- English

- 中文版

What is Stagflation and How Does It Affect the Economy?

Trade on stagflation with CFDs

Create a live Pepperstone account

So what is stagflation?

The term stagflation is an economic definition for a period characterised by high inflation and slowing or no economic growth. This is a situation in which the economy is stagnant yet inflation rates either increase, or remain high.

This type of economic stagnation occurs when the cost of living increases faster than wages, reducing consumer purchasing power and leading to lower consumer spending which further slows down economic activity. In other words, a combination of macroeconomic factors create an environment where demand for goods and services decreases while an increase in production costs makes matters worse.

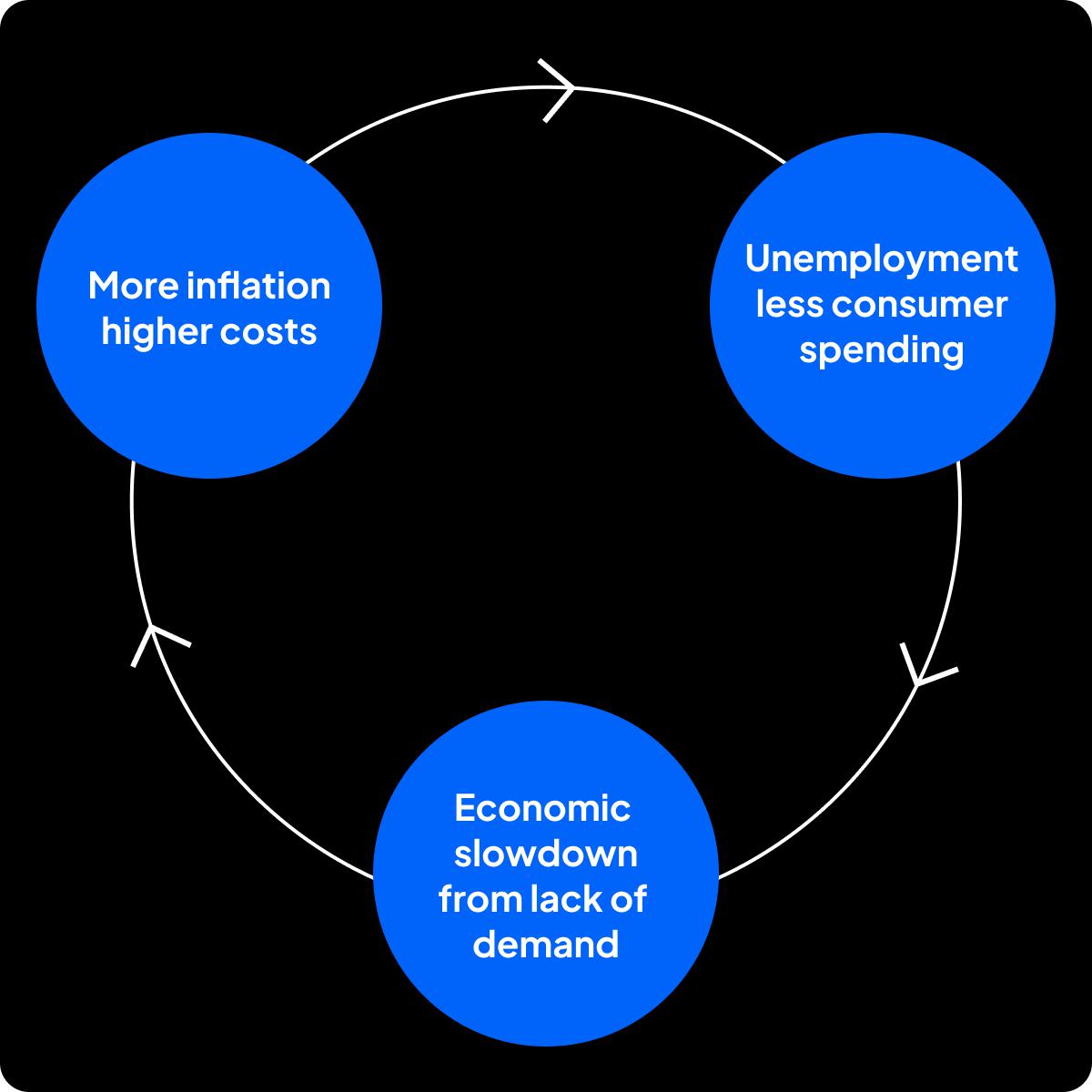

When stagflation occurs, it has a significant negative effect on the economy. A rise in prices due to inflation means consumers have less disposable income to spend - spending which would in turn boost the economy - creating a vicious cycle of slowdown.

Characteristics of stagflation

There are several tell-tale signs of a stagflation environment. It is characterised by:

- High inflation rates and rising prices

- Low economic growth, and low production levels

- High or rising unemployment rates

High inflation rates and rising prices

The first sign of impending stagflation is usually an environment of relentlessly rising inflation, or interest rate hikes - or both.

When inflation rises, central banks like the Federal Reserve will typically raise interest rates in an attempt to avoid runaway inflation. This will cause a trickle-down effect to banks and all other merchants, resulting in goods and services being more expensive.

The knock-on effect for the man in the street is that both the inflation and the interest rate hike decreases their money's value, as money's purchasing power is reduced by the rising cost of living.

However, inflation is usually associated with times of economic growth. But when inflation and/or interest rate hikes continue on for too long, these actually slow down the economy with the pressure the higher cost of things puts on consumers and businesses alike.

Low economic growth

This leads us to the next sign of a stagflationary environment: low or no growth. In a country where inflation has gone on too long or been too severe, spending goes down.

During times of an economic dip, countries typically require more spending to lift them out of the doldrums. But with a higher cost of living and doing business thanks to inflation and rate hikes, most are forced to save rather than spend. This means that less money is being pumped into the economy.

Soon, this shows up in GDP figures and other signs of growth - or lack thereof.

High unemployment rates

The third harbinger of stagflation is joblessness. The combination of slow economic growth and high inflation can lead to a decrease in production, which can then lead to job losses and lower employment.

As we've said, high inflation rates mean that the cost of living is increasing, which means a decrease in consumer purchasing power, making it difficult for businesses to sell goods and services. In turn, this can lead to a decrease in production - and the workforce production requires. Additionally, businesses may be forced to increase prices to keep up with rising costs, which can further exacerbate the inflation problem and lead to a decrease in demand for their products.

All this means that businesses are often forced to cut one of their most expensive resources as they tighten their belts: staff. But this only adds fuel to the stagflation fire on a macro level, because unemployed people also typically don't do the spending an economy requires to come out of a slump.

Effects of stagflation on the economy

The effects of stagflation tie directly into its characteristics. In a country experiencing stagflation, the focus of state, individuals and businesses alike moves from wealth creation to preservation and survival.

Less emphasis is often placed on technological innovation and infrastructure at a national level while governments pause on big projects, and in the markets equities like stocks tend to underperform while 'wealth preservers' and safe-haven assets like gold and some other commodities like wheat and oil often do well.

In other words, expenses are cut down to bare necessities as all tighten their belts. For businesses, this often means cutting even more jobs, and nations in a stagflation environment tend to report higher and higher unemployment figures.

On an international level, stagflation can have a significant supply shock on supply chains for goods and services macroeconomically. High inflation can lead to increased shipping costs and cost of production, which can result in manufacturers and transporters passing the cost onto consumers in the form of higher prices.

This, in turn, can reduce demand for goods and services, leading to a decrease in production and employment levels. Disruptions in supply chains due to factors such as financial crises, war (like Russia's invasion of Ukraine) or natural disasters can exacerbate these effects further. In such an environment, policymakers may implement measures such as interest rate hikes or austerity measures to combat inflation, which can again slow economic growth and impact supply chains even more.

In other words, it's a negative cycle where each cause and effect leads to the next one.

A practical example of stagflation

The 1970s oil crisis

In the 1970s, stagflation occurred in the United States under then-president Richard Nixon due to the tripling of oil prices, which led to high inflation and uneven economic growth. The oil embargo, coupled with high budget deficits, further worsened America's economic situation.

The Federal Reserve's response to the stagflation resulted in high inflation expectations, leading to the loss of its credibility as an inflation fighter. It also led to economic growth plummeting and a rise in unemployment. The situation was finally brought under control by then chairman of the Federal Reserve Paul Volcker, who limited the money supply by increasing interest rates to bring inflation under control.

How to control stagflation?

There are a few stock-standard responses and tactics that reserve banks use when dealing with stagflation. They are:

Changes to monetary policy

Changes to fiscal policy

Changes to other supply side policies

These aim to avoid runaway inflation by positively affecting taxation, monetary value and supply chains.

Monetary policy

Monetary policy is the central banks' set of rules surrounding money, and is used to influence the supply of cash and credit in the economy, which in turn affects the level of interest rates and the availability of credit. Specifically, they'll adjusting interest rates (usually raising them during stagflation) to discourage too much borrowing by making it more expensive. This can have a significant impact on economic activity, inflation, and employment levels.

The reasoning behind using monetary policy to control stagflation is that it can help to stabilise prices and promote economic growth without causing undue harm to the labour market. By carefully adjusting interest rates to balance inflation and employment concerns, reserve banks aim to promote stable economic growth while avoiding the negative effects of stagflation.

Fiscal policy

Another way to try and control stagflation is via fiscal policy. Fiscal Policy involves decisions made by governments about taxation, government spending, and borrowing to influence economic activity. The main purpose of fiscal policy, in this case, is to reduce inflation and unemployment, which are the two main causes of stagflation.

When governments control stagflation with fiscal policy, they typically utilise either expansionary or contractionary policies. During times of stagflation, expansionary fiscal policy increases government spending and/or reduces taxes in an effort to stimulate economic growth and reduce unemployment. It aims to increase consumer demand, which encourages businesses to produce more and hire additional workers.

Supply Side Policies

In response to stagflation, some governments have sought out supply side-policies in order to help stimulate economic growth without exacerbating the already high levels of inflation. Such policies include deregulation, tax cuts, investment in infrastructure, and other strategies.

Supply side policies are designed to increase economic growth by encouraging increased production capacity by decreasing production costs, which should theoretically lead to more jobs and increased consumer spending power which will then drive up demand for goods.

One example of this is deregulation - reducing or eliminating certain government regulations that limit the amount of competition within an industry or product market. This type of policy allows for new businesses to enter markets with little barrier to entry, stimulating competition and driving down prices.

Another example is the implementation of tax cuts, especially lowering taxes on businesses to encourage greater production capacity and job creation over time. Tax cuts may also give individuals more disposable income, for more consumer spending.

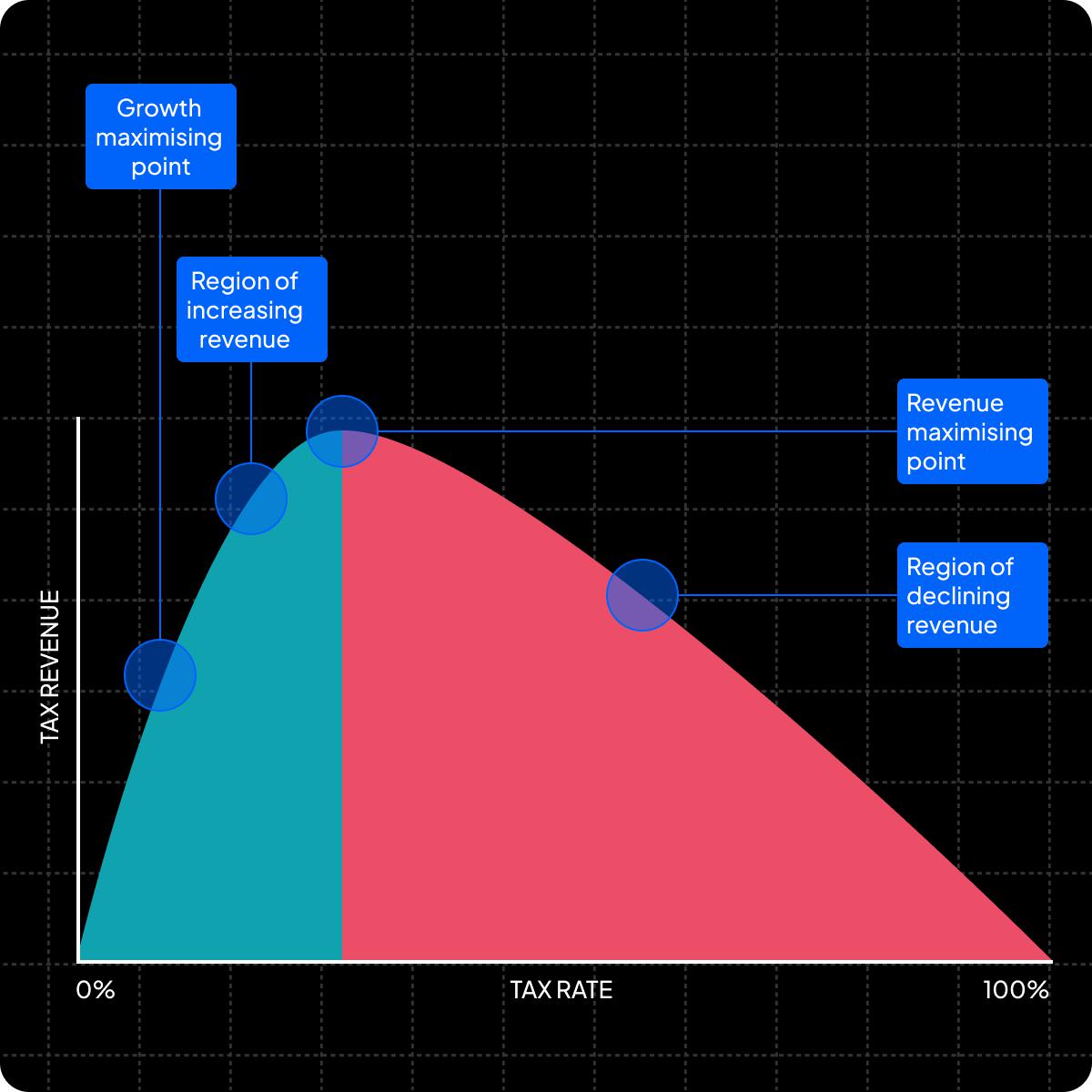

The Laffer Curve and investment infrastructure

Another strategy employed by countries fighting stagflation has been government investment into infrastructure projects such as roads, bridges or housing. The idea here is that this will lead to job creation, demand for goods and services and greater industry in the country, all of which should hopefully perk up the economy.

Over time, the better infrastructure will also hopefully help various sectors' companies produce more goods and services with less time/money, allowing them to pass those savings onto consumers who now have access to cheaper products and services, thanks to increased supply chain efficiency.

The theory behind this is called 'the Laffer Curve'. The Laffer Curve is the theory that higher taxes might actually lead to less revenue generated if taxed too heavily - instead, there's an optimal 'balance' where taxation generates maximum revenue for governments, while not stifling economic growth. Here is a pictorial illustration of this curve:

Trading strategies for stagflation environments

Stagflation is far from a pleasant environment - but it can be a predictable one. It can mean the use of certain strategies which some traders have found to work in past periods of stagflation.

One of the most important strategies is to focus on asset classes that have been less affected by stagflation. For example, stocks may have experienced slow growth during times of stagflation. Here, those with longer-term trading styles may hedge existing stock positions by allocating resources into other asset classes such as bonds and commodities.

Another trading strategy for during a period of stagflation, for position traders, is to manage your risk by diversifying across different asset classes. The idea here is to trade on underlying assets that preserve their value in times of uncertain or worsening economic conditions. For example, gold tends to perform well during stagflation periods, because it is a safe-haven asset and demand for it increases when market conditions are uncertain. This often goes for many other commodities as well.

Another strategy traders can use during a period of stagflation is short-selling markets you believe underperform in a stagflation - like for example shorting an emerging currency against a major one in forex trading. Short-selling involves 'going short' on a market, which means predicting its price will fall. If you're correct in your prediction, you'll make a profit if the trade's underlying asset price falls, but a loss if its price rises.

This can be profitable if done correctly, as it banks on the general assumption that most assets will depreciate in value during stagflation. However, there is the risk of losses when short-selling, as there's no limit to how high a market can rise. And while we’ll never allow your balance to fall below zero,* there is always the risk of substantial losses.

In conclusion: the TL;DR summary

- Usually, inflation is synonymous with financial growth in a nation. However, an economic environment that's defined by a combination of inflation causing increase in prices and economic stagnation, as opposed to growth, is known as 'stagflation'.

- Stagflation is an economic phenomenon synonymous with interest rate hikes and a rising cost of living, increased unemployment and low to no GDP growth for the country or region experiencing it. These characteristics tend to form a negative cycle, each one leading on from the other.

- Usually, governments and central banks tend to deal with stagflation by changing monetary policy, usually in the form of interest rate hikes. However, changes to fiscal policy can also be used, encouraging more spending by businesses and consumers by introducing tax breaks, government bonds or infrastructure projects to invest in and deregulation.

- Traders can take advantage of stagflation by utilising strategies like short-selling, diversification and increasing exposure to asset classes known to do better in previous eras of stagflation like bonds and gold and some other commodities.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.