The Week Ahead: Crypto Surges, Equities Hit All-Time Highs, and the USD Rally Stalls

‘Crypto Week’ and the various acts (GENIUS and CLARITY) that were passed through the House, and the suite of regulations and clarity on classification (for stablecoins), usher in a new sense of legitimacy, accelerated adoption and issuance.

We saw that firsthand last week, with record inflows into the iShares Ethereum ETF (ETHA) – with ETHA ETF seeing far higher realised volatility on the up days (in price) than any of the recent down days. Crypto moons hard, but the real story here is the rotation within the coins, with Bitcoin’s dominance collapsing and crypto players rotating hard into Ethereum and many of the other alts, resulting in some incredible momentum shifts.

New all-time highs seen in select DM equity indices

In the old school world of TradFi, we see new all-time highs seen in the ASX200, FTSE100, S&P500 and NAS100, with bullish breakouts or strong momentum moves seen in the HK50, China H-Shares and Kospi.

The Russell 2k (US2000) shows consolidation in the daily technical set-up, but the US small-cap index falls on the radar for a possible upside break too, and alerts can be set for a daily close above 2280, and a possible continuation of the primary bull trend.

Volatility continues to get crushed, with SPX500 30-day realised vol at a meagre 9.29% and into a new YTD low, with heavyweights like Microsoft realising on just an 11% vol. The steady grind higher in the price action for US equity indices and in many of the mega-cap single stock names and the low close-to-close daily price changes keeps implied vol pinned, with the VIX unable to break above 17%. This is also true in FX markets, with G10 FX 1-week implied vols (bar USDJPY) all held below the 20th percentile.

Goldilocks still dominates the backdrop for equity risk

Granted, all is not perfect in risk markets, with the higher 1 Aug tariff date looming, and Fed independence called into question; however, equity players still see an early dismissal of Jay Powell as Fed chair or his resignation as a low probability and have subsequently bought any weakness that has come from either issue. We have also seen some uplift in the market pricing for short-term US inflation expectations (US 1- & 2-year inflation swaps gained 14bp & 9bp respectively last week) and Treasury term premium gained 13bp w/w, and both require monitoring.

However, the low realised equity vol pushes further capital off the sidelines, and this has been backed by a strong turnaround in US soft data economic releases. US interest rate swaps still price a Fed cut in September as more likely than not, with 45bp of cut implied by year-end.

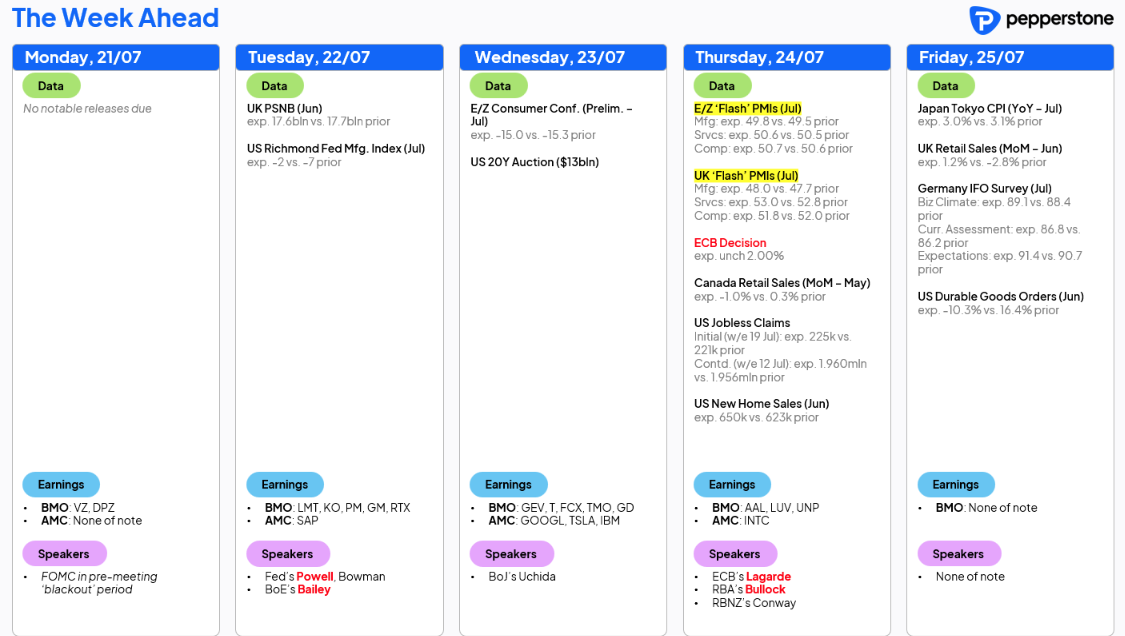

US earnings in focus

US corporate earnings also come in more liberally from here, with Alphabet, Tesla and Intel the big names to report this week. Rich valuations and the recent run-up in price make the bar to please the market that much higher, but there seems to be little concern about holding equity risk or eve to hedge against an imminent drawdown at this stage. The high-flying AI plays won't report earnings this week, but Trump is expected to outline plans for AI prioritisation on Wednesday, so we’ll see if that has any bearing on Nvidia et al, at a time when traders have run these names higher on news that they will indeed be able to sell certain chips to China.

FX review - the USD rally stalls at the 50-day MA... eyes on Thursday's ECB meeting

In FX markets, many have been frustrated by the lack of follow-through buying in the USD rally, with the 50-day MA capping the upside for the DXY through last week. The US 2-year Treasury yield pulled lower to 3.86% is one factor that has curbed the DXY rally into 99.0, and we look to see how the USD fares in reaction to some of the tier 2 data this week – S&P Global PMI’s being the highlight of the US data flow. Outside of the US, the ECB meeting on Thursday will largely be educational, and while the bank will almost certainly leave rates on hold, the following September ECB meeting is seen as a ‘live’ affair, with a 25bp cut implied as a 50/50 bet. The ECB’s statement and appetite to cut further could influence the pricing for September and through the balance of 2025, although one suspects the risk is skewed that the ECB are in a wait-and-see camp – in turn, this justifies the consolidation at 1.1600 in EURUSD.

Japan's Upper House election seemingly priced into JP assets

USDJPY gets close inspection on the day, with Japan’s upper house election moving as the polls have recently suggested, with the LDP coalition set to lose its majority. Reports suggest the ruling coalition will get 41 seats is certainly on the low side of expectations and would be a woeful outcome for the LDP party - but it is a scenario well priced by Japanese assets. In essence, the LDP coalition could still partner with DPP to get the 50 seats required, and that is helpful for the JPY. However, most importantly, PM Ishiba has been defiant in his stance to stay the course as PM, but his hand has been sufficiently weakened.

With Japan’s markets closed for the Marine Day holiday and Typhoon Wipha forcing many in HK to WFH, liquidity will naturally thin out, possibly leading to more exacerbated moves in markets through Asia. The Osaka futures exchange is therefore closed, so for those eyeing any fallout in the JGB bond market will need to monitor/trade the SGX JGB and Nikkei 225 futures, a venue that typically sees a far lower daily notional traded than the Osaka exchange. Traders may also express a view on the JGB market through UK gilts, German BUXL or S&P500 futures, and while we’re seeing buying in the JPY at this early stage, if the respective bond futures do find sellers on open, then the JPY rally may be short-lived.

Elsewhere, the RBA July meeting minutes may get some attention with Gov Bullock detailing that the call to hold rates was more about “timing, than direction”. After the weaker employment report, a cut by the RBA on 12 August is seen as a lock by rates traders, and we’d need to see a sizeable upside surprise in the Q2 CPI print (30 July) to derail those expectations.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.