- English

- 中文版

A Traders’ Weekly Playbook – Buy what’s strong sell what’s weak

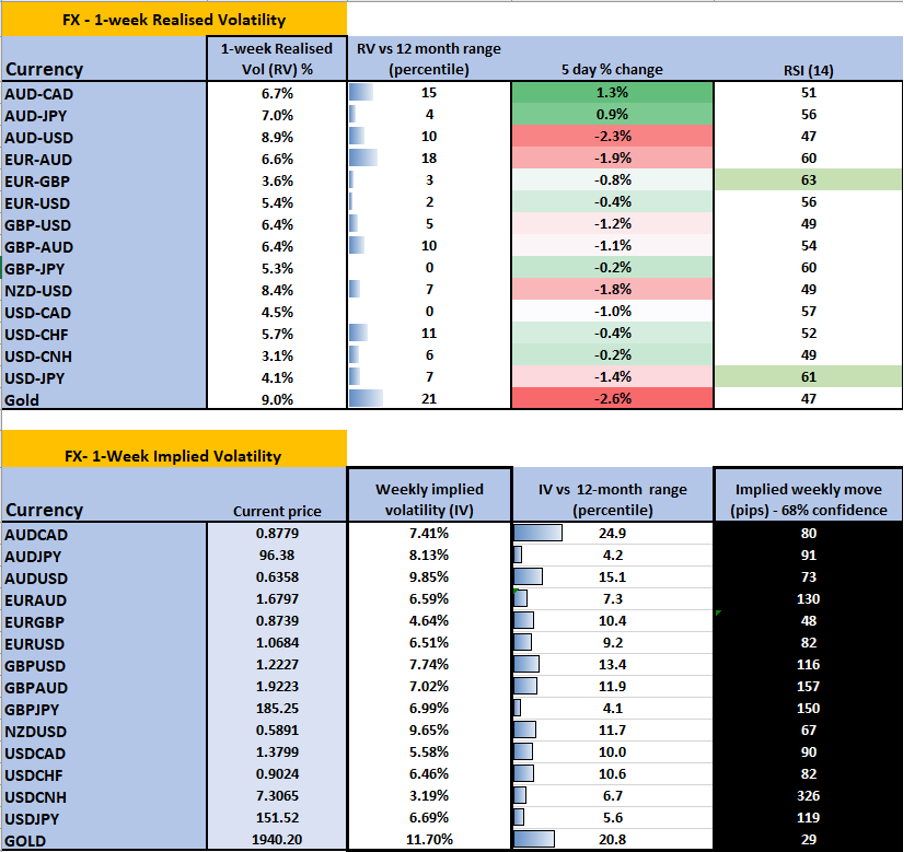

The USD has found a modest bid of late and tests the 106-handle, with EURUSD gravitating towards 1.0600 and USDJPY into 151.50. While we have seen some pockets of movement in FX, realised volatility (1-week) is super low, and we see nearly all pairs at or below the 10th percentile of the 12-month range. The RSIs are all around the 50 level, which speaks to a lack of trending conditions and our trading conditions. A cheeky MoF JPY-intervention would shake things up, but buying JPY solely for this idea is for the special situation trader.

US real rates are pushing higher once again and worth putting on the radar and with the geopolitical risk premium being priced out of gold, we could easily see gold re-establish its typically high correlation with bond market dynamics. A simple look at the higher timeframes shows the sellers firmly in control here, with price testing the 38.2 fibo of the October-November rally – a break of 1933 should see 1910/00 come into play.

Platinum and palladium can be put on the radar too, as neither can find a friend in this market and while grossly oversold, should find sellers into strength.

Our equity index flow is still quite lively, and clearly, the NAS100 is where the fast money is right now, and traders are buying what’s working and is hot and selling what’s not working – momentum is therefore the strategy du jour. This is true of the crypto space too. Long NAS100/short US2000 is another expression if one is to play a lower beta strategy or long NAS100/short China another, but with China’s growth and credit data in play this week that trade has risk, as Chinese authorities will not want equity bourses to break YTD lows.

We also see Alibaba and Tencent reporting quarterly numbers this week, so the HK50 could get lively this week.

Friday's outlook downgrade by Moody’s has certainly caught a bit of attention. No one in the market is too shocked by this and the rationale for the outlook change to negative is for reasons that have been well discussed. Still, this is the fourth ratings action this year by a ratings agency and the odds are we can expect the rating to be cut at some stage, marking the point where the US has lost its AAA status by all 3 agencies. It is not a market-moving story and semantics are at play. One can expect the Republicans to leverage this in the elections next year and while immigration (border security), abortion/women’s rights, and the economy are key voting determinants, the government’s fiscal position is certainly a factor that is starting to become a mainstream factor too.

The marquee event risks of the week

- US govt shutdown – the deadline for Congress to avoid a govt shutdown is the 17 Nov. This will likely get front-page news as it further speaks to a dysfunctional Congress but shouldn’t be a major catalyst for cross-market volatility. It does look like the wheels are in motion for a short-term solution, with Speaker Johnson presented a temporary and staggered funding plan that would see some govt agencies funded through January, and others to February.

- China credit data (no set date this week – anytime) – China’s new yuan loans & M2 money supply could influence sentiment, with the consensus expecting a sizeable fall in new loans in October at RMB655b (from RMB2310b in Sept). Below consensus loan data could see sellers in Chinese/HK equity markets, with the CHINAH index looking to revisit the October lows around 5800.

- UK jobless claims and wages report (14 Nov 08:00 AEDT) – UK wages are expected to fall a tick to 7.7%. Any number on wages below 7.7% would see the GBP spike lower.

- EU Q3 GDP (14 Nov 21:00 AEDT) – after a number of weak data reports from the Eurozone of late, we get EU Q3 GDP which is expected to come in at -0.1% QoQ and +0.1% yoy. EURGBP is worth putting on the radar, with price threatening to start bull trending and a move through 0.8760 would see momentum tick up and raise the probability of a stronger move to 0.8900.

- Aus Q3 Wage Price Index (15 Nov 11:30 AEDT) – The economists’ consensus is for wages to increase 1.3% QoQ / 3.9% yoy (from 3.6%). With a 6% chance of a hike in the December RBA meeting and a 32% probability priced for the February RBA meeting, a 4-handle on wages would see hike expectations rise once more.

- China monthly data releases (15 Nov 13:00 AEDT) – China Industrial production, retail sales, and fixed asset investment are due with the market expecting some improvement across the range of growth data points, notably in retail sales which are eyed at +7% yoy (from 5.5% in Sept)

- US CPI (15 Nov 00:30 AEDT) – the key event risk of the week – the market expects headline inflation at 0.1% mom / 3.3% yoy, and core CPI at 0.3% mom / 4.1% yoy. Using core CPI month-on-month as a guide, a print below 0.2% mom would likely see USD sellers and fuel further gains in the NAS100. A rise above 0.35% mom would see USD buyers and possibly weigh on gold and equities.

- UK CPI (15 Nov 18:00 AEDT) – the consensus is for headline CPI to come in at 4.7% yoy (from 6.7%) / core CPI 5.8% (from 6.1%). Providing we don't see a strong upside surprise, the further moderation in inflation justifies the rates pricing, with no hikes priced in Q224, and the door open for cuts from June 24. Comments from BoE member Haskel after the UK CPI print could be interesting for GBP traders.

- US retail sales (16 Nov 00:30 AEDT) – the consensus is for a decline of 0.3% mom, driven by weaker new vehicle and gasoline sales. Importantly, the ‘control group’ element – the group of goods that feeds more directly into the GDP calculation - is expected to rise 0.2%. The outcome of this data point could see growth nowcast models being revised higher or lower, with Q4 GDP estimates currently running around 2%.

- Aussie jobs report (16 Nov 11:30 AEDT) – The consensus is for 25K jobs created and the U/E rate at 3.7% (unchanged). Coming after the Q3 WPI the outcome of the jobs report could further impact expectations for a hike in February or March, and by extension cause a short-term move in the AUD.

Corporate earnings of note

- US corp earnings – US retailers report this week and could offer guidance and insights into margins and the US consumer – Home Depot (14 Nov – after-market), Target (15 Nov - after-market) and Walmart (16 Nov - 23:00 AEDT) get the focus.

- HK Corp earnings – Tencent (15 Nov) and Alibaba (16 Nov) report quarterly earnings.

- ASX200 – ANZ FY23 earnings (13 Nov)

Central bank speakers

- RBA – Kohler speaks (13 Nov 10:30 AEDT)

- Fed – There are 22 scheduled Fed speakers this week. Those speaking after the US CPI print would be more insightful.

- ECB - There are 17 different scheduled ECB speakers this week – see the schedule below.

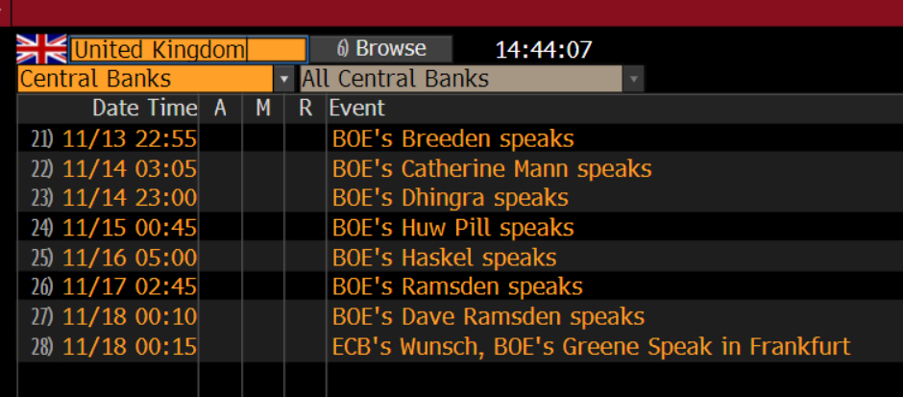

- BoE – we hear from BoE members Breeden, Mann, Dhingra, Huw Pill, Haskel, Ramsden and Greene.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.