- English

- 中文版

- Tactical developments from the French 1st round vote

- Tech dominates amid poor market breadth

- Staying long Tesla and Microsoft

- US Treasuries positioning for Trump 2.0

- Crude eyeing higher levels

- Asia equity opening calls and upcoming event risk

We close out the first full trading session for July and Q3, and there are moves worth highlighting – notable in crude, NAS100, MAG7, and US Treasuries.

On the flow side, we’ve seen heavy interest in the EUR, with EURUSD and EURCHF seeing upbeat activity. The French election 1st round vote essentially removed the tail risk scenarios and EU assets have responded, but one suspects there is there is more to play out.

We’ll learn more in the session ahead, where a number of the candidates who qualified for the second-round vote, but came in third or fourth place, could tactically choose to drop out of the race – we know the Left Bloc (NFP) have stated they will pull any candidates who finished third in each constituency, so as to bolster the prospects of Macron’s centrist bloc. Likewise, the Centrist bloc will pull candidates who also finish third, unless the Left candidate running is considered to be extreme. This process takes place at 6 pm local time (5 pm UK / 2 am AEST).

It will all become very tactical as we look to see if Le Pen’s RN party can get an absolute majority, or if France is headed for a hung parliament, which is looking like the market’s base-case.

We’ve seen the France-German 10-year yield spread narrow by 6bp to 74bp, which is a punchy move, but we’ve still seen selling in French bonds, so I’m not sure this is truly a bullish signal for market risk. The CAC40 opened strongly but was sold all session and while the net change was positive (+1.1%), price closed on session lows. EURUSD traded into 1.0776 but has found supply kick in with USD flows more broadly seen with US Treasury yields moving higher.

EURCHF and EURCAD longs have fared well, while EURGBP gets attention given the UK election this week, and where tactical traders may start to fade the recent strength, and it's a currency cross I like lower from current levels in the near-term. EU CPI (due 19:00 AEST) poses a risk to EUR exposures, with the consensus eyeing headline to fall a tick to 2.5% and core CPI to 2.8%.

US equity indices have seen both the S&P500 cash (0.3%) and the NAS100 cash (+0.7%) close higher, while US small caps again struggled (the Russell 2k closed -0.9%). Breadth was once again poor, with only 24% of S&P500 constituents closing higher, with tech and consumer discretionary working well. Materials, industrial and REITS closed lower, and again underperformed, so growth was again the dominant thematic.

Momentum in Tesla is there for all to see – it’s a name I’ve been bullish on of late and would be holding and trailing stops on longs. Microsoft hits new highs, Apple looks well supported and should print new highs through $220, while I would be looking to work buy-stop entries on Amazon above $198.90 with the view of seeing continued momentum. Nvidia is lacking real momentum flows, and as a result we see choppy price action on the daily timeframe – that said, we are seeing good bids kick in around $120, and I would be looking to jump into longs if we saw a push through $130.

The US Treasury market has been lively, with sellers seen between the 5- and 30-year maturities. US data did promote a short-term reprieve from the selling with the June ISM manufacturing survey coming in below expectations at 48.5 (vs 49.1 expected), and US construction spending -0.1%. The Atlanta Fed GDP nowcast model was revised down to 1.7% and we see the Citigroup economic surprise Index at -32.4, the lowest since August 2022.

In the session ahead there could be some reaction in the bond market and USD to the US job openings report (due 00:00 AEST), with the broad consensus expecting a further moderation to 7.95m openings, an outcome which would please the Fed.

One would argue the sell-off in US Treasuries was related to the US Supreme Court verdict that detailed that Trump is indeed entitled to some degree of immunity from prosecution. The US bond market seems to be telling us a message, notably with the aggressive 2s vs 10s bear steepening playing out. Bond traders have an eye on Trump’s increasing odds of taking the White House and the market senses Trump 2.0 will be inflationary, given the potential to extend the expiring tax cuts in 2025 resulting in an ever-larger deficit, as well as wide-ranging tariffs.

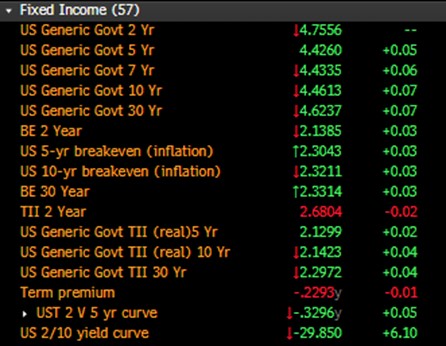

US Treasury moves on the day:

We continue to see USDJPY getting the focus as we grind higher towards ¥162, although EURJPY and AUDJPY have found form. Client conversations on MoF/BoJ JPY intervention risk remain a dominant talking point but given the bullish one-way price action, few are overly concerned or positioned for a 400-500 pip rip to the downside. Onwards and upwards it seems.

USDCNH is also on the radar, with the pair breaching above 7.3000. Today's PBoC yuan fix (11:15 AEST) will get some focus, as the PBoC seem to be allowing a glacial devaluation of the yuan, and with this cross grinding higher the moves are putting pressure on Chinese equity indices and upside in other USD pairs. The Chinese bond market is key to this move though, but it appears that we may see measures implemented to halt the buying and the move lower in yield, which is pushing capital into the USD.

In commodities, we see crude as the standout and the bulls remain in control here – I still like price through $84 and into $86, so I am staying long for now. Copper seems to have found better support and closed +1%, while gold (+0.2%) chops around in the same sideways range.

Turning to Asia open, and our calls suggest modest downside across the boards, with the ASX200, HK50 and NKY225 all eyed to open lower by 0.3%. There’s not much to get me overly excited that the buyer’s step in and support the early weakness after the respective exchanges open, but portfolio flows can often surprise.

By way of event risk ahead, some will maintain a focus on developments in the French election, but we get the RBA meeting minutes, EU CPI, US job openings (JOLTS) and Powell and Lagarde speak.

Good luck to all,

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.