- English

- 中文版

Perhaps the move in meme names got more attention than would typically be the case given the subdued moves in equity, fixed income, and FX, but it took just a single picture/meme from ‘Roaring Kitty’ to set GMC and AMC on fire. Activity was huge, with GMC turning over 177m shares (AMC 478m shares) and 402k call options traded – nearly 4x the 20-day average. 85k contracts traded on the $34 strike expiring today (0 days to expiry) alone and those lucky enough to buy at the lows saw a 1848% price increase. Clearly an isolated issue, but it seems Reddit’s saviour has returned and for the punters out there whose expected returns are closer to 100% over a week, and not 10% over a year, many hope we’re in a re-run of 2021, albeit without the lockdowns.

Bitcoin has seen increased volumes too – whether this is in sympathy to anything meme-related is debatable, but we did see some incredible moves in GameStop crypto coin which at one stage was up nearly 4000% (now +1270%), while the Roaring Kitty coin traded up 6600% (now +3977%). Perhaps some of this filtered through to Doge, and the broader suite of meme alts, and by loose extension Bitcoin. Bitcoin looks to push into channel resistance and the 50-day MA (65218), which has been an excellent trend filter.

Outside of these ‘fun times’ markets, and in more traditional markets, the S&P500 closed -1p with the index tracking a 26p intraday high-low range. The index opened on its highs and traded down to 5211 by midsession before traders called it a day and we saw a flat line into the close. 44% of stocks closed higher, with tech and REITS in the green, and financials and industrials the underperformers, lower by 0.4% - 0.5%. Cash volumes through the S&P500 were 15% below the 30-day average, again, backing up the view that we’re in a holding pattern ahead of US CPI and retail sales, with traders going about their business massaging exposures according to their view on potential volatility and directional risk.

US bond markets have closed largely unchanged, and this has resulted in limited the moves in G10 FX, although we did see some life in USDJPY after the NY-Fed 1-year inflation expectations came in at 3.26% (from 3%), which has pushed into 156.25. EURUSD managed to find buyers above 1.0800, but once again supply kicked in above the figure (again, coinciding with the NY Fed inflation expectations), with conviction levels to stay long low ahead of US CPI – it does feel though that the market wants to squeeze this into 1.0900 though, and a daily close above the 3 May high of 1.0812 increases that probability. AUDUSD traded in a 0.6629 to 0.6586 range, and we see price settling mid-range now.

We’ve seen good flow in commodity markets, notably gold lost $24 (-1%) and just when we saw the bullish break of the range highs of $2352 the sellers smacked this one back down, frustrating the momentum buyers who were hoping this would kick towards $2400. On the day I would be playing a range of $2357 to $2315, and looking to fade moves into these levels.

The unwind in Cocoa continues with price -18% and we see new run lows – many took the elevator up to $12,400 and they are taking it back down again and avoiding the stairs. Keeping it exotic, and OJ has been working to the upside, and after the volatility squeeze is starting to trend – further upside is expected.

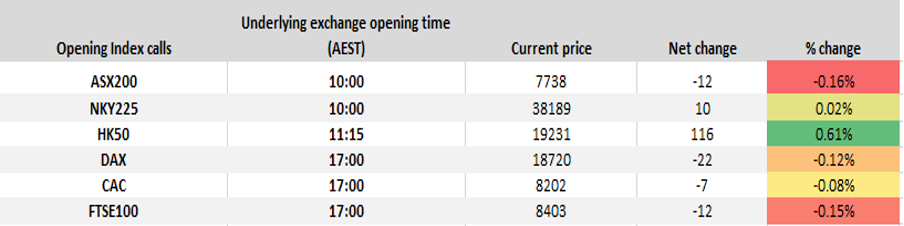

Pepperstone’s index opening calls

How does this all feed into Asia?

Our calls for the various equity index open suggest the ASX200 opens -12p, and after three days of lower highs, and a grind lower into 7738, we’ll see if the buyers step in today – there seems enough reasons for the buyers to stand aside for now. The HK50 is the index that is really working, and we should see the cash market open 0.6% higher, with all eyes on earnings from Tencent and Alibaba – both will need to deliver earnings above consensus results and inspiring guidance, as expectations are high, and the market is long and strong. Baba’s ADR closed +5.7%, so that should support the HK listing but the implied move on the day (priced by options) is 6.2%, so the HK50 could get lively from here.

From an event risk perspective, in the session ahead we get UK wages and employment (16:00 AEST), which means eyeing GBP exposures, with the UK rates market pricing a 44% chance of a June cut. US PPI inflation (22:30 AEST) could also offer some movement to rates and the USD, and it will help shape expectations for US core PCE inflation on 31 May.

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.