- English

- 中文版

The sell-off in the US 10yr Treasury has been widely discussed on the floors, with yields rising by a solid 11bp to 4.19%. The moves have been driven several factors - supply, US election hedging and front running the risk of a ‘Red Sweep’, better US data of late, and technical factors (the trend is firmly higher) – but the wash-up is that yields have closed above the 200-day MA, and the trend higher is growing legs. We also see US real rates breaking higher, with 10-year real rates (i.e. US 10yr Treasuries adjusted for inflation expectations) gaining 10bp - and when the real cost of capital is rising at a clip it is typically a USD positive, and it’s no surprise that the USD found a steady bid through trade and sits higher vs all major currencies I track ex-CLP.

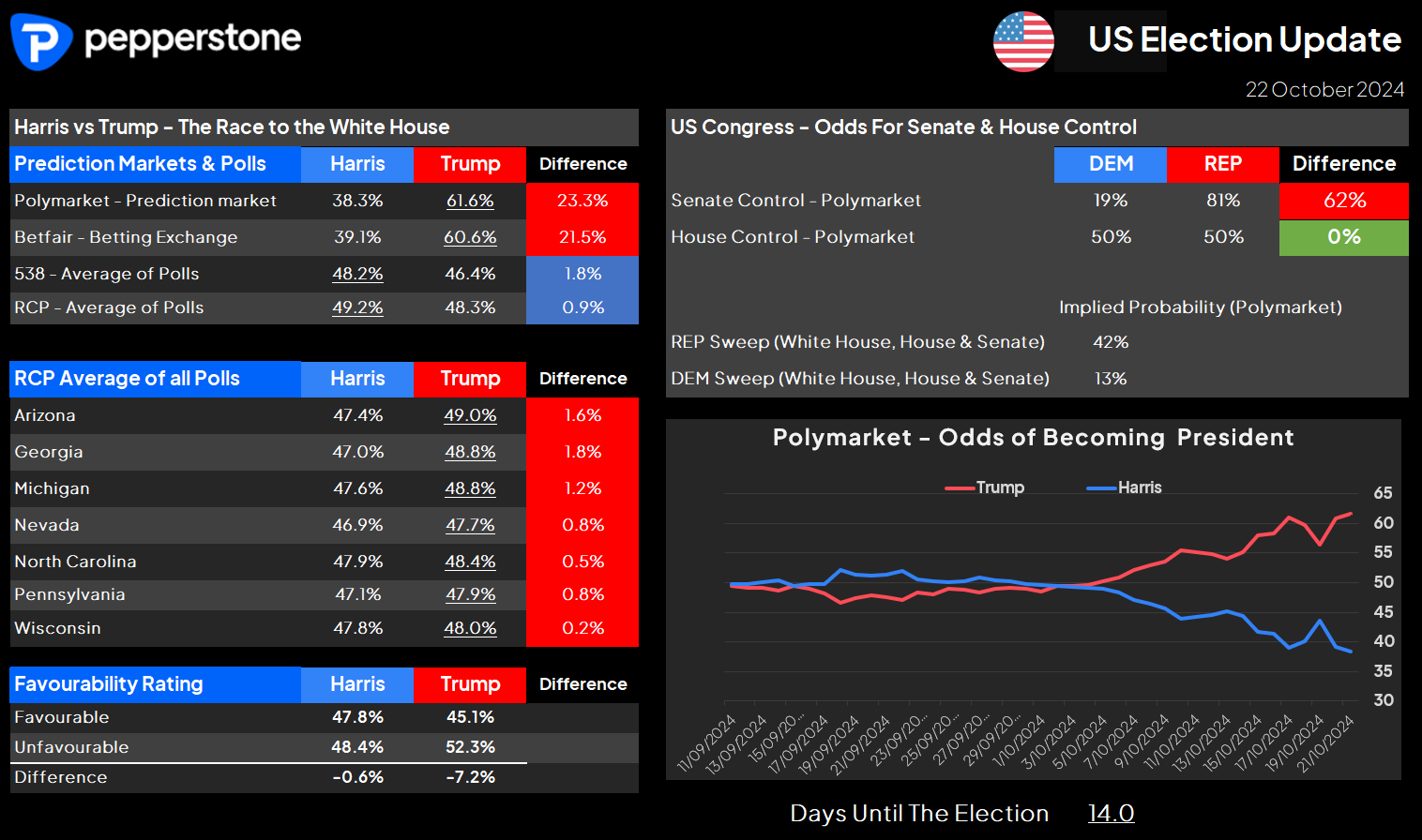

In the volatility space, consensus Trump tariff proxies have found further interest, with USDMXN 1-month implied volatility pushing to new highs at 21.75%, with MXNJPY 1-month vol also moving higher. Most in the market remain sceptical of the signal provided by the now heavily skewed US election betting odds, especially when the average of all polls are still so close in the 7 swing states – however, with Trump now over 20ppt ahead in nearly all betting markets, and the ‘Red Sweep’ scenario offered a 50/50 implied probability, the chance of it actually playing out is considered high enough that running short US treasury exposures on the risk of a further blow out in the fiscal deficit (given Trump’s proposed fiscal plans), backed by deep-reaching protectionist measures, is becoming too tough to ignore.

USDJPY has been the cleanest expression of higher US Treasury yields, with the spot rate eyeing a push into 151.00 – a trade I remain skewed for further upside on and see the risk of 152.00 emerging soon enough. Gold and silver remain well traded by clients, with the net position skewed on the short side, with a widely held view that the yellow metal had gone too far too fast.

Certainly, we can see increased volume in the gold futures on the intraday move above $2750, with the sellers making a statement, regaining control, and working the metal lower through US trade, with XAUUSD following in alignment. Perhaps the sell-off in US Treasuries and the rally in the USD finally made an impact, but the $2750/55 area in gold futures seems to be a near-term barrier for the bulls to eventually retest and break.

US equity found sellers kick in hard after the first hour of cash trade, with the intraday tape in the S&P500 pulling back from 5866 to 5824, before stabilizing and pushing to 5853 at the close. In a tough market, Nvidia has worked like a champion, and has broken to new highs, and it seems the market has regained it love affair with this name and likes the stock higher – backed by the read-through from TSMC’s recent number and traders positioning ahead of the soon-to-be-announced capex intensions from the hyperscaler businesses (Meta, Amazon, Microsoft, Alphabet) in their upcoming earnings releases. Take Nvidia out of the equation though and there isn't too much positivity on the floors, with all S&P500 sectors ex-tech in the red, and 84% of S&P500 companies lower on the day, with REITS, health care and financials leading the market lower.

Turning to Asia we see a tough open eyed for the ASX200 and HK50, with cash equity trade in Japan is expected to modestly outperform. China/HK equity contuse to find a fair value where we see a choppy technical picture, with traders failing to be inspired by the PBoCs larger Prime Rate cut and the market seems to be holding in for the upcoming NPC Standing Committee session later this month. Here, the market will be demanding real substance on a number of the recently announced fiscal measures, as they do on the levers to support the property market.

While local banks may be asked to step in and support China/HK equity into the NPC meeting, we could feasibly see the market attempt to push risk lower from here, sending a message to policymakers that they will need to deliver clarity at the meeting. Also, keep an eye on the opening of DAX futures and our GER40 index, due to re-open shortly after the NKY225 opens, as SAP – who hold the largest weighting in the DAX40 - has just reported and the numbers look good and should result in the DAX40 finding buyers open the re-open.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.