- English

- 中文版

Risk On: Bulls Drive US Stocks, Crypto & Gold Higher After Fed Meeting

New highs for the US small-cap equity index was a key development, with the rally in the R2K from the April lows extending to an impressive 42%. The strong outperformance of small caps versus US large caps overlooks the notion that concerns are building on household consumption trends, and that the Fed has just such incredibly low conviction in its assessment of how the US economy will evolve through 2026. The Fed is as dispersed in its views on monetary policy as we’ve seen in recent memory, and, for markets, when the central entity tasked with shaping financial conditions holds such a wide range of possible economic and policy outcomes, in theory, should increase the future volatility in markets.

The Fed’s—and possibly soon the Trump administration’s—commitment to supporting the labour market and US households/consumers may run the risk of inflation becoming entrenched around 3%, which could see inflation expectations build and long-end USTs rising. Perhaps a concern for another day, because for now, the market sees the strike price on the Fed put pulled even closer to the market, and this dynamic has supported risk-taking on the day.

Evidently, there has been little to no concern about holding risk into ‘triple witching’. Positive flows are not just evident in small caps, but we see that in other areas of the market and within the S&P500 sectors, styles and factors. While the equity move has been driven predominantly by tech, with strong moves seen in Intel, CrowdStrike, Micron, Palantir, and Nvidia and Alphabet adding index points, high short-interest stocks rallied hard as shorts trimmed back, while retail favourites also finding good interest from buyers...

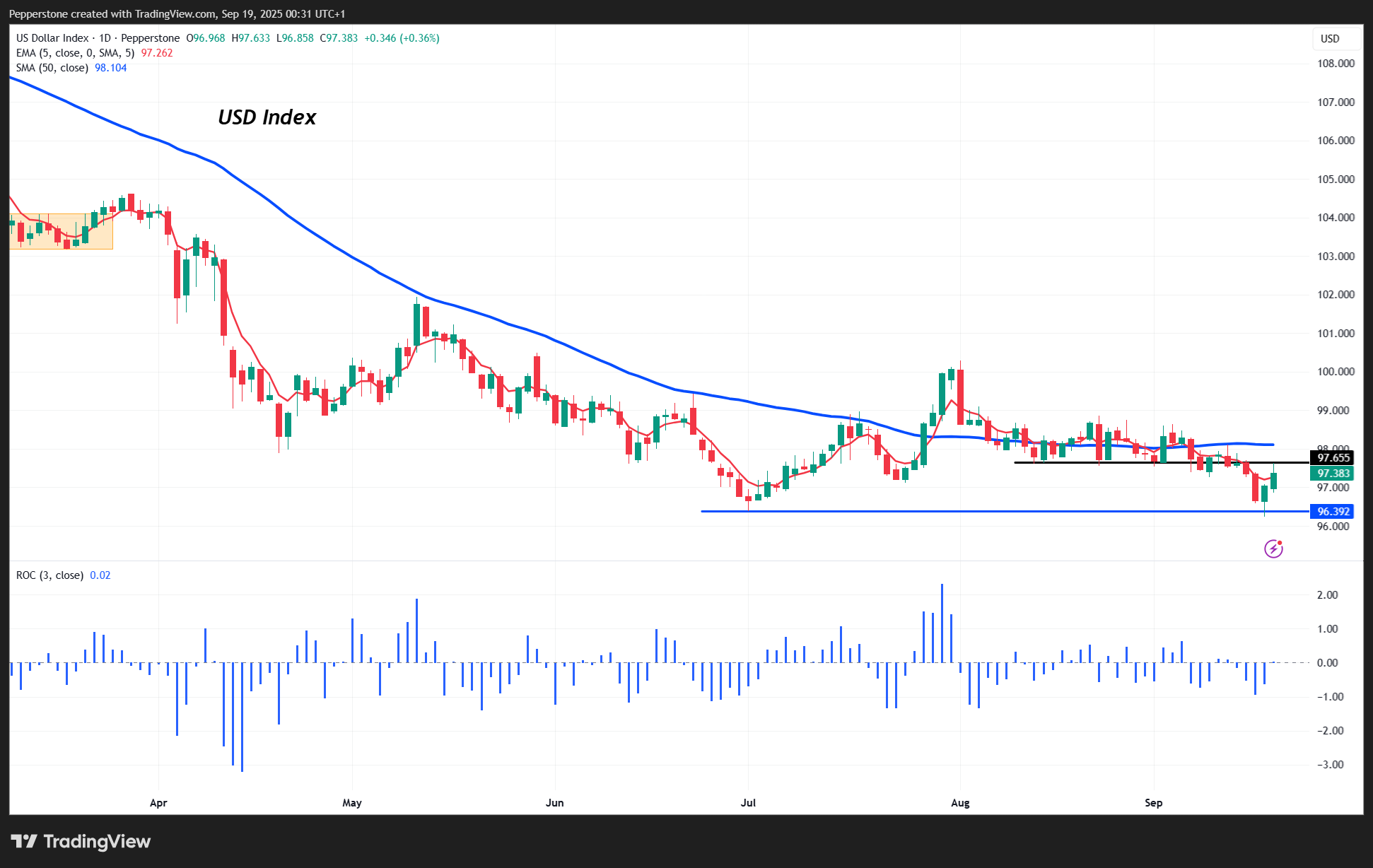

In FX markets, the USD retraced higher on the day—most notably against the JPY and NZD—with the DXY pushed up to 97.63 before meeting supply at the former August range lows. We had flagged the asymmetric upside risk to the USD from the Fed meeting, and that played out well, with US 2-year Treasury yields closing +5bp at 3.55% and the market-perceived fed funds terminal rate settling +3bp to 2.98%.

The question now that with the Fed, BoE, and BoC meetings out of the way and any legacy pre-event risk positioning flushed out, is whether it’s time to re-engage with USD shorts.

Tactically, I’d argue that the Fed meeting reinforced the higher-probability outcome that the USD is set to take a new leg lower, and I am now waiting for the price action and the technical set-ups to evolve before putting money to work in USD shorts...

It seems fair to say that it was USD-positive (gold negative) that both Fed Governors Chris Waller and Michelle Bowman didn’t dissent in favour of a 50bp cut—this removed a small degree of Fed independence concerns and lowered the USD political risk premium. However, when many other G10 central banks are moving closer to a more united, consensus view on policy, the opposite is happening at the Fed. The increased dispersion in views on policy settings for 2026 from the 19 Fed members who submitted a 'dot' highlights that the Fed really has no idea how the economy will play out in 2026. We consider which of these 19 dots are voters/non-voters, for both 2025 and 2026, but that increased dispersion in views when other central banks are more united builds to the risk for the USD in my view.

Powell stated, “There is no risk-free path.” While other central banks may indeed be forced to alter policy in the months ahead, their current “wait and see” mode arguably puts them in a more optimal and relatively attractive position than that of the Fed. The Fed, meanwhile, must react to any further slowing in labour growth while keeping vigil on both short- and longer-term inflation expectations—and hope they don’t become unanchored, and no central bank ever wants to rely on hope...

All of this reinforces the positive investment case for gold. While we’ve seen a flush-out of what is still an extended long gold positioning, if the incoming US labour market data highlight growing stress on US households, and if US goods prices continue to rise—squeezing real incomes and eroding purchasing power—the market’s favourite trade of short USD, long gold, and UST curve steepeners will once again attract significant capital.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.