- English

- 中文版

• Trump 2.0 trades in focus

• US energy and financials outperform

• Fed chair Powell gaining increased confidence from recent inflation reads

• USD moves on the day

• Opening calls for Asia equity markets

The Trump trade has been seen front and centre across markets, and while some attention has been placed on Fed chair Jay Powell’s interview with David Rubenstein, as well as the spluttering of US corporate earnings that are starting to roll in, it’s the Trump 2.0 trades which stand out.

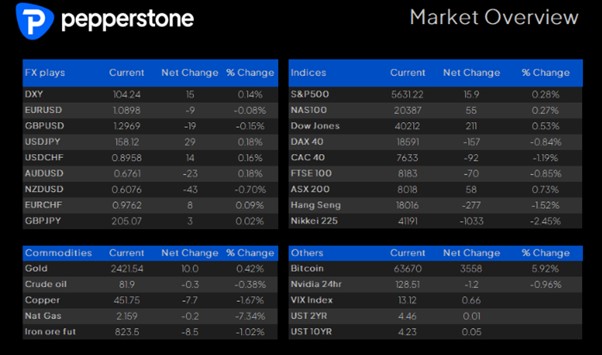

Notably, we see these expressions in the US bond market, with institutional players trading US 2s vs 10s, and US 2s vs 30s yield curve steepeners intently, with the 2s vs 30s curve un-inverting for the first time since January. Outside of the insto space, and Bitcoin has gained 6.2% and eyes a move into 64k, and while the crypto scene still has SEC chair Gary Gensler as a consideration on the regs side, potentially having the leader of the free world in your corner will always sit well with crypto heads.

Crude oil sits -0.3%, but we see S&P500 energy-related equity names firing up with the S&P500 energy sector the best performer on the day, followed closely by financials which have seen tailwinds from strong numbers from Goldman Sachs – with the stock breaking to new highs and looking really well supported – while the steeper yield curve also offers tailwinds to the banks. In the session ahead, earnings from Bank of America and Morgan Stanley will keep the banks in the spotlight, while UnitedHealth (UNH) also report pre-market – not a stock well traded by the short-term players, but it does have an 8.4% weight on the Dow, and with options markets implying a -/+4.4% for UNH on the day of earnings, we could see some increased life in the well-traded Dow in the session ahead.

While the S&P500 closed +0.3%, it was US small caps have once again attracted good attention with the Russell 2000 breaking to new cycle highs and I see this pushing higher in the near term.

Fed chair Jay Powell did mention that the recent inflation reads “do add somewhat to confidence”, and with that, we’ve seen the US swaps market price a September rate cut at 100%, with 65bp of cuts (or 2.5 25bp cuts) now priced by December. The market feels validated that the Fed chair is turning far more aligned and receptive to their view. In the session ahead we get US retail sales and with expectations of a 0.3% contraction, this data point could have modest implications on current interest rate expectations but given the trend in the USD of late and the bearish USD positioning, any retail sales print that is better than feared could see a punchy upside reaction.

USD flows have largely centered on EURUSD, GBPUSD and USDJPY, but the Trump 2.0 trades and the notion of 10% sweeping tariffs (60% tariffs on China) have resonated in USDMXN buying and some buying in USDCNH. The big moves on the day have been in USDZAR, and USDNOK and I am biased for follow-through moves higher here in the near term. Keep an eye on CAD exposures too, with Canadian CPI due (at 22:30 AEST), where a moderation in price pressure is expected (headline CPI is expected to fall to 2.7% from 2.9%) and this should also seal the deal on a 25bp cut at the BoC meeting on 24 July. I favour buy-stop orders on USDCAD above 1.3689, for a momentum move into 1.3750.

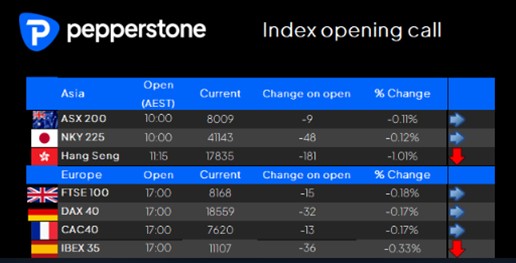

With the Republican National Convention underway, the new news is that Trump has picked JD Vance as his running mate – this appointment will be seen as a supporting the long USDMXN trade, as he is firmly “America-First” and a protectionist ‘hawk’ when it comes to trade, national security, and immigration. JD Vance sits in the camp of taking China on head-first in a bid for improved trade deals for the US, and this will only weigh on sentiment towards China, where we saw better selling in China equity yesterday and while China's Q2 GDP was weaker than expected (4.7% vs 5.1% eyed) our opening calls for suggest another day of selling.

Despite these leads, we see the ASX200 opening on a flat note, and given the 0.7% rise yesterday, with the index holding firmly above 8000, the tailwinds are there and weakness in the index should be well supported.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.