- English

- 中文版

Post-Election Market Adjustments: USD lower, Treasuries rally, and the S&P500 eyes 6000

This is the case through US trade, with the US Treasury market finding a far better bid, with yields 7 to 11bp lower across the curve, and the USD index also reversing much of the post-election rally. The question for bond and FX traders now is whether to trust this move on the day or simply put it down to a post-election readjustment and profit taking – subsequently, traders using this pullback in the USD to reestablish longs.

I favour the latter, although the US Treasury and interest rate futures will decide that outcome, and we may need to see new further better US economic data, confirmation of the House vote, and new substance on Trump’s drive to roll out harder-hitting tariffs, to get the USD pumping again. A rough outline of a fiscal timeline would also be welcomed, although this will require clarity on Trump’s cabinet picks and won’t happen immediately.

The FOMC meeting offers few new signals

There was certainly more to the session than just a post-election readjustment, as traders navigated a 25bp cut from the BoE and an outlook of gradualism that has seen UK swaps feeling strongly that the BoE will refrain from cutting again in December. The FOMC meeting and Jay Powell's presser failed to ignite markets and lacked any real new substance to promote late-session volatility. At best, we saw modest tweaks to the FOMC statement, with the Fed removing the word “further” from its inflation progress, with labour market conditions seen as “generally easing”.

No real smoking gun or signal for how the Fed plan to move in the December FOMC meeting, and US swaps now price 14bp of cuts for the December FOMC meeting and a lineball call on a further 25bp cut. Further out we see the implied terminal fed funds rate – or the estimated low point in the Fed’s cutting cycle – fall to 3.71%, pricing an additional 9bp of implied cuts.

US CPI is the big data point to focus on next week, with expectations that we see core CPI rise 0.3% m/m and headline increase 0.2% m/m, taking the year-on-year pace to 2.6% (from 2.4%).

S&P500 futures push above 6000

While the USD pulled lower, there was no reversal in the large-cap US indices, and we see another solid trend day in the S&P500 and NAS100, with the MAG7 plays lifting the market. S&P500 futures have broken above the big number 6000, and while positioning is a concern, we look for the S&P500 cash index to follow suit soon enough. US small caps have failed to follow-through after a solid day yesterday, with the Russell 2k seeing a whippy intraday session, and not helped by financials, which have seen a healthy bout of profit taking, with a flatter curve in the Treasury market a reason to trim back.

Commodity markets fire up

Commodity markets have been lively with the buyers stepping back in and underpinning the positive sentiment expressed through broad markets on the day. Copper has been the big percentage mover in the space, with a 4.5% gain on the day, with the rally frustrating those initiating shorts on yesterday’s break lower through the recent range and consolidation lows.

Gold back above the rising trend support

Gold was also looking ominously poised for a further breakdown yesterday, with the yellow metal closing through rising trend support. However, the bulls have fought back pushing gold +1.8% on the day, driven by a weaker USD, a 7bp decline in US real rates and a general broad commodity rally, with price subsequently closing back above the former trend – a positive for those positioned on the long side, but they will now want to see a move back above $2750 to feel more confident about the potential for a re-test of $2800. A hard one to chase given the USD upside thesis remains in place.

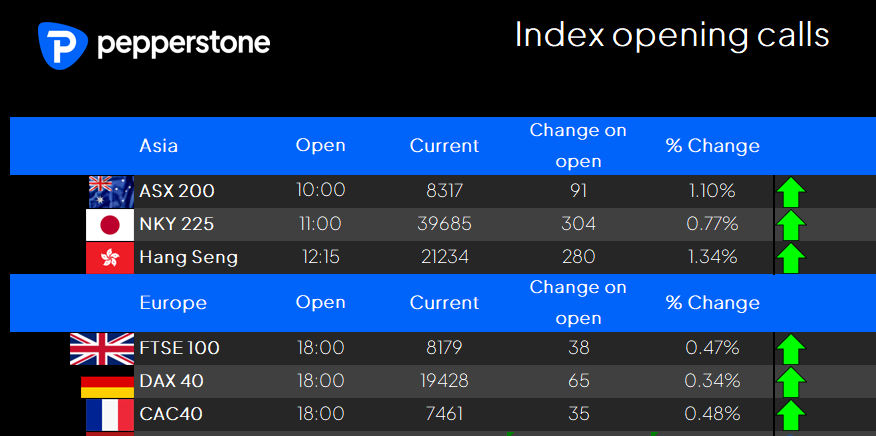

Turning to the Asia equity open where our opening calls look constructive across the various indices, and the bulls will take the leads and run with it on the final trading session of the week.

Having peddled a ‘Buy US’ view yesterday, that remains intact, although positioning is a concern. However, the idea of being long S&P500 / short HK50 as a pair’s idea is looking precarious, with the set-up in the HK50, CHINAH and CN50 indices compelling to trade from the long side. We can see that on the daily timeframe, with all three indices breaking out topside of the recent consolidation phase, and that is a bold move given expected headlines due out from the NPC meeting - but the buyers are stating a case, and the price action here is looking quite interesting.

The ASX200 eyes an open firmly above 8300, and while the banks have a tough lead to price from the S&P500, we also have ANZ’s numbers to price, and if banks do open on a flatter note, then the materials, energy and industrials space should outperform.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.