Analysis

Markets are unpredictable at the best of times, but I hadn’t anticipated such a rally in risky assets - as we saw on Friday - after such a solid nonfarm payrolls report – clearly someone was in the mood to cover shorts in US banks and that fed through to a broadly positive vibe.

We’ll see if it continues – but it’s clear that US regional banks and financial stability remain front and centre to market sentiment.

This week we continue to focus on US banks but get treated to US CPI inflation and the Q1 Fed senior loans survey. The outcome of which we should have a good idea whether the Fed are indeed done hiking, which is strong consensus in the market. Agility and an openness to understanding that the market will see what it wants to see on any given data point.

Low volatility across asset classes remains central to our trading environment. Like most traders I speak to, I’d like to see volatility higher, especially in margin FX markets. There are moves bubbling away and patience is required, but it's coming.

Trading views for the week ahead:

NAS100 – the bull flag target at 13,800 is still in play, where a break of the range highs of 13,289 accelerates this view. Likely flip to bearish bias on a close below 12,800.

US500 – could we be ready for another test of 4160? The market has seen good supply here on numerous occasions, but could his time be different? A firm close above 4160 sets the index up for a test of 4300.

GER40 – consolidating in a 16000 to 15700 range and we currently see price testing the upper bounds – currently biased neutral, but would look to trade the break (on a closing basis)

HK50 – Low conviction on this HK50, but do favour longs for 20,800, placing stops below 19514. Will turn more bearish on a close through the 200-day MA (19509)

XAUUSD – longs have part covered after the lows in Thursday's pinbar candle were taken out – favour trading this in a possible range of $2055 to $1975 this week – US CPI is the big event risk for gold traders.

SpotCrude – a huge double bottom has been put in at $64.00 – scope to climb to $75.60 but price closed right at the 38.2% fibo of the recent sell-off, so we’ll see how traders react to this level on Monday.

EURUSD – Clear consolidation on the daily timeframe where neither the bulls nor bears are prepared to make a stand – given the low realised volatility I’d be playing a 1.1115 to 1.0920 range this week – a bit of wood to chop into 1.1100 though, and a big level for the scalpers.

GBPUSD – momentum favours the bold here – the BoE meeting is a risk to manage but the market is not expecting fireworks in price. Would consider a buy-stop order above 1.2652 for a quick move into 1.2700. The upside likely capped this week at 1.2780/90. EURGBP is also of interest given the test of YTD range lows.

Bitcoin – 30,000 remains the line to break, and consolidation remains the theme - happy to trade this on the long side on a close above 30k.

Daily chart of the NAS100

Marquee event risks in the week ahead to navigate:

Debt ceiling headlines – President Biden meets with Congressional leaders on Tuesday to try and inject some urgency in forging an agreement to raise the debt limit before 1 June. We’re already seeing clear stress in US T-bills maturing in mid-June, so the market is certainly taking the threat of moving past the June X-date seriously. Given the tight window to negotiate, it increases the possibility of a short-term extension to September or October.

It seems a matter of time before traders start to look at the JPY and gold as the default debt ceiling hedges.

US CPI (Wed 22:30 AEST) – the marquee data point of the week. The consensus estimate is for headline CPI at 0.4% MoM, and 0.3% MoM on core CPI, with the core YoY pace eyed at 5.5% (from 5.6% in March). With the market not pricing any hikes for June it would need a big upside surprise to see the market price in hikes for the next Fed meeting – interestingly, in the past 6 CPI prints the USD has fallen in five of those (in the 5 minutes after the data drops), while gold has rallied in all 6 occurrences.

A print below 5.3% would see cuts being priced for June and price July as a 50:50 proposition; a clear positive for gold and see the NAS100 push towards my 13,800 target.

Fed’s Senior loan officers survey (Monday at 04:00 AEST) – with the market looking for a tightening in lending standards, resulting in a credit crunch and potentially future recessionary conditions, this survey matters. Fed chair Jay Powell knew the outcome and mentioned the survey in his press conference last week, detailing the survey will show tighter lending practices. The survey has historically been well correlated where tighter lending standards results in wider corporate credit spreads and drawdown in the S&P500.

BoE meeting (Thursday 23:00 AEST) – Given the recent inflation print, the BoE should almost certainly hike by 25bp, with the market fully pricing this outcome. The split in the MPC voting may matter, with the markets discounting that the BoE hike again in June and possibly August. GBP has been strongest vs the JPY and EUR, with EURGBP eyeing a break of the YTD range lows. GBPUSD trades at the highest levels since May 2022 and while it’s tough making a call on GBPUSD with US CPI due this week, I’m not fading this strength just yet.

US PPI (Thursday 22:30 AEST) – The market will pick and choose when it wants to react to the PPI data point, so it’s a risk event to consider. The consensus is we see PPI +2.5% YoY (from 2.7%), with core PPI eyed at 3.3% YoY (from 3.4%). While the PPI data is important (especially when considering corporate margins), unless we see a big surprise, I’d expect market moves to be fairly contained over this print.

China (April) credit data – there is no set time for the credit data (new yuan loans, M2 money supply and aggregate financing, but given credit has been largely front-loaded in 2023, to support the re-opening, it should be expected that new yuan loans and aggregate financing fall significantly from the lofty levels we saw in March. An outcome above RMB1400b (in new yuan loans) could boost China’s markets and China proxies (AUD and copper, for example). The CHINAH index is tracking a range, but I see scope for a push into 7000.

China CPI/PPI (Thursday 11:30 AEST) – the market sees CPI at a lowly 0.3% YoY (from 0.7%) and PPI at -3.2%. In a world of high inflation, China is the clear outlier and a below-consensus reading could see renewed calls for policy easing – China’s bond markets are finding solid buyers of late (yields lower) and this may start to impact, with a weaker yuan the possible result - watch USDCNH as a guide and any upside in this cross (yuan weakness) could weigh on the AUD and NZD.

US April NFIB small business optimism (Tuesday 21:00 AEST) – this is a survey I am watching very closely given the leverage US SMEs have to the smaller and regional US banks. The market sees the survey coming in at 89.8 (from 90.1 in March), which if correct, would be the weakest read since 2013 and a sharp decline from levels seen in 2021.

Australia govt FY 2024 budget (Tuesday 19:30 AEST) – the budget is being viewed on three main ideals: the cost-of-living relief, economic growth, and Australia being more resilient to international shocks. One that should get media airtime, and could impact the AUS200, but it’s unlikely to be a driver of AUD volatility. AUDUSD shorts have been covering and we see price testing trend resistance, but the big level remains the Feb- May range high at 0.6800.

Fed speakers – Kashkari, Jefferson, Williams, Waller, Daly, Bullard

ECB speakers – Lane, Rehn, Vasle, Schnabel, Centeno, De Cos, Guindos

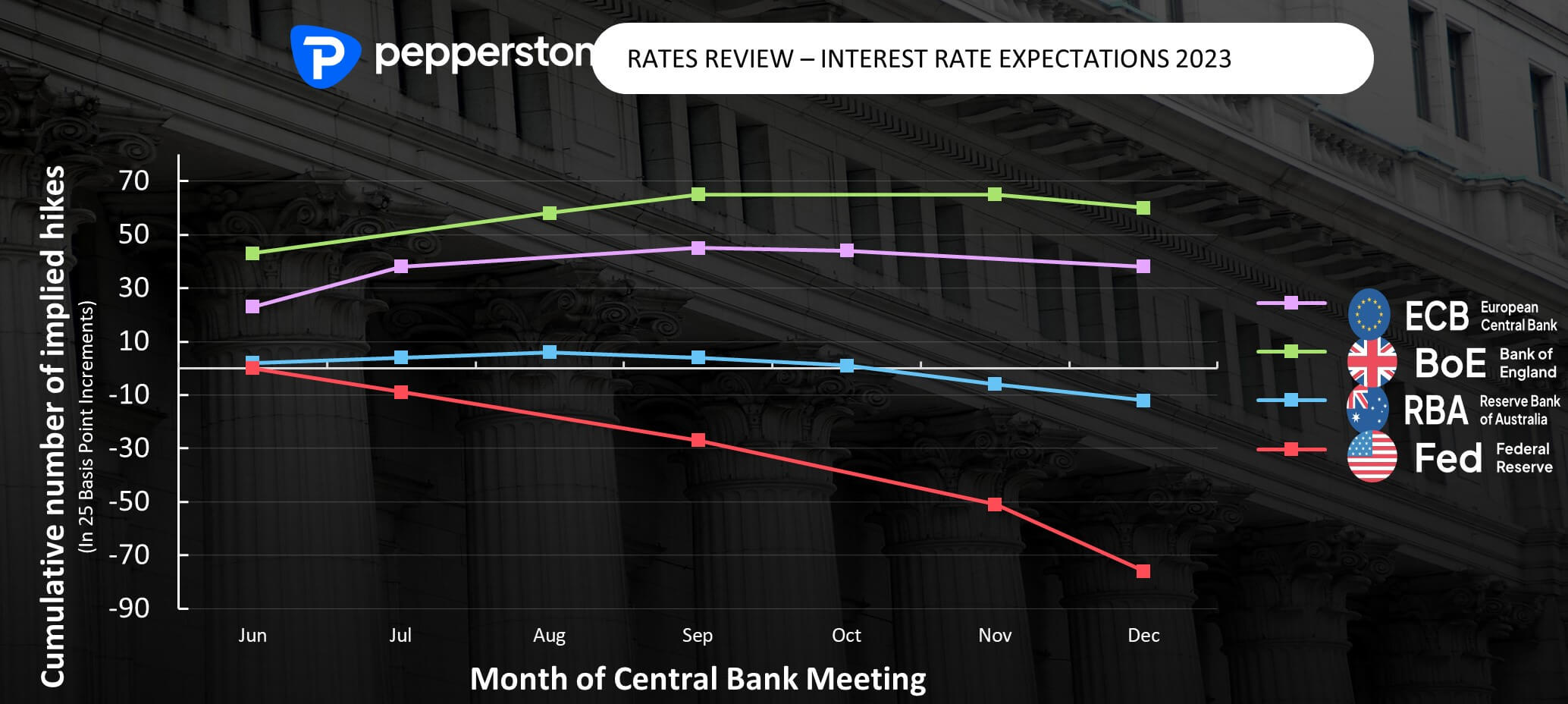

Interest Rate Review – we look at market pricing for each forward central bank meeting and the cumulative number of hikes (in basis points) priced into the future. The clear question here is whether the market is indeed correct to feel the Fed cut by 76bp by December.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.