- English

- 中文版

Risk management becomes a science more so than ever and it’s in these situations should you choose to stay in, where we consider volatility and adjust our risk accordingly. As whippy moves just increase the risk of getting stopped out and paying spread. This obviously means reducing position sizing should you take on more risk.

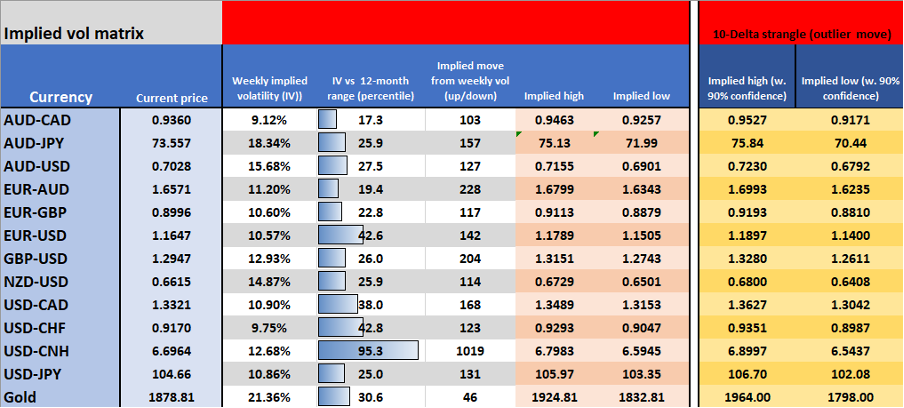

Here's the weekly implied volatility matrix (prices from Friday's close) for a guide on expected movement with a 68.2% and 90% degree of confidence in gold and key margin FX pairs.

Consider on the calendar this week we get:

- US election - Clearly the dominant force, but will we get an outcome on the day or by Friday (if it comes down to Pennsylvania)? Will any key states contest the outcome?

- Covid newsflow - UK and EU lockdowns increase fears of a renewed economic downturn. Huge covid-19 cases are also being seen in the US, with a rapid rise in hospitalisations. A vaccine can’t come fast enough.

- FOMC meeting (Friday 6am AEDT) - Could the Fed give a clear signal of new policy action in the December meeting? Will it turn out to be the non-event most traders expect?

- RBA meeting - (Tuesday 14:30 AEDT) - The RBA is firmly expected to lower the cash rate to 10bp, as well as its 3-year bond yield target. The bank should announce a new QE (bond-buying) package of $100b to be implemented by end-2021.

- BoE meeting - The market has pared back its view on negative rates, but it would not surprise if the bank increased its bond-buying (QE) program by £100b to £845b. New forecasts on growth and inflation could get some focus, although economics are incredibly hard to model given the new restrictions and the prospect that these drag on over the Christmas period.

- US non-farm payrolls - Seemingly a non-event given the US election, but it should be on the radar. The consensus expects 600,000 jobs to be created, with the unemployment rate to tick down 20bp to 7.7% (the participation rate is eyed at 61.5%).

The US election takes the crown though and the overriding question is whether we get an outcome on the night or whether it drags on for a day or two, or if a race is close could certain states be contested. A fate that would negatively impact risk assets. A contested outcome is more of an issue where that state may very well decide the final out of the presidency, such as Florida.

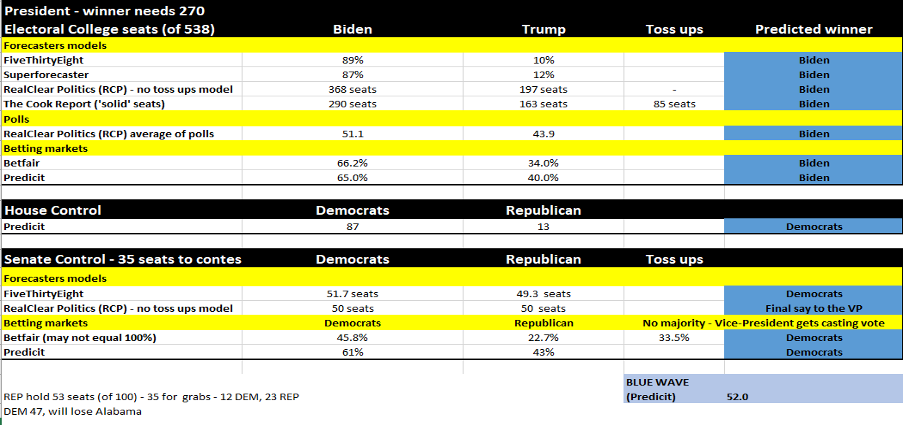

Election expectations matrix

Here we see the current aggregated expectations model for the Presidency, House, and Senate. Clearly, expectations for Biden’s presidency are incredibly high and the likes of FiveThirtyEight see a much higher probability of Biden winning than they did Hillary Clinton at this point in the race in 2016.

Many will disagree with these numbers pointing to rapid changes in demographics, voter registration (in favour of the Republican party) and the silent Trump vote. The Senate race looks too close to call.

Certain states are almost guaranteed to vote Democrat or Republican, so it’s the swing states such as Florida, Pennsylvania, North Carolina, Arizona, Michigan, Wisconsin, Iowa and Ohio, that will decide the fate of who gets the required 270 Electoral College seats to become the President. Many believe that if Biden can take Florida, he's basically home. Although, the odds of this are less than 50% with Biden’s prospects also elevated if he could take North Carolina and Pennsylvania

If Trump can take Florida and Pennsylvania it becomes very interesting.

Most political watchers therefore say the three key states to watch are Florida, Pennsylvania, and North Carolina. Although, we may not get the outcome in Pennsylvania until later in the week. Expect markets to move when we hear the outcome of these states, or specifically when a TV network calls their projected outcome. Which they only do when their models reach a 99.5% confidence level.

Given the incredible level of mail-in voting, certain states such as Michigan, Wisconsin, and Pennsylvania will likely take longer to release their results.

Consider there's no set time so keep your eyes peeled on our Twitter feed and TV networks for breaking news. It may be a first movers’ advantage.

The race for the Senate

The Senate is perhaps just as important in many ways, as whoever's in control here will dictate the size and scope of any future fiscal stimulus and the ability to pass many of the more significant Presidential agendas. The REPs should gain Alabama which would take them to 54 seats (of 100), but the DEMs are expected to take Arizona, Colorado, Maine, and North Carolina, which should create 50 seats a piece for each party. In this situation the final say goes to the Vice-President.

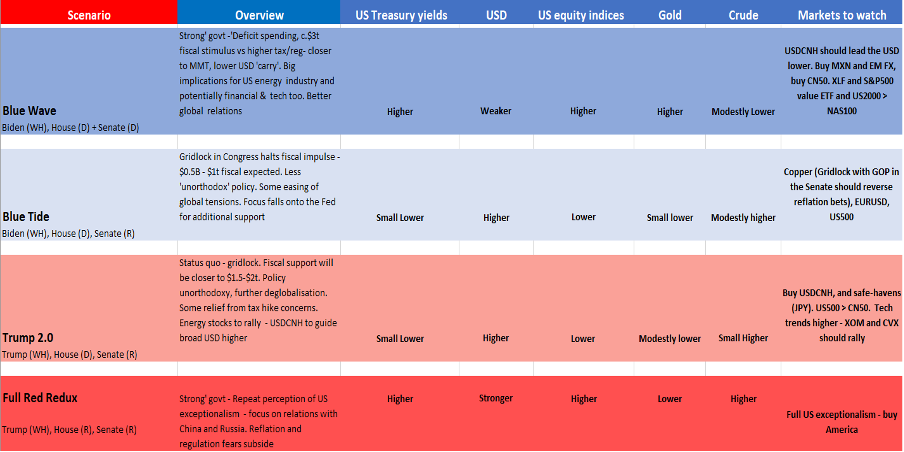

Expected market reaction

Another thing is the potential reaction in markets. It would not surprise if we just had a pure risk rally simply on an actual outcome and a scenario where traders have to close contested election hedges. This would be a short affair before the market re-focused on who is the president and the make-up of Congress.

I’ve put together what the various outcomes are expected to mean for markets, or at least the consensus expectations. At this point we need to consider market expectations, positioning, and changes in liquidity conditions. Not just the direction markets are expected to move when they start forging a higher conviction on the final outcome – as each state is projected by various networks the market will have a clearer idea on the outcome. Although, certain states (as talked about before) will carry far more weight.

Certainly, liquidity can have huge implications for trading costs and as we saw in 2016, the bid and offer spreads blew out dramatically.

React and survive

The other consideration is to not be married to a view. This playbook is what is expected given a simple sense check of policies and the stance on fiscal support, which is key. While a DEMs clean sweep might be considered a strong USD negative, a case could be made that it could a USD positive. As always holding an open mind, not just to the results but market moves – the ability to react is key.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.