- English

- 中文版

Key event risks for the week

- US Q3 corporate earnings kick-off – 7% of the S&P500 market report this week

- UK ILO unemployment rate, claimant count (Tuesday)

- US Sept CPI (Wednesday)

- China trade data (Wed) & CPI/PPI (Thursday).

- Aussie employment report (Thursday)

- US retail sales (Friday)

For now, the debate is about stagflation and the possibility of it playing out is being slowly priced through markets – bond yields are rising, interest rates are being increasingly priced in and energy is finding buyers easy to come by on weakness. In margin FX markets, the CAD had a breathtaking week last week with the ZAR and AUD following behind.

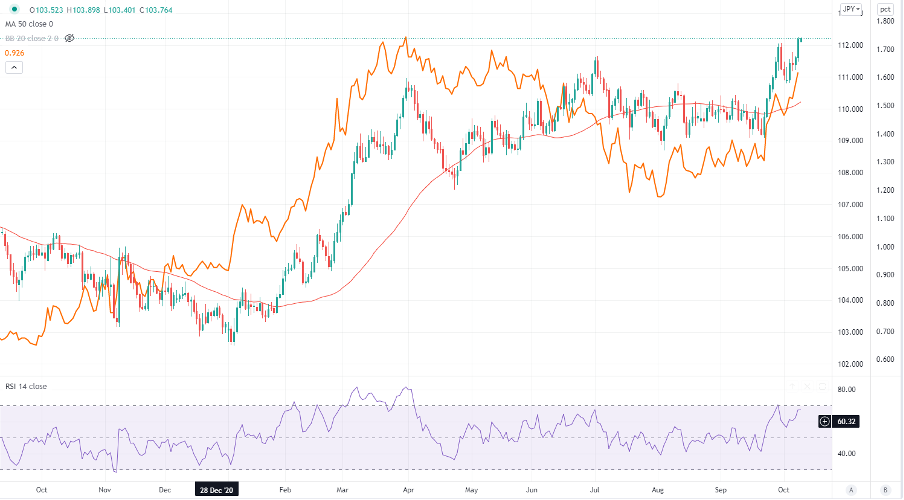

CADJPY the place to be of late

CADJPY gained 2.5% last week and was the place to be in G10 margin FX, as it aims for the May highs – who said there's no movement in margin FX markets! NOKJPY was not far off (+2.1% on the week), thanks again to the moves in Brent crude which now really needs to close above $82.50 for this bull trend to power on. AUDJPY also has its eyes on key swing highs around 82.00, with price pulling further away from the 50-day MA – the move in AUDJPY has been so powerful that it takes a brave soul to be long JPY, with the JPY the preferred funding vehicle now.

AUDJPY daily

(Source: TradingView - Past performance is not indicative of future performance)

AUD traders - Eyes on Thursday’s Aussie jobs report (11:30 AEDT) with the market looking for 120k jobs lost and the unemployment rate at 4.8%. One consideration is the participation rate, which is expected to come in at 64.7% - a solid decline since the 66% levels we saw back in June and seemingly in fitting with the US payrolls, where perhaps the big story, along with 0.6% wage growth, was the poor participation rate.

China may play a role too in the AUD move, with focus on September trade data (Wednesday – no set time), and CPI/PPI (Thursday 12:30 AEDT). Again we watch the ever-growing divergence between PPI (consensus 10.5%) and CPI (0.9%) and this spread just leads to perceived weakness in corporate margins. Not a particular healthy factor when we’ve still a beady eye on China’s high yield credit markets and whether this deterioration spills over into China’s equity markets and then broader market sentiment – for now, it’s the fallout from the credit deterioration seems contained, but we’re watching it closely…ominously.

US bond markets set to drive

(Source: TradingView - Past performance is not indicative of future performance)

USDJPY is really a mirror of the US 10yr Treasury, which has broken to 1.61% and the highest levels since 4 June. Fundamentally, it feels like the 10yr should be capped into 1.70% to 1.77%, but this is one that is centre of the markets this week. It’s an inflation story we’re watching though, with US Sept CPI (Wed 23:30 AEDT) expected to increase 0.3% MoM and 5.3% YoY on the headline and 4.1% on core. I would also be watching the University of Michigan report (Sat 01:00 AEDT) and notably the inflation expectations element.

Given stagflation is a growing market theme, the US retail sales report (Friday 23:30 AEDT) could be interesting – hypothetical of course, but a strong CPI number and weak retail sales and market participants will recalibrate portfolios towards this vibe and that may weigh on risk. It’s a tough one for central banks, but I note that interest rate expectations are the highest they’ve been and the market is primed for the Fed to taper in November. Perhaps we'll see the median dot for 2022 pulled higher in the Fed’s December meeting.

We see 81bp of Fed hikes priced in by the end-2023. It's not hard to see why USDJPY is rallying past 112 in that environment.

GBP traders eyeing UK labour data

With rates in mind, put GBP on the radar – tomorrow’s UK labour market read (17:00 AEDT) gets additional focus with the BoE making it clear this could be the trigger for near-term hikes. We’ve seen BoE member Michael Saunders saying the market is right to price in a quicker pace of BoE tightening and while we see rates market pricing a 24.7% chance of a rate hike (from the BoE) at the 4 November meeting, a solid jobs report could push this pricing to 40% and with-it GBP should find buyers. GBPUSD is consolidating and needs new news, but a break of 1.3650 takes me to 1.3700. short EURGBP or long GBPJPY might be a better play given the clearer signs of central bank policy divergence – 0.8450 in EURGBP looks possible.

US Q3 earnings ramp up

Equities don’t really know what to make of this backdrop but have their own focus this week with US Q3 earnings ramping up – 7% of the S&P 500 market cap report this week, with banks setting the scene. It's an important catalyst for markets, with CEO’s telling us how it is, hopefully giving us insights into the bottlenecks, supply-side constraints and input costs that have been so widely talked about. I currently holding a neutral bias on the US500, and really want to see a push above 4463 to turn more constructive, married with better breadth.

Gold also has its sights set on the bond market and after a blistering move into 1781 after Friday’s weak NFP headline, the market did an about-face after putting a higher weight to the solid revisions and wage growth. Gold is a slave to the US bond market, but then so is the USD. If real rates head lower this week, then Gold should close and break above 1780. However, if bond markets sell-off and nominal rates outpace inflation expectations, and real rates rise, then Gold will chew through bids seen between 1755 to 1744 and will set up for a move towards the 29 Sept low of 1721.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.