- English

- 中文版

The Big Five

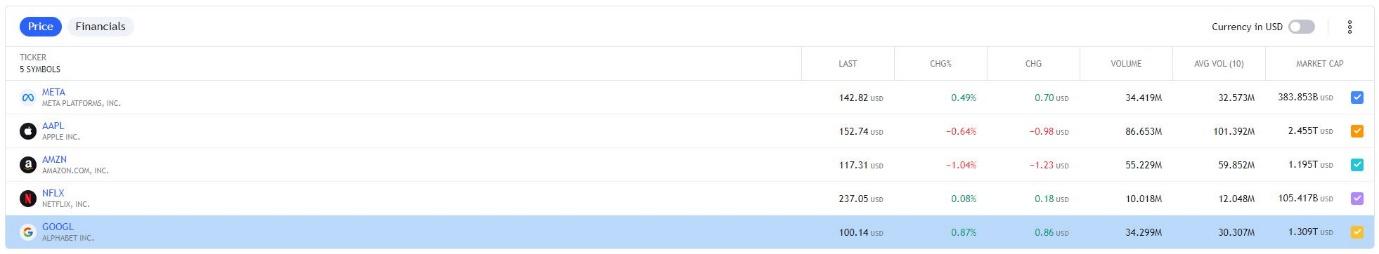

Who are the Big Five? FAANG is an acronym for the five largest big tech companies in the United States. Facebook, now known as Meta Platforms (META), Amazon (AMZN), Apple (AAPL), Netflix (NFLX) and Alphabet (GOOG), previously known as Google.

They have a combined market cap of $5.448 trillion (as of the 23/09/2022).

Figure 1 TradingView FAANG 23/09/22

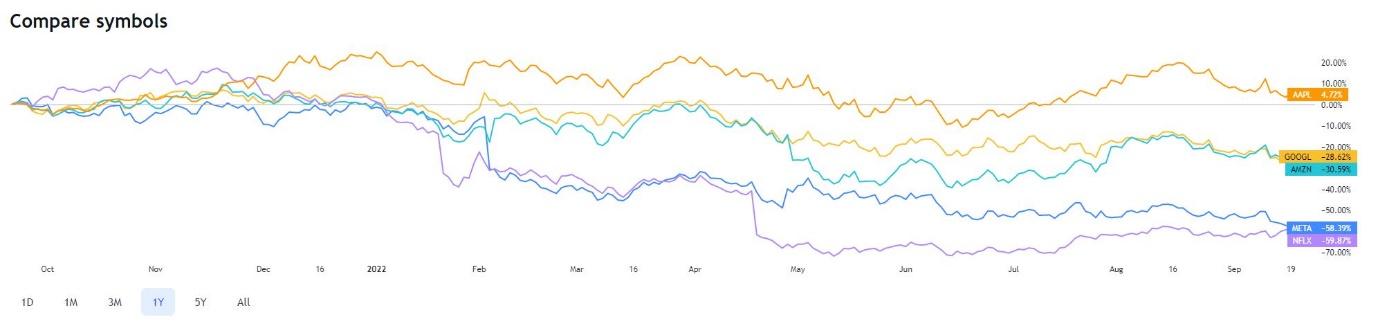

FAANG price comparisons for 2021

Apple is the only FAANG company that has posted an increase in share value for the last 12-month period (+4.72%). Google and Amazon have devalued close to -30% with Meta platforms and Netflix near -60%.

Figure 2 TradingView the past 1-year performance

Why the downturn?

There has been a brutal selloff in the FAANG basket from the 2022 high of 5821. As of the week of 13th June 2022, the decline was over -40%.

Although these companies were clear winners during the lockdown period of the COVID 19, most have seen a dramatic turn around in profits, earnings forecasts and market expectations.

There is also the argument that the quick rise in inflation and interest rates will have a severe dampening effect on global stocks.

Can we expect a turnaround in expectations? With earnings estimates on the low side, this could take some time.

A look from a technical perspective

The weekly chart highlights the last move lower being in three-waves. This normally dictates that the selloff is corrective. Although we have seen a stalling close to the 61.8% Fibonacci level of 3608 (from 2237-5843), there is no clear indication of a change of trend.

The next clear downside barrier is between 3005 and 2682.

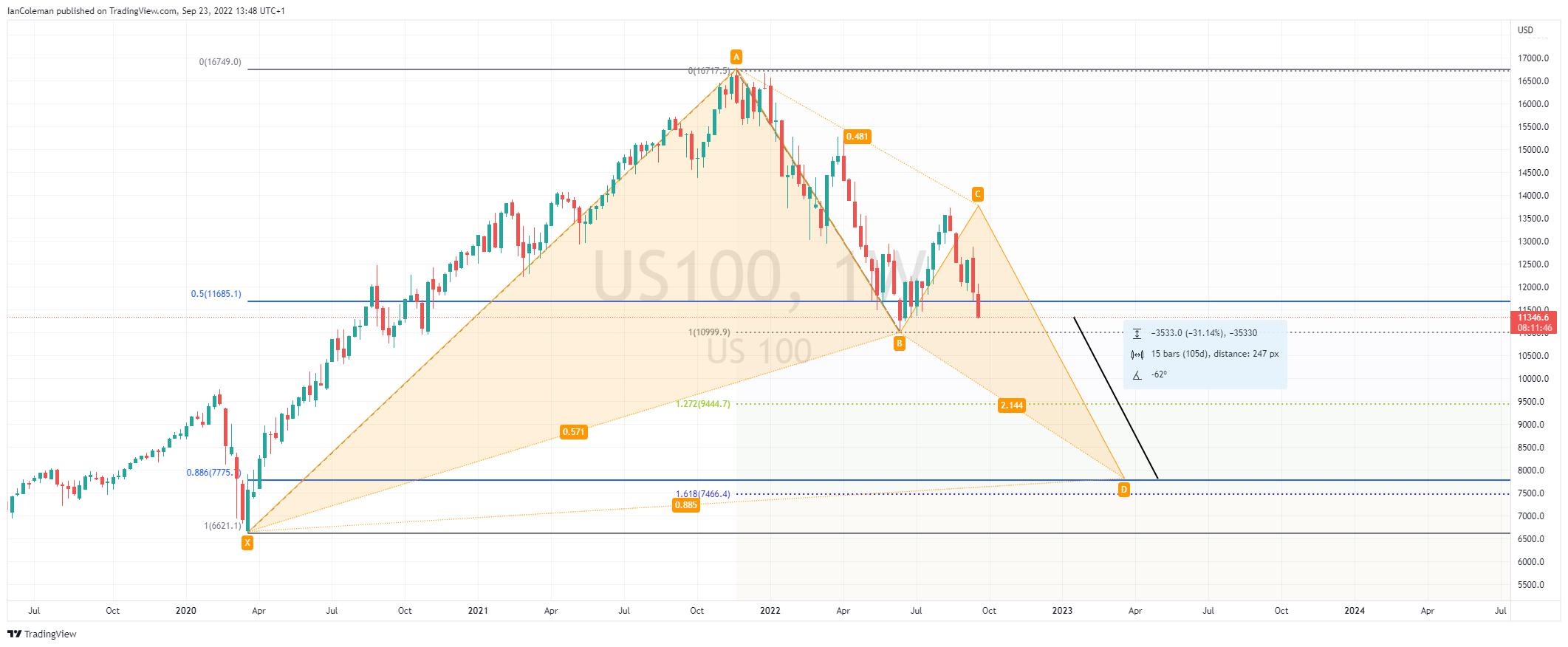

Figure 3 TradingView FAANG weekly chart

Looking at the Nasdaq100 (US100), this chart could suggest another -30% fall towards 7775 and 7466. This will then form a bullish pattern known as a BAT and could suggest a temporary low in place.

Figure 4 TradingView Nasdaq weekly

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.