Analysis

That is, US AI-related, big tech and discretionary names showing leadership, growth and cyclical plays firing up with defensives taking a backseat, US Treasures rallying and some questioning “Why should I buy gold when I can just buy Nvidia?”.

It's rare that we see the US PPI reported before CPI, but in this case, the PPI outcome has resonated and has set expectations for the CPI print to an extent. While not all metrics in the PPI report were lower than consensus expectations, the wash-up from the PPI print is that the elements we take out to forecast the more important US PCE inflation print (seen on 30 Aug) are constructive and would see economists’ lower estimates within their models.

Many would now forecast the Fed’s preferred inflation gauge of core PCE at 0.16% m/m – a slight revision lower. Today’s US CPI print will galvanize that call, and whether it’s premature to go into the CPI print having gone hard buying Treasuries and equity is a risk - but traders have reduced right-tail risk, and the chase is back on, at least for now.

The US bond market has held the keys on the day, where there has been solid buying in the 2-year Treasury, with yields falling from 4.02% to settle at 3.92%. We can see within that move, that swaps traders have added 3bp of cuts to the September meeting, and now price 37bp of cuts – However, further out we see 12bp of additional cuts added to respective meetings seen through Q2, where interest rate swaps price 203bp or 8 25bp cuts by July 2025.

Risk (growth equity, NZD, AUD, GBP) will find buyers if additional implied rate cuts are driven by a reduced inflation dynamic (i.e. right tail risk). However, the opposite is true if any additional rate cuts are driven by weaker growth or poor labour market readings – this week’s US retail sales report could therefore be influential on that thesis.

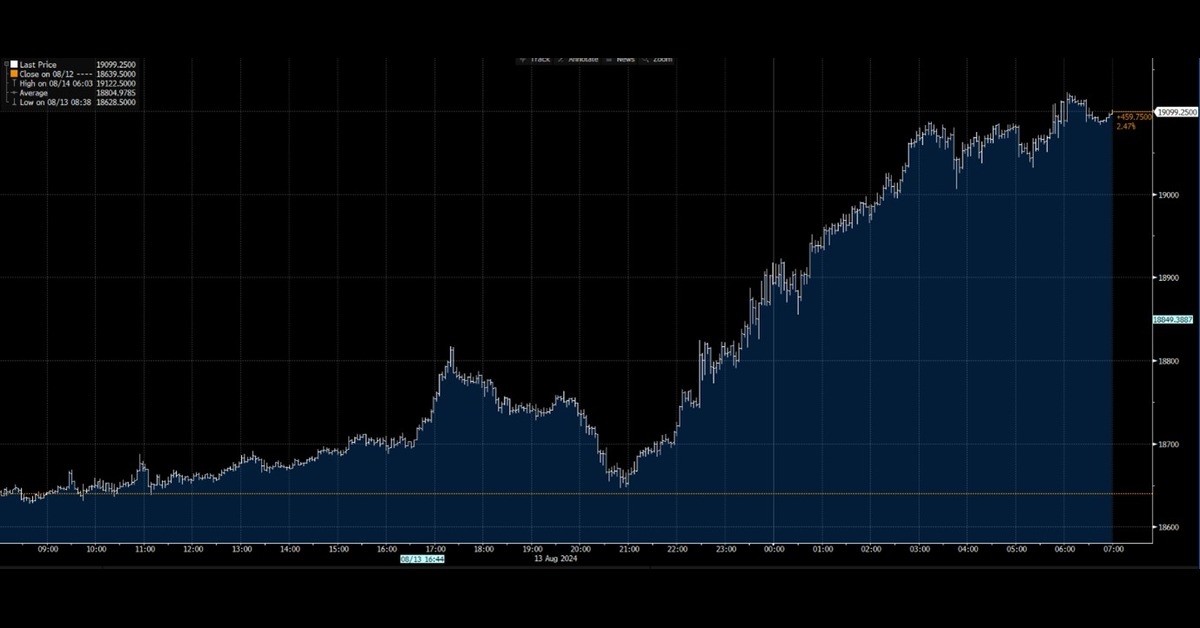

(NAS100 futures – intraday chart)

The intraday tape of the NAS100 was as clear cut as they come – it was an out-and-out trend day, and it seemed the sellers just stood aside or pulled orders to higher levels. The NAS100 futures joined the S&P500 futures in closing firmly above the 100-day MA, with the S&P500 cash index seeing a similar move and closing right on session highs. Participation was solid, with 84% of S&P500 stocks closing higher on the day, where only energy subtracted index points.

Geopolitical concerns really played little part in the thought process of traders, and it was tech and discretionary names that showed leadership – very June-like as I say.

Given the moves in US Treasuries, our USD flows on the day have increased, with the USD lower across the G10 and EM FX space. Notably, the NZD has outperformed with NZDUSD rallying 1%, and we see real momentum in the price heading into today’s RBNZ meeting (at 12:00 AEST). NZ interest rate swaps price and imply 17bp of cuts priced for today’s meeting, so some would see the risk vs reward skewed towards being long the NZD, as ‘the market’ has essentially discounted a 70% chance of a cut.

My preference would be to leave limit orders to buy into 0.6040/35 – so if the RBNZ does cut, then we get a quick move lower as the 30% that isn’t priced is realised. That said, the ongoing move in the NZD will be down to their guidance and whether the tone meets the pricing for five 25bp rate cuts by Feb 2025. I see downside risk in AUDNZD, but again I would be reacting to what was said, overplaying my hand over the meeting.

Taking the RBNZ risk out of the picture, GBPUSD has seen solid range expansion and eyes a move into 1.2900 – client flow has been upbeat in this pair, although there is risk here too, with UK CPI (16:00 AEDT) a landmine which could put a 25bp cut firmly on the table for the 19 Sept BoE meeting. The market ascribes a 1-in-3 chance of a 25bp cut at this meeting at present, so a UK core CPI print lower than 3.3% and market-implied could move towards 50%. Conversely, a print at or above 3.5% y/y and the GBP could be the flavour of the day.

Either way, we’re seeing some bearish trends developing in the USD pairs, largely a function of a better tone in equity, as it is on relative rate differentials, and this needs monitoring as we head into the US CPI print.

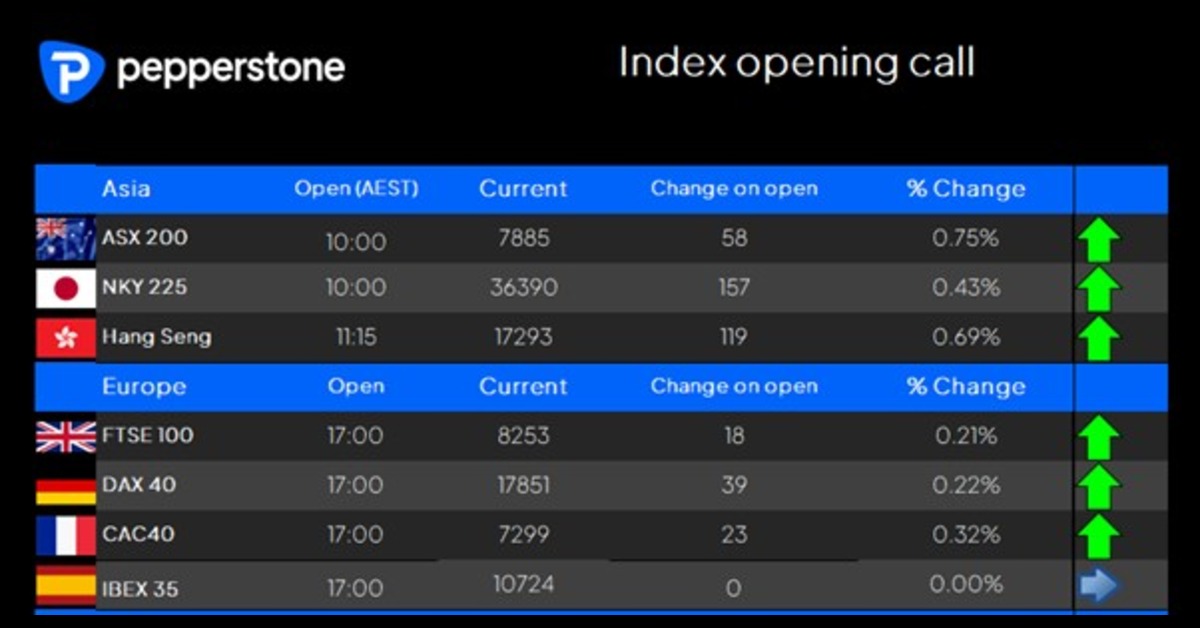

Turning to Asia our opening index calls look constructive at this stage, with the ASX200 set to outperform. Earnings matter today though, with CBA just reporting FY numbers and on first blush look compelling and have beaten expectations on FY NIM, cash profit and dividend – with a 9% weight on the ASX200, and a clear influence into the other banks, the numbers matter for AUS200 traders. In HK we see Tencent report earnings, and again this may be well traded by clients, and influence the direction of travel for the HK50.

Good luck to all,

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.