- English

- 中文版

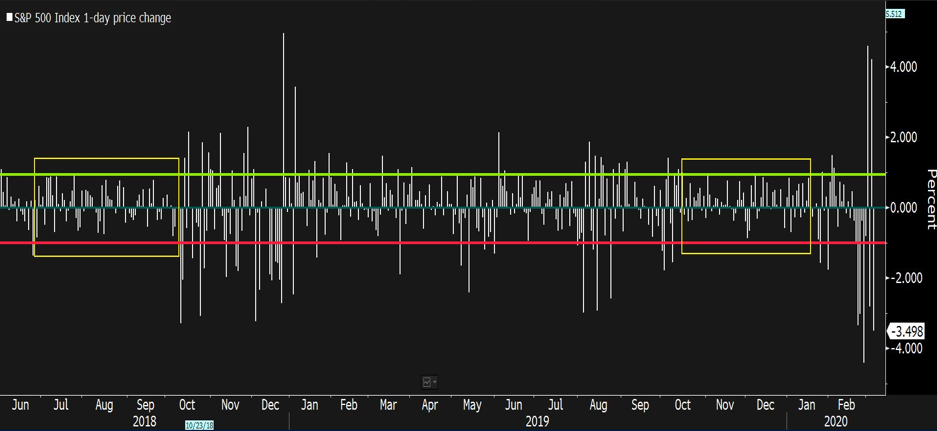

Markets wise, it’s been a week where implied volatility has driven strategy – it’s driving the demand to hedge and for those not respecting the massive percentage changes in the market and subsequently adjusted position size accordingly, it has been quite painful. For many, it's been a week of capital preservation and for others, this vol backdrop has been a lucrative environment to grow portfolio capital.

(Percentage moves in the S&P500- higher or lower)

The video above is a long watch, but it focuses on the charts that define my world, and right now there are many that showcase and portray the level of extreme pessimism and fear. So, while on any other day I would offer conviction that my equity pessimism/reversal model was flashing a huge contrarian buy, the message I am sensing is that ‘this time is different’. As I argue, one should imagine the capital markets where all major central banks have interest rates settings at the effective zero bounds, some have negative rates and others expanding the monetary base through QE. That is not just a possibility, but by the time the coronavirus has done its damage to economics, then it’s actually probable.

How exposed are we to future shocks as investors, when we can’t use interest rates to influence financial conditions? When US Treasury yields, if we look at the long end of the curve, are starting to price an element of QE from the Fed and RBA. Some will argue I am being dramatic, and I hope that is the case. The virus will have an endpoint, but we are modelling the impact of the virus behaviours, and that is incredibly difficult. The virus has hardly made its way onto our fair shores, here in Australia, and we have a rush to buy toilet roll.

Anyhow, recessions don’t just happen, they are caused by a mistake. Either from a central bank or even government, or in this case a black swan event. However, it’s the response that is key and the market is telling you the response is going to cause economic fragility when we already have way too much corporate debt and little ammo from central banks. Today's session reeks of traders de-risking into the weekend, and that seems fair because on balance the news flow is likely to stay bearish and the possibility of a negative gap in risk on the Monday open seems higher than a positive one.

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.