- English

- 中文版

2024 Mexico Presidential Election - Trading The MXN

Expectations

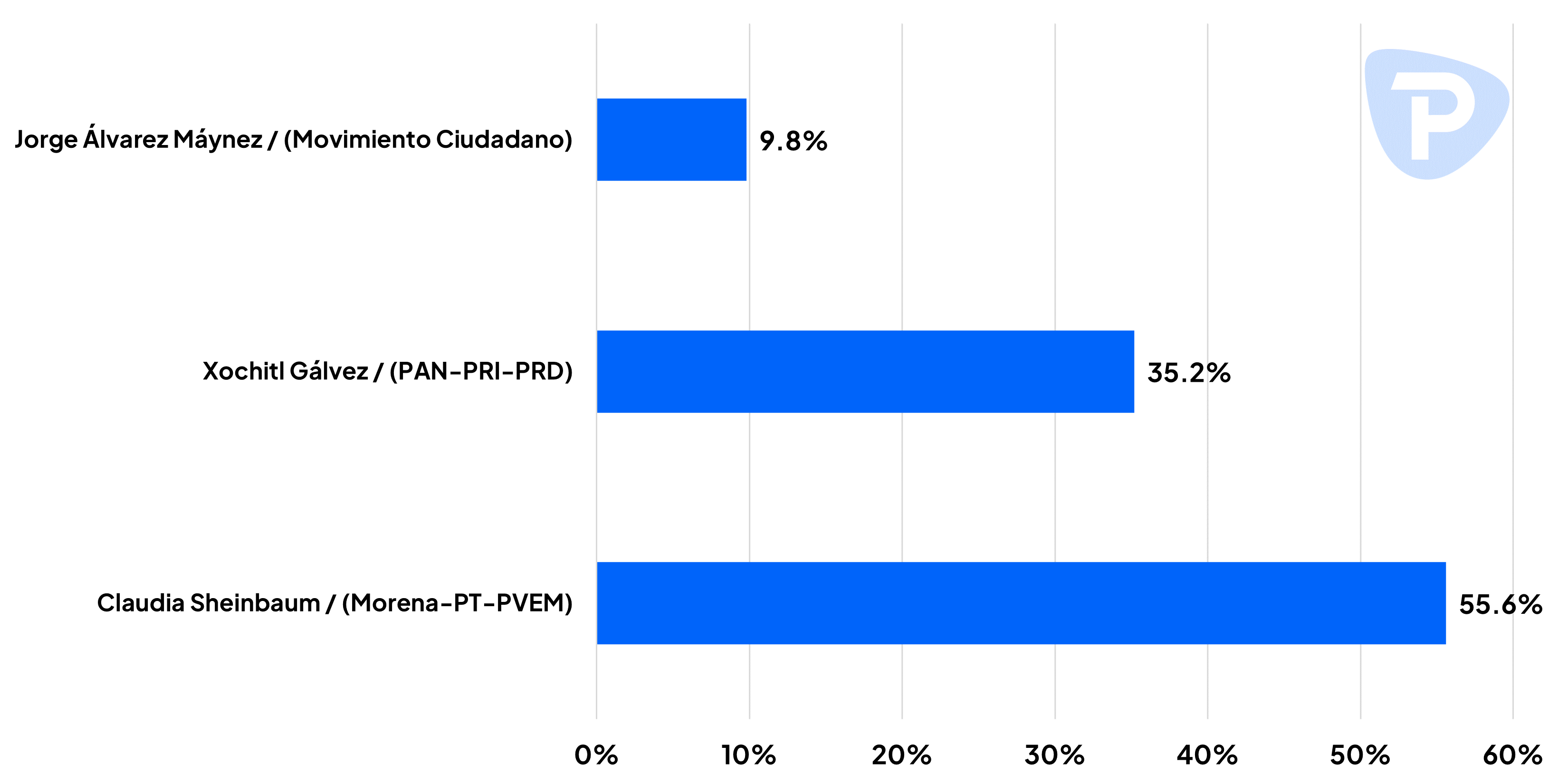

Claudia Sheinbaum, the candidate of the Morena party and current Mayor of Mexico City, leads the polls with a significant advantage over her competitors.

Opinion Polling

Interest Rate Differentials

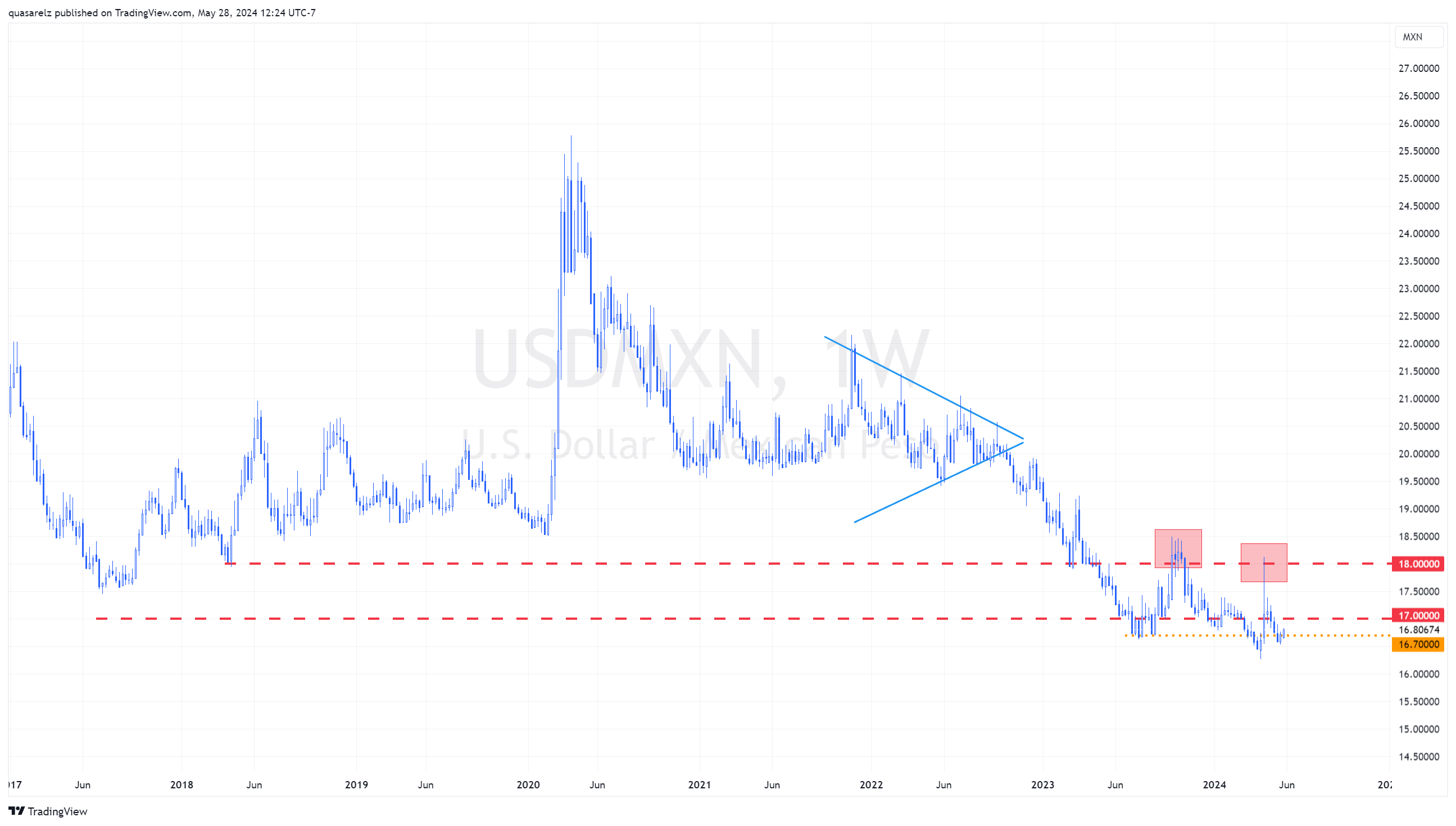

One of the pillars of the strength of the Mexican peso has been its attractive interest rate differential. The Bank of Mexico (Banxico) has maintained a prudent monetary policy, especially in a context of rising inflation. Recently, inflation has shown signs of an increase, leading Banxico to proceed with caution regarding future rate cuts, trying to limit expectations that these adjustments will be considered a normalization cycle.

At the moment, the main expectation is that these interest rate differentials will continue to support the Mexican peso in the near future, as investors seek to take advantage of these returns.

AMLO Administration

During the AMLO administration, despite some initial conflicts with the private sector, the economy has maintained a level of relative stability. The reforms and policies implemented have not been as radical as initially feared, allowing for a more harmonious coexistence between the government and the private sector. This has contributed to a perception of lower political risk, reflected in the stability of the Mexican peso in international markets.

2024 Presidential Elections

The outlook for the 2024 elections is that Morena will maintain power, either with a simple majority or potentially a majority in Congress. This expectation of continuity has allowed markets to focus on fundamental economic factors rather than political uncertainties. Analysts expect that the Sheinbaum administration, if elected, will continue with economic policies that have been relatively favorable for the market.

Potential Outcomes

Although Sheinbaum leads by a wide margin, there is a possibility that the margin will be narrower than indicated by the polls. This could result in a more robust system of checks and balances in Congress. In any case, the prevailing expectation is that Morena will maintain a strong position, which should translate into political stability and continuity.

Long-Term Risks

In the long term, one of the main risks to the economy and the Mexican peso is the possible return of Donald Trump to the presidency of the United States. A Trump administration could harden bilateral relations, negatively impacting the Mexican economy. In the context of global fragmentation, some Chinese companies have begun or expanded operations in Mexico to take advantage of its proximity to the US market. If this trend continues, it could have an unfavorable effect on the economy and the Mexican peso, as the Republican candidate seeks to limit China's economic advances.

"Friendshoring" and "Nearshoring" Dynamics

Somewhat related to the previous point, the West has tried to limit its commercial and economic exposure to China, driving dynamics such as "friendshoring" and "nearshoring". These strategies, where companies seek to establish operations in friendly or nearby countries to mitigate geopolitical risks, have benefited Mexico. The Mexican economy has been favored by these trends, attracting investments that seek more stable alternatives close to the US market. This flow of investments is crucial for the country's economic development and could continue to support the Mexican peso in the long term.

Weekly chart USD/MXN

Conclusion

The elections on June 2, 2024 are expected to bring "stability" and continuity under the leadership of Morena. Financial markets have shown relative calm, focusing on interest rate differentials and positive economic profile. However, long-term political risks, especially related to the presidential elections in the United States, will remain a critical variable. Overall, Mexico is in a favorable position to maintain economic and monetary stability, as long as current investment and monetary policy trends continue.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.