- English

- 中文版

The outcome of the jobs report could critically impact the Fed’s thinking around the June FOMC meeting and massage market expectations for the June FOMC meeting – in turn, this could hold big implications for the USD, US equity indices CFDs and gold.

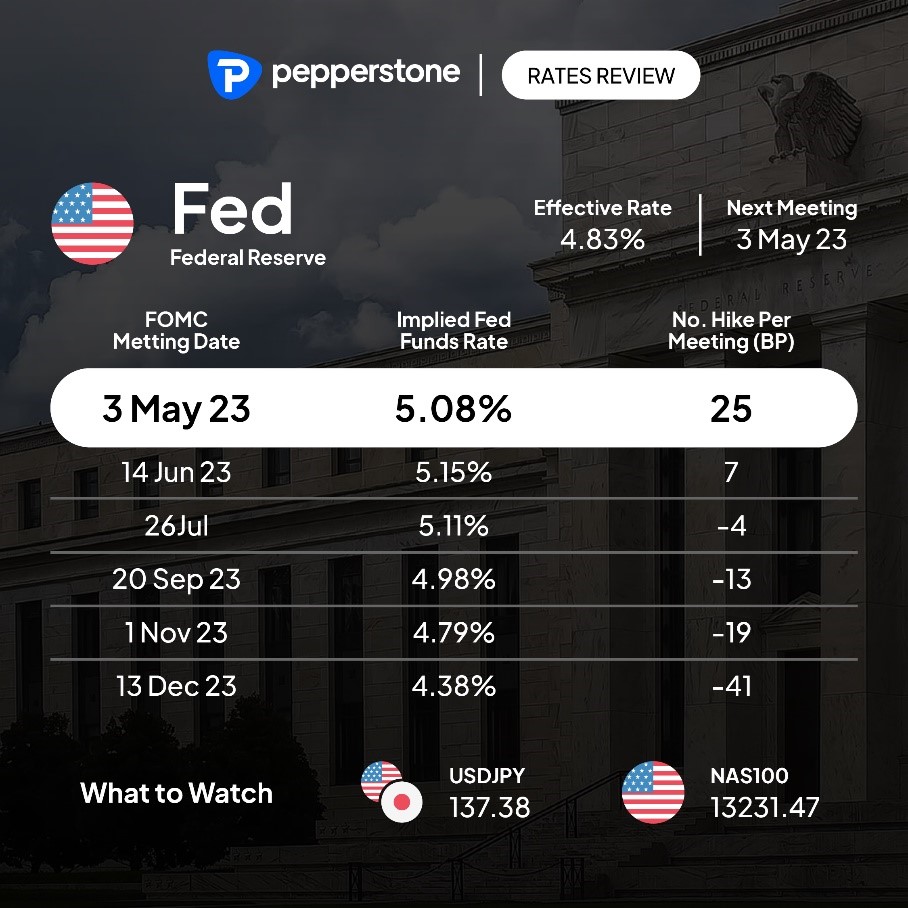

(Market pricing for each respective FOMC meeting)

It is a risk traders need to navigate, manage, and react to – here’s what’s expected.

Timings: 5 May at 22:30 AEST / 13:30 BST

Consensus expectations:

- 180,000 jobs are expected to have been created in April - the economist’s range of estimates sits between 265k and 125k jobs created in April.

- The unemployment rate is expected at 3.6% (from 3.5%) - the economists’ estimates sit between 3.6% and 3.4%)

- Average Hourly earnings (AHE) is eyed at +0.3% MoM, 4.2% YoY (unchanged)

Statistics to consider:

- A cooling labour market - The 3- and 6-monthly average is 390k and 313k jobs per month respectively – so if we do see 180k jobs created it would be around half the 3-month average.

- 180k jobs would be the lowest number of jobs created in a month since December 2021

- The most accurate economist in the past 12 months (from Sterna Capital Partners) is calling for 200k jobs.

- The NFP print has been above expectations for 12 of the past 12 payrolls reports – the form guide certainly favours an upside surprise to the median estimate – the USD has rallied in the following five minutes (from the NFP release) in 8 of these 12 occurrences. Gold has fallen in 5 of these 12 occurrences.

- A 1 Standard deviation outcome from the median consensus estimate (of 180k) is 208k and 154k jobs – so, one could use this as a guide for how markets may fare.

- AHE’s have fallen from 5.8% (in March 2022) to currently sit at 4.2% YoY – A move below 4% would justify the level of rate cuts priced through 2H23 and into 2024 and would be a USD negative and keep the upside momentum going in the NAS100.

Why the US nonfarm payrolls report is important?

While we await the FOMC statement, it seems highly likely the Fed will retain a data-dependant stance, and a modest tightening bias. This means the NFP report could genuinely influence rate expectations for the June FOMC meeting. At this stage the market prices 7bp of hikes for the June FOMC (a 28% chance of a 25bp hike), but if we get a solid jobs report, with a turn higher in wages then traders will increase the probability of a hike and that should be a USD positive. It would also weigh on gold and tech.

A weak AHE (vs expectations) would promote strong USD sellers and boost gold and risk.

The playbook

(The distribution of economists’ expectations)

It’s rare that all the stars align, and we get a weaker NFP, higher unemployment rate and a falling AHE and we can get conflicting forces in the different labour outcomes.

While the reaction in markets will be driven by the outcome vs expectations, we also consider market positioning and a market that is long of USD’s and short S&P500 futures.

Nonfarm jobs report:

- Below 150k jobs - Risk positive (short USD, long AUD, long gold, long US equity indices CFDs) below 150k

- Above 250k – risk negative (bullish USDJPY and USDCHF, negative NAS100, gold and AUDUSD)

Average Hourly Earnings:

- Below 4% - Very positive for risk (as above scenario) as bond yields fall.

- Above 4.3% - Negative for risk (as above).

Unemployment rate: the U/E rate is driven not by the NFP print (which is formed by the Establishment survey) but by the Household survey, which asks US households about their employment situation.

- Above 3.7% - Modest upside for risky assets as the market cheers a cooling of the labour market

- 3.5% or below - Modest downside for risky assets as additional rate hikes for June are priced.

It’s time to consider the NFP report and the risks to your position - Could it be that the NFP report is the volatility event of the week?

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.