- English

- 中文版

However, we also know that it's okay to be wrong in trading, but you need to know you’re wrong and manage that loss unemotionally and quickly. Trading is about the probabilities seen in a market at that point, and assessing where the market has the greatest potential to move to, knowing that the market will go where it wants to go on any given timeframe, and flow and sentiment are the most influential short-term drivers.

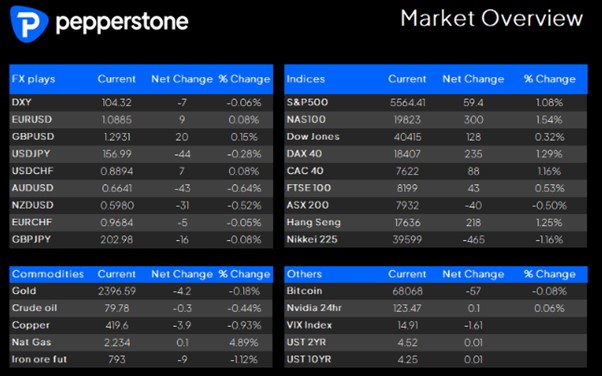

As we close out US trade and look towards Asian trade, we can see this dynamic first-hand through the moves across markets and while many try to justify what has played out, the rally in US equity has certainly surprised.

US equity was coming off a sharp liquidation last week, with tech and semis having a shocker, which one can justify that sell-down not just through a grossly saturated positioning, but by hawkish comments from both Biden and Trump towards Taiwan and big tech. I had anticipated that the NAS100 and S&P500 could pullback a touch further to the 50-day MA, but the buyers have moved in before we got to the trend filter, and one now questions if the action seen in US equity proves to be a dead cat bounce, or whether this can kick further higher.

Either way, in the daily battle between supply and demand, the bulls have certainly wrestled back some control here, and I’d argue the probabilities of a further push higher in the NAS100, US2000, and S&P500, and through Tesla and Alphabet earnings (aftermarket in the session ahead), look fairly high.

As may have seen on the day, US equity futures started to find organic buyers through European trade, which then forced the recent short sellers to close, and as levels of implied volatility pulled back, we saw a new wave higher in equity through US cash trade. The result was 1%+ rallies in the NAS100, S&P500, and Russell 2k, while the Dow closed +0.3%. Tech drove the moves, with consumer service names also working, and while 78% of stocks closed higher, it was energy that lagged – a full reversal of what we saw late last week.

The talk on the floors remains centred on the US election and we’ve seen a further wave of endorsements for Kamala Harris, notably from Nancy Pelosi and Chuck Schumer – with Joe Manchin detailing he will not run for the Dem nominee the list of potential challengers to Harris becomes even more scarce, and the prospect of the Democratic party uniting around Harris into the National Convention in August subsequently increases.

The prediction markets place Harris’s chance at 41% (Trump at 60%), and the risk is this could tighten further, but that depends on the team she can forge around her, and notably if Harris can convince Pennsylvania Gov Josh Shapiro to be her running mate.

Still, it's hard to say if US election dynamics had any real effect on the cross-market moves we’ve seen and with limited economic data, this likely speaks more to positioning and to flow than traders really sinking their teeth back into ‘Trump Trades’ or alike.

FX markets have also seen a reversal of the flows we saw last week, with Latam FX finding solid buyers following the moves in US tech/semi and notably the CLP and MXN caught a solid bid. The net change in G10 FX has been subdued, although we are seeing better sellers in AUDUSD and NZDUSD, and that has been impacted by a weaker tape in copper and iron ore futures. Moves in US Treasuries have been contained, and this has lent to a small net change in gold and silver.

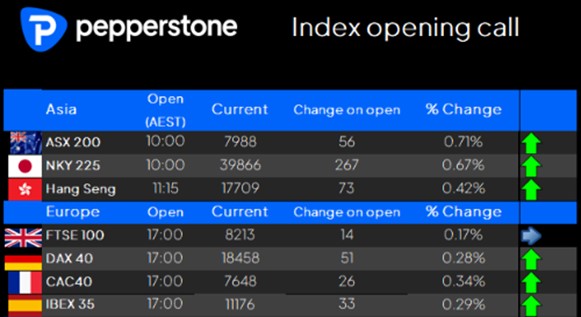

Looking ahead to the Asia open and given the moves in US equity, our opening calls look constructive, with broad-based gains expected. The ASX200 eyes an open closer to 8000, and I am enthused by the pullback to the former breakout point (28 March high), with the buyers stepping in to confirm this as support, and we look to see if the buyers can now build on the positive open – a close above 8k would be a small but welcomed win for the bulls.

By way of event risk, on the data side growth comes into the spotlight, with PMIs’ seen in Australia, Japan, Europe, the UK, and the US, and notably the EU and US PMIs could move the dial in EUR, USD, and the respective equity markets. The Bank of Canada meets, where we see CAD swaps pricing an 84% chance of a 25bp cut, so consider CAD exposures on the day. On the earnings side, Tesla, Alphabet and Visa report after market, and given the elevated implied volatility in these names one can expect some lively price action after hours.

Good luck to all,

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.