ASX200 Nears Record Territory as Rate Cuts and Dividends Fuel Momentum

More holistically, cross-asset volatility also holds at very low levels, and we see tighter credit spreads, and positively trending equity markets. Subsequently, carry (income) strategies have seen increasing adoption from money managers/hedge funds, whether that is in LATAM FX or in equity, where the ASX200 is home to some of the highest quality high dividend paying stocks around.

The technical set-up

With the ASX200 now just 2.5% away from the all-time high printed on 14 February, new highs are well within sight, although it may well take S&P500 futures to break 6000 to get the Aussie equity index breaking out to new highs.

There is a sense of buyer’s fatigue in the daily set-up, with the 5-day average high-low price range narrowing to 82p, while the last 3-day consecutive daily gain was last seen on 12 May. We can also look at the market internals and see that participation in rally hasn’t been great – for example, since 8 May the ASX200 has rallied 3.3%, but the number of ASX200 companies with price above the 20-day MA has fallen from 92% to 62%.

That said, the index continues to print higher highs, and on positive momentum (the ROC (5) is rising), while the 3-day EMA holds above the 8-day EMA - with both averages angled higher. Until I see the index record a daily close below the 8-day EMA, I favour a further grind higher with the price gravitating towards the 14 Feb highs.

What to like about the ASX200?

• Unless a CFD trader adopts an index long/short strategy, where the S&P500 heads to from here matters for the ASX200. We look towards Nvidia’s earnings in the session ahead, and the outcome could result in big moves in the NAS100 and SPX500, which will filter through to the ASX200 – however, the set-up for the S&P500 looks strong, and dips should be well supported.

• As stipulated above, there is a migration towards income strategies, and should this theme continue it suggests further tailwinds for the ASX200 banks, REITs and utilities.

• ASX200 Tech has worked well recently, and significantly outperformed the ASX200 in 2025, although the sector weighting is low, and so the effects of a 23% YTD gain (for the ASX200 tech sector) on the index is less pronounced.

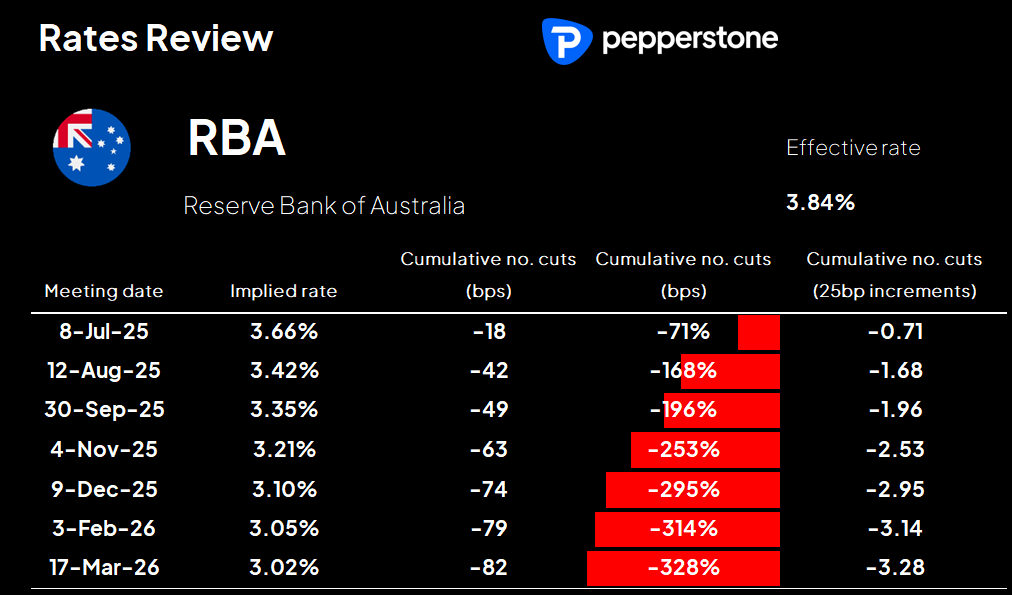

• The Aussie interest rate swaps market implies a 71% chance of a further 25bp rate cut in the July RBA meeting, with three 25bp cuts implied by December taking the cash rate to a trough low of 3%. 80bp of additional implied rate cuts, when the ASX200 is 2% away from ATHs, is an interesting dynamic, and it offers continued tailwinds for equity appreciation.

• The 6-month Bank Bill Swap rate has fallen 100bp since December and at 3.73% resides at the lowest level since April 2023. This reduction in the lending base rate and the lower cost of capital will offer businesses some breathing room when they hit the semi-annual review period.

• The Australian economy is hardly blowing the lights out, but a recession is implied at a low 20% over the coming 12 months. Granted, most, if not all of Australia’s GDP growth and job creation has been driven by govt spending and centred in the public sector, with the private sector seeing anemic growth - but house prices remain strong, bank asset quality remains high, credit demand is solid and ASX200 earnings looks stable and set to grow 5% over the coming 12 months.

• The Aussie banks continue to attract inflows and are well supported on dips. The recent bank earning season highlighted lacklustre earnings growth, with margins constrained by competition - but CBA and NAB defy sky-high valuations and continue to perform admirably.

• The idea of monthly inflows into ASX200 equity from domestic pension funds, with the mandatory monthly super contributions needing a home in the most liquid parts of the market supports the banks and to an extent the big energy plays and miners. Plus, with the rise and rise of ASX200 ETF tracking funds, much of the daily ETF rebalancing (to bring the ETF price in line with its NAV) has been a core reason why CBA and NAB have outperformed when so many in the analyst world have a ‘sell’ recommendation on CBA.

In summary

Until the momentum truly comes out of the ASX200 daily set-up, and the index closes below the short-term moving averages, I remain constructive on further upside potential. It may be hard for traders to chase the tape and deploy new capital on the long side at these levels, and some may wait until the coast is clear post-Nvidia’s earnings – but should Nvidia hit the mark, then the positive sentiment that could filter through to the ASX200, with reduced volatility, should offer renewed tailwinds to high paying dividend plays – subsequently, 2% doesn’t seem that far away and simplistically you can’t get any more bullish than a market at all-time highs.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.