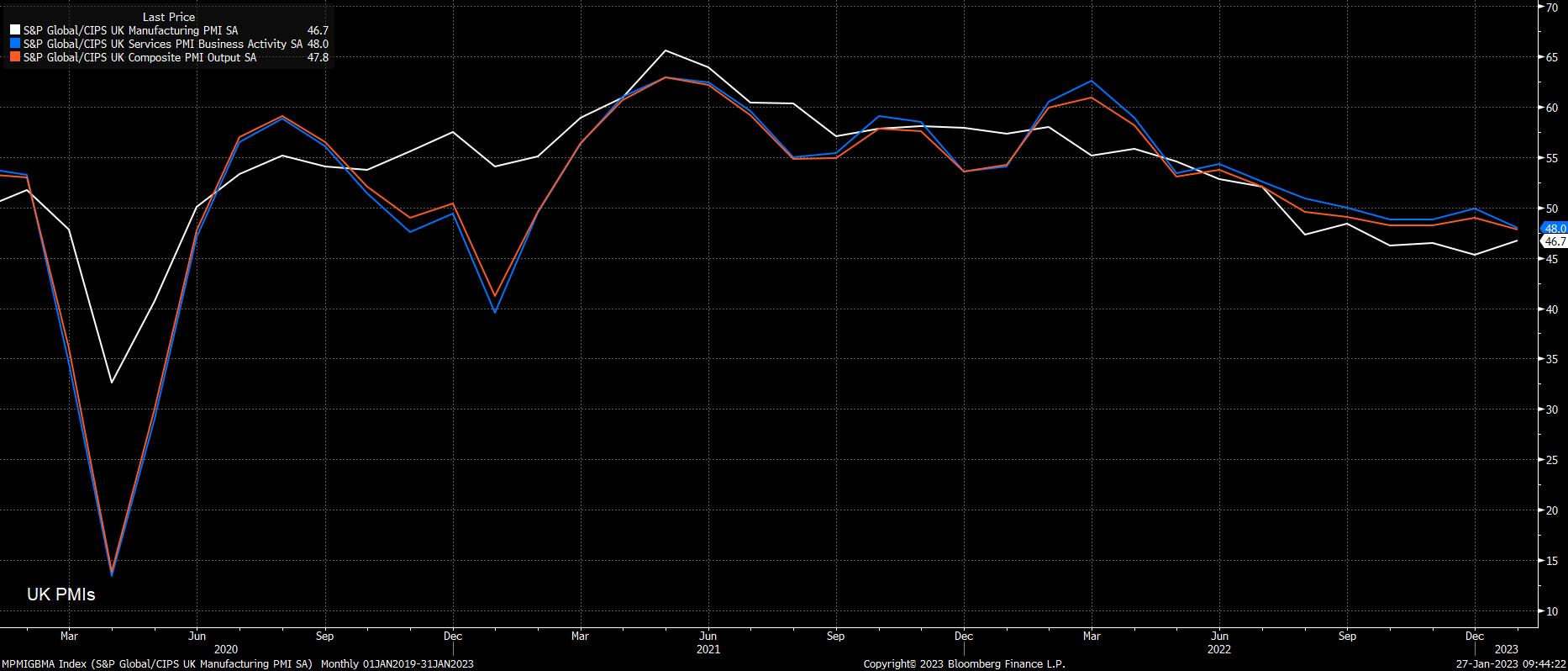

Meanwhile, the December MPC decision also saw a hawkish dissent – from external MPC member Catherine Mann – in favour of a 75bps rate hike at said meeting, who flagged the fact that “forceful” tightening now would likely “reduce the risk that Bank Rate would need to rise…as the economy slowed further”. While incoming survey data has borne out the latter part of this argument regarding the loss of economic momentum, it seems unlikely that a similar point could be made again given that the expected slowdown has now occurred, meaning Mann is likely to re-join the majority of the MPC in plumping for a 50bps move.

While we see it as likely that the majority of the MPC vote for a 50bps increase, it is impossible to rule out a third successive three way split among Committee members. This is especially true given the ‘Old Lady’s’ historic tendency to look for any possible way to produce a dovish surprise relative to market expectations, in addition to the lack of any recent commentary from influential policymakers such as Deputy Governors Cunliffe and Ramsden somewhat muddying the waters.

It is not only the rate decision itself that will be on the market’s radar, but also the Bank’s guidance as to the future rate path, especially as we approach the tail end of the tightening cycle. It seems reasonable to expect that the MPC’s prior guidance, that “further increases in Bank Rate may be required”, will be revised to be more dovish in nature. Such a revision is likely to emphasise that the Bank will carefully consider further rate rises, while also assessing the impact that the cumulative effect of rate hikes is having on the UK economy.

Explicit language, however, is not the Bank’s preferred signalling mechanism. Instead, perhaps rather illogically, the Bank prefer to provide policy signals via their quarterly inflation forecasts, conditioned on market rate assumptions – the latest iteration of which is due this week.

Said forecasts, in November, showed that the Bank expected CPI to fall to 1.8% YoY by the end of 2024, before falling further to 0.4% YoY at the end of 2025; an implicit message that markets were pricing too aggressive a pace of tightening. While the market implied rate path has flattened since then – with the terminal rate now priced at 4.4%, around 30bps lower than previously – it is likely that we see a further downward revision to the inflation projections this time around, sparked largely by falling energy prices. Again, such a revision should be interpreted as the ‘Old Lady’ telling markets that too significant a degree of tightening is priced.

As for other areas of the economic forecast, further revisions are also expected. While incoming activity data has begun to soften at the start of 2023, growth proved firmer than expected in the final quarter of last year, with a sharp – and unlikely – 0.6% MoM contraction required in December for the Bank’s pessimistic five quarter recession forecast to ring true. While growth will remain anaemic, and a 2023 recession continues to inch closer, a modest upgrade to the BoE’s GDP forecast can be expected.

Consequently, November’s rather grim unemployment projections are also likely to be downwardly revised, with the previous expectation of a rise in joblessness to 6.4% now looking far too pessimistic.

For GBP pairs, risks over the BoE decision appear tilted to the downside. Cable’s recent upswing, driven largely by dollar weakness than any UK-specific factors, has stalled once again at 1.2450, which represents not only the high from mid-December 2022, but also the 61.8% retracement of the entirety of last year’s decline.

With the market pricing a further 50bps of hikes after the February decision, that the MPC is likely to pushback on, sterling may face rather significant headwinds, as the market revises its expectations for the future rate path. The bears are likely to initially target the bottom of the recent range, around 1.2250, with downside momentum likely to intensify further were cable to break below the 50-day moving average – which we have not spent a prolonged period below since last autumn.

Options, incidentally, imply a range of +/- 310 pips next week; though, of course, this also includes other event risk such as the first Fed decision of the year, and the January nonfarm payrolls print.

As for equities, the FTSE 100 is also at an interesting juncture, having recently backed away from a challenge of the all-time high, befitting the broader market theme of sideways chop ahead of the event-laden week ahead. A dovish BoE should be good news for the UK benchmark, besides banking stocks of course, with the potentially weaker GBP also likely to provide a fillip for the market.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

_2023-01-27_09-46-23.jpg)

_ftse_2023-01-27_09-46-38.jpg)