- English

- 中文版

The Resurgence of the Japanese Yen: Monetary Themes and Geopolitical Winds Shift the Course

After hovering near multi-decade lows in early 2025—just below 160 yen per dollar—the Japanese currency has staged a significant recovery, briefly strengthening below the key 140 level this week. This move is not merely a technical adjustment but a reflection of a confluence of fundamental, geopolitical, and technical factors that are reshaping the USD/JPY landscape.

Japan’s Safe Haven Amid Trade Uncertainty

In the short term, the yen’s strength has been driven by a renewed search for safe-haven assets by investors. Uncertainty on the global trade front—particularly stemming from U.S. policy—remains a key catalyst. Recent reports suggesting that the U.S. administration is considering reducing tariffs on Chinese imports, conditioned on future negotiations, initially generated some partial optimism. China’s stance, open to dialogue but demanding an end to new threats, along with statements from Treasury Secretary Scott Bessent denying formal negotiations or imminent unilateral tariff cuts, has kept tensions elevated.

In a world where U.S. trade policy introduces volatility, the yen is reaffirmed as a stability anchor, attracting capital flows seeking safety beyond the dollar.

Additionally, the U.S. informing Japan’s trade delegation that Tokyo would not receive preferential treatment under the current tariff regime underscores the erratic and combative nature of U.S. trade policy. This approach not only causes direct friction but also casts doubt on the predictability of the world’s largest economy’s economic policies—indirectly benefiting the yen. Paradoxically, the unpredictability of current U.S. trade policy is strengthening the yen as investors begin to question the U.S. dollar’s status as the undisputed safe-haven asset.

A Paradigm Shift: Diverging Monetary Policies

Looking beyond recent trade-driven fluctuations, another significant factor for the yen in 2025 is the shift in monetary policy divergence between the U.S. Federal Reserve (Fed) and the Bank of Japan (BOJ).

During 2022–2024, the Fed’s aggressive rate-hiking campaign—while the BOJ maintained an ultra-loose stance (including negative rates and Yield Curve Control, or YCC)—created a massive interest rate differential that pushed the dollar to multi-decade highs against the yen.

However, the landscape in 2025 is considerably different. After peaking rates around 4.25–4.50% in early 2025, the Fed has adopted a neutral stance, contemplating gradual cuts later in the year (projecting perhaps two modest reductions). Fed Chair Jerome Powell has emphasized patience, awaiting clear inflation consolidation toward the 2% target, which, while significantly lower (2.4% YoY as of March 2025), remains slightly above target.

In contrast, the BOJ, under Governor Kazuo Ueda, has begun a historic normalization. After ending negative rates and YCC at the end of 2024, the BOJ has executed several rate hikes, bringing the benchmark rate to 0.50%—its highest level in over a decade.

This shift—unthinkable just a few years ago—is backed by a fundamental change in Japan’s economy: inflation has persistently stayed above the 2% target (3.2% core in March 2025) for nearly three years, and crucially, wage growth has shown unprecedented strength (with average increases of 5.3% at large companies in 2024, the highest in 33 years).

The interest rate differential, previously the main driver of yen weakness, is narrowing. The Fed pauses while the BOJ moves forward—this divergence provides additional tailwinds for the yen’s recovery.

Economic Fundamentals: A Stable Dollar vs. A Recovering Yen

The U.S. economy remains resilient in 2025, with declining inflation, moderate but stable growth (forecasts around 1.7% for 2025), and a robust labor market (unemployment near 4.1%). While this prevents a crisis scenario that could hit the dollar, the absence of sharp inflationary pressures and the prospect of slower growth eliminate the need for further Fed hikes, limiting USD upside.

Japan, meanwhile, presents a narrative of improvement. Growth is modest (around 1–2%) but supported by domestic demand thanks to wage increases. The exit from deflation and the normalization of monetary policy signal an economy that, while facing external challenges, is on a fundamentally positive path. Japan is no longer the story of stagnation and deflation. Its economic renaissance—with rising inflation and wages—gives the BOJ ammunition to normalize policy, which intrinsically supports the yen’s value.

The Geopolitical Factor and Pressure on the Dollar

Trade tensions and U.S. foreign policy not only impact risk sentiment but can also directly influence exchange rate expectations. The current U.S. administration has shown a tilt toward protectionist policies and, according to some reports, might even welcome a stronger yen (and weaker dollar) to address trade imbalances. This position contrasts with the traditional “strong dollar” policy and adds another layer of political downside pressure on USD/JPY.

Technical Analysis: The Battle for the 140 Level

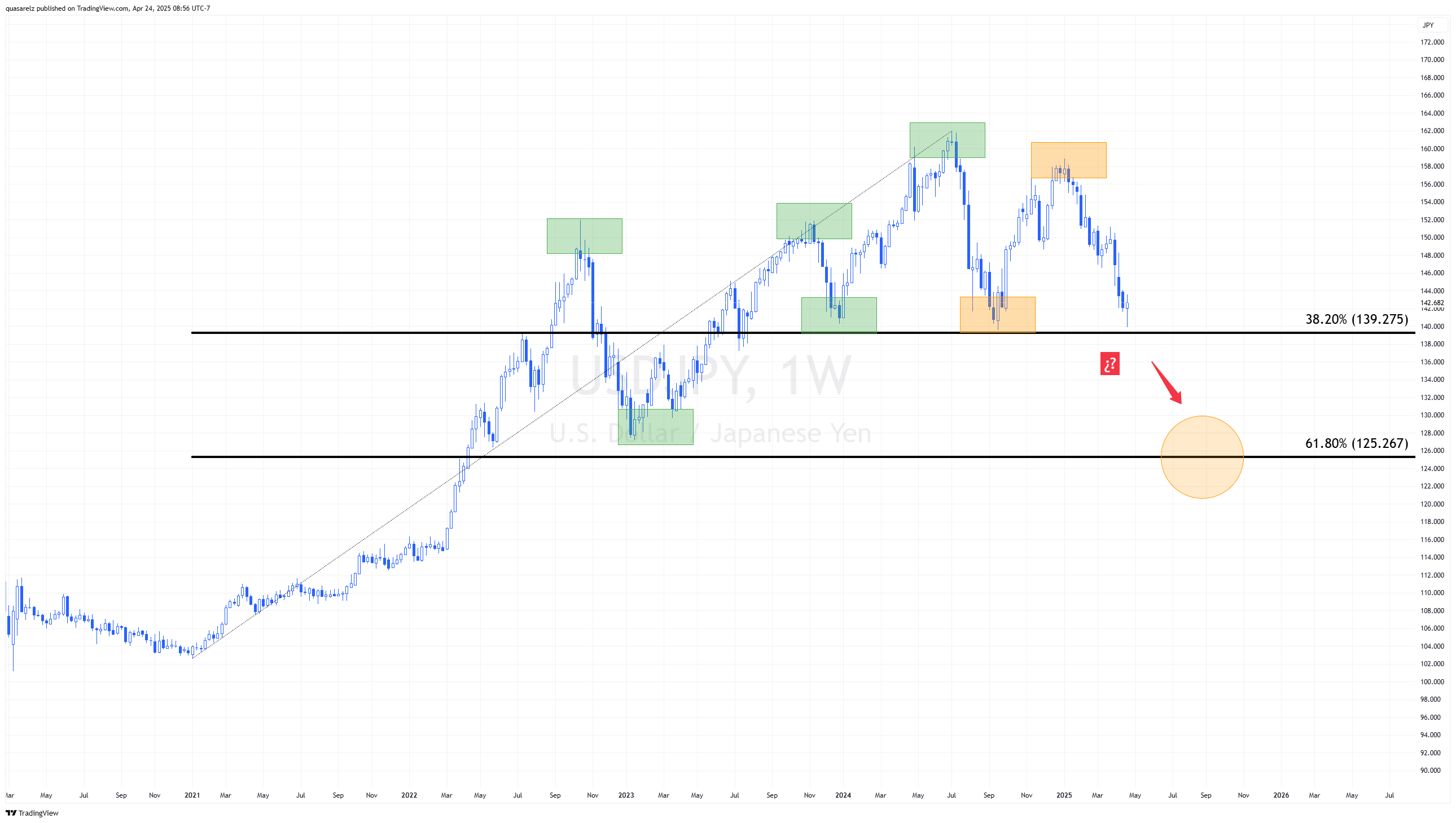

From a technical perspective, all eyes are now on the psychological and technical level of 140 yen per dollar. This level is significant not just for being a round number but because it roughly corresponds to the 38.2% Fibonacci retracement of the entire USD/JPY bullish leg from the 2021 lows.

A sustained break below 140 would be a major bearish signal. Given that we have already observed signs of a potential structural shift in the long-term trend of higher highs and higher lows, losing the 140 support could intensify selling pressure on the dollar.

The 140 yen level is not just a number—it is a key technical threshold that could confirm a long-term structural trend reversal and open the door to deeper declines.

If this support were convincingly breached, the next significant support level based on Fibonacci retracement would be much lower—around 125 yen per dollar, which aligns with the 61.8% retracement. This scenario would imply a substantial yen appreciation from current levels.

Weekly Chart USD/JPY:

Medium-Term Outlook: Trend Continuation with Volatility

Looking ahead to the coming quarters of 2025 and into 2026, the prevailing outlook leans toward a gradual continuation of yen strength, though the path will likely be volatile. The monetary policy divergence (with the Fed potentially cutting and the BOJ gradually hiking toward 0.75% or 1.0%) will remain a key factor.

Communication from both central banks will be critical. Any sign of faster Fed cuts or more aggressive BOJ hikes could accelerate USD/JPY’s downward movement. Similarly, surprising economic data (a U.S. inflation reacceleration or unexpected cooling in Japan) could trigger adjustments.

Geopolitical factors—especially the evolution of trade policies and global tensions—will remain a key wildcard, with the potential to spark risk-off episodes favoring the yen.

Conclusion

The year 2025 is marking a turning point for the Japanese yen. The combination of a BOJ in the process of normalizing monetary policy, a Fed potentially having peaked, improving Japanese economic fundamentals, and a geopolitical environment that favors safe-haven assets beyond the dollar is creating strong tailwinds for the Japanese currency.

While volatility will persist, the underlying trend appears to support further yen appreciation against the dollar in the medium term. The technical level of 140 acts as a crucial barometer; its break would confirm that the era of extreme yen weakness may be behind us, ushering in a new dynamic for one of the world’s most important currency pairs.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.