What is silver trading and how to trade it?

Silver is a precious metal with significant industrial applications across various sectors, including electronics, mobile communications, solar energy, and speciality chemicals. Its broad utility makes silver a highly sought-after commodity CFD.

Silver trading involves speculating on price movements, a practice undertaken by producers, consumers, institutions, and retail traders alike. Traders aim to profit from these fluctuations, however there is also a risk of loss when trading. Whether through buying silver in anticipation of price increases, selling ahead of a decline, or hedging against future production and input costs.

The silver market comprises diverse participants with differing perspectives on the metal's future. These views, combined with shifts in supply and demand, sentiment, and other factors, contribute to the ongoing price movements in the silver market.

How to trade silver

In order to trade silver, you'll need a brokerage account, which must be funded by depositing money.

In addition to the trading account, a well-structured silver trading strategy is essential.

This strategy can be based on either fundamental analysis of the silver market or technical analysis of price movements and indicators. In many cases, a combination of both approaches is used.

Whatever the chosen strategy, it should clearly identify trading opportunities, provide actionable insights, and suggest entry points, take-profit levels, and stop losses.

Effective money and risk management are also crucial components of a trading plan. Traders should consider factors such as the size of each trade, the number of open trades at any given time, and an acceptable risk-reward ratio. The risk-reward ratio measures the potential profit from a trade relative to the money at risk. Ideally, the reward should exceed the risk.

With a funded account and a trading strategy in place, you're ready to begin trading silver.

However, many beginners prefer to develop their strategy and improve their trading skills using a demo account. A demo account offers a realistic market simulation and trading conditions without the risk of losing real money.

Silver Share CFDs and ETF CFDs

Trading physical silver, such as bullion, is one way to participate in the silver market. Another approach is to gain exposure through silver mining share CFDs. However, it's important to note that mining share CFDs do not offer a direct correlation to silver prices. This is due to the unique characteristics of each mining company, including factors like production costs, debt levels, and ownership structures, which all impact share CFD prices alongside movements in silver prices.

A potential way to minimise these company-specific factors is by trading an exchange-traded fund (ETF CFD) that tracks silver mining equities or an index of silver miners. For more direct exposure to silver prices, one could consider trading silver ETF CFDs that mirror the price of physical silver. However, it’s worth noting that these ETF CFDs may not perfectly track the spot price of silver due to the way they hedge their exposure. This discrepancy, known as tracking error, can lead to differences between the ETF CFD’s performance and that of the underlying commodity.

How to trade silver CFDs

- One of the most efficient and accessible ways to trade silver is through silver CFDs (Contracts for Difference).

- CFDs are cash-settled contracts that allow traders to speculate on silver price movements without owning the physical asset.

- With silver CFDs, traders can take either long (buy) or short (sell) positions, depending on whether they anticipate a rise or fall in silver prices. A long position reflects an expectation that silver prices will increase, while a short position is based on the expectation of a decline.

- Traders should also be mindful that trading leveraged products, such as silver CFDs, carries a high level of risk.

Why trade silver?

Silver serves as both a precious and industrial metal, with hundreds of thousands of ounces traded daily. It is a relatively volatile commodity, with a recent two-year price range spanning from $17.85 to $32.68 per ounce.

This volatility and frequent price fluctuations create numerous trading opportunities in silver. Prices are influenced by factors beyond silver production, such as interest rates and inflation, and it is often viewed as a store of value.

While silver is no longer held by central banks as part of their reserves in the same way as gold, it still share CFDs some of gold's qualities. Like gold, silver is not strongly correlated with other asset classes, offering a hedge against inflation. However, trading silver also involves exposure to its industrial demand and usage.

Additionally, silver offers a more accessible entry point into precious metals trading, with gold currently trading at approximately 88 times the price of silver.

Benefits of trading silver

Silver occupies a distinct role in the markets, serving as a bridge between precious and industrial metals, with daily trading volumes reaching hundreds of thousands of ounces. Its notable price volatility is evident from its substantial two-year price range, oscillating between $17.85 and $32.68 per ounce. This volatility, combined with frequent price fluctuations, creates ample trading opportunities.

Silver prices are influenced by a variety of factors beyond its production, including interest rates and inflation, and can act as a store of value. Unlike gold, however, silver is less commonly held by central banks in their reserves. While silver share CFDs some characteristics with gold, such as its role as a hedge against inflation and a store of value, it also reflects its industrial demand. Additionally, silver offers a more accessible entry point into precious metals trading, priced at approximately 1/88th of gold’s value.

Risks of trading silver

Silver is often overshadowed by gold, which attracts a larger share CFDs of investments in precious metals and receives more media attention. Although demand for silver exceeded supply in 2023, net investment in physical silver decreased by 28% according to the Silver Institute, with forecasts indicating a further decline of 13% in 2024. This trend may further reduce or even eliminate excess demand in the silver market.

As with other precious metals, silver does not generate income, which may lead traders to prefer dividend-paying share CFDs or bonds instead. The volatility, frequent price changes, and broad trading ranges associated with silver can present trading opportunities but also pose risks that require careful navigation.

What moves silver prices?

Silver prices are influenced by a variety of factors, including market sentiment, supply and demand dynamics, and evolving information about the metal and its markets. Additionally, external factors such as fluctuations in the US dollar value and broader macroeconomic conditions play a significant role in shaping silver prices.

The price of spot silver overlaid on US Non-Farm Payrolls Job Creation data over two years

Source: Trading Economics

The interaction of these factors results in price fluctuations as the market seeks to establish a transaction price by balancing buyers and sellers. Given that these inputs are constantly changing, silver prices remain dynamic and responsive to new information.

How to approach silver day trading

For day trading silver, identifying the prevailing trend is crucial. Determine whether the trend is a continuation of an existing pattern or represents a new direction. Assess the strength of the trend to gauge its potential longevity.

Trends can be categorised as uptrends, characterised by higher highs and higher lows, or downtrends, marked by lower highs and lower lows. An uptrend generally indicates potential price increases, while a downtrend suggests potential price declines.

Day traders should also monitor for patterns and indicators that might signal a trend reversal. Key indicators include candlestick formations (e.g., shooting star or hammer), moving average crossovers, and overbought/oversold conditions as indicated by tools like the RSI 14.

Silver vs. Gold

Silver is often compared to gold, though gold frequently dominates headlines and market attention. Central banks no longer hold substantial amounts of silver in their reserves, which has affected its prominence.

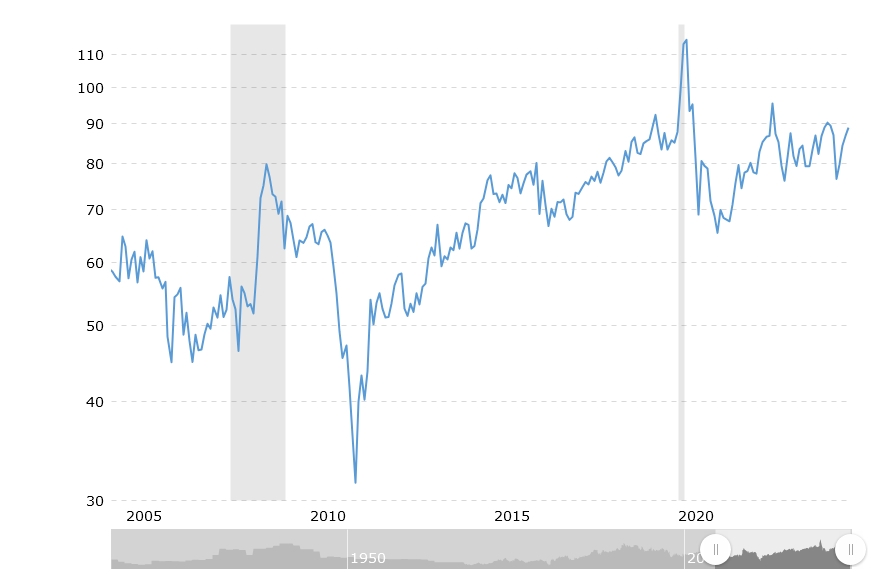

Traders track the gold-silver ratio by dividing the gold price (in dollars per ounce) by the silver price (in the same units). This ratio reflects the relative value of gold to silver and has seen significant variations, from a low of 31.6 to 1 in April 2011 to a peak of 114.7 to 1 in April 2020.

The gold-silver ratio over the last 20 years

Source: Macrotrends.net

Despite fluctuations in the ratio, silver and gold have generally moved in the same direction over the past five years. Gold has appreciated by 63.50% during this period, compared to a 55.60% increase in silver.

Traders may consider the historical relationship between gold and silver prices to make trading decisions, including setting entry levels, stop losses, and profit targets. However, it is important to note that past performance is not a reliable indicator of future outcomes.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.