- English

- 中文版

The Daily Fix: Traders questioning exposure to reflation as blue wave gets repriced

Hedging is expensive here, especially for those using volatility and optionality. The ‘Blue Wave’ (Biden as President, DEMs both chambers of Congress) scenario has not been fully priced in my opinion, which is contrary to what some believe. However, the real question should be, given moves in certain markets how much fiscal stimulus is now priced in for 2021?

There are simply too many unknowns and while some have said having a plan to tackle the election is required, I think Mike Tyson’s quote “Everybody has a plan until they get punched in the mouth” is more appropriate. What we think will play out could be wholly incorrect. Not just when it comes to the result, but the subsequent market reaction – an open mind and reacting is key.

Also consider the fact that 52 million Americans have requested absentee ballots, with the PEW Institute suggesting 39% of registered voters will mail-in votes. Without going into depth, there’s plenty that can go wrong and the idea that certain states could see requests for re-counts is a real risk. The idea of contested is not priced in my opinion, whether that is for the Electoral College or Senate seats and should that play out then risk should get negatively impacted.

Close to 60m people have already voted, which is huge but hardly a surprise, but while many will say this favours Biden, the battleground states (Pennsylvania, Michigan, Wisconsin, Florida, North Carolina, and Arizona) are too close to call. In fact, Trump has closed the gap, with three rallies on Saturday alone. This will have people questioning their exposure to the reflation trade.

While weekend news has certainly picked up about the explosive increase in the US and global COVID cases, US fiscal is the key talking point and not just when it comes, but the size and scope – that will be determined by the political landscape.

Expectations of fiscal have been at the heart of the recent move in the US yield curve, with US Treasury 10s and 30s selling off relative to other parts of the curve. Banks have worked well in this environment, especially the US regional banks, as they source a larger percentage of earnings domestically (another massive US fiscal stimulus will benefit companies that earn domestically over abroad). Larger US banks have been well traded, (Pepperstone offer the SPDR XLF ETF on MT5) but underperformed their regional peers.

(Source: Bloomberg)

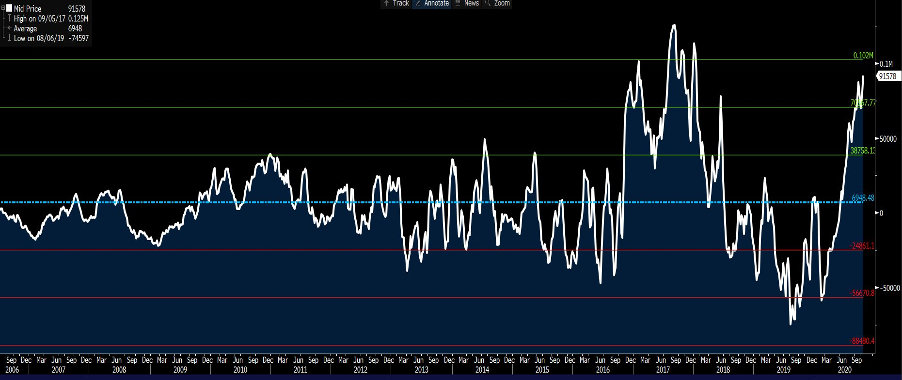

The perception of fiscal is where we see industrial metals having had a strong run and if I look at futures positioning in copper futures (held by leveraged funds) we see net longs nearly two standard deviations above the long-run average. Has this run too hard as fiscal becomes fully priced? Watch the copper and gold ratio which could be good pairs to trade (i.e. short copper and long gold) this week, especially if we see some profit-taking on US treasury shorts and real yields fall.

(Source: Bloomberg)

Reflation, is in-part, driven by the decline in USDCNH, which has been trending lower in a bear channel, with USD selling manifesting into selling of USDs vs the majors. The combination of a weaker USD and stronger yuan has played into a solid bid in the EEM ETF (MSCI Emerging Market ETF – again, traded on MT5). Another chart for the break-out traders, although the EEM ETF really needs USDCNH to push further lower. Would a Trump win result in a reversal in this cross? I suspect it would and re-enforces (in my view) that this cross is as influential in FX markets as any.

In equity markets, share CFDs that are most sensitive to changes in corporate tax rates have been significantly underperforming, testament to the perception of Biden’s prospects and plans to increase the corporate tax rate to 28%. Value share CFDs, we can trade as a ‘factor’ on MT5 through the S&P 500 value ETF (IVE ETF), have worked in this environment of rising Treasury yields, with funds rotating out of the QQQ (Nasdaq 100 ETF) and the NAS100, which worked well in an environment where bonds yields are moving lower. Lower bond yields this week could see that trade reverse.

These trades get re-assessed now as fiscal gets questioned here. Doubts creep in and positions will be adjusted to run a more neutral setting.

Will a Blue wave really play out? I notice this is now priced at 51% on Predicit and falling.

(Source: Bloomberg)

What will a divided Congress mean for fiscal, that being where the REPs keep the Senate? That's a real possibility and lowers fiscal expectations to around $1t, regardless of who is in the White House. What happens if Trump stays in power, but has to work with a full DEM Congress? We can't rule this out either.

Energy is worth watching, not so much the price of WTI or Brent crude, but the equity names like Exxon Mobile (XOM) and Chevron (CVX). This is not so much as play on fiscal, but Biden’s energy policy and his Green Energy deal. A Trump victory or even the REPs maintaining the Senate will see these names work well and find solid buyers (not just short covering). So, if we see Trump’s odds come in then these names could a better tone.

Take a look at Union Pacific Corp (again, traded only on MT5), share CFD traders have been using this as a bellwether on the recovery story and potential fiscal tailwinds. This share CFD now trades on an outrageous valuation of 23.7x FY Earnings, and 14.95 EV/EBITDA. If you want to trade or just assess the notion of a cyclical recovery in the US and to an extent globally, then UNP is worth putting on the radar. Again, if we see traders questioning the make-up of Congress and fiscal bets, this may trade lower.

In FX, USDCNH aside, watch MXN and CAD given they are the US’s closed trading partners. Conventional wisdom is that a Blue Wave should see thew USD hit hard, although I’m also sympathetic to a strong USD here. A view that reflation is unwound from markets may negatively impact these currencies.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.