- English

- 中文版

Staying Long Tech, Hedging Risk and Diversifying Portfolios with Gold

With S&P500 20-day volatility realising on just 6.9%, cash continues to be pulled into US equity from the financial institutions that target a level of standard deviation in the portfolio. This is then given additional tailwinds from the systematic momentum players and the 0DTE options crowd who chase and then perpetuate the move higher.

Poor breadth but the S&P500 and NAS100 pushes further higher

S&P500 futures flatlined through Asia and European trade, but as soon as the US cash equity session opened, buy orders came in hot. After the first 10 minutes of the usual order flow dynamics, the buyers stood up and dominated. The platform in S&P500 was set at 6700, and from here we saw a strong low-to-high trend day, with S&P500 cash equity volume around 8% above the 30-day average.

Breadth and participation, however, was poor, and index bulls would have liked to have seen Meta, Alphabet and Amazon trade better, and while the S&P500 cash index managed a 0.4% gain on the day, only 49% of stocks closed in the green, and the S&P500 equal-weighted index closed 0.2% lower.

Still, concentration risk and leadership dominated by US tech plays shouldn’t be overly concerning at this stage and can continue. Importantly, we’ve seen active rotation play out since April, so when tech gets overly hot, we continue to expect funds to rotate into other sectors, styles and factors... Subsequently, the prospects for a blanket sell-off in equities currently lack an obvious catalyst and a volatility shock.

Gold ripping higher & higher

Of course, investment managers and traders can and are offsetting their US core equity with long exposures in gold. With both short- and long-term statistical correlations between the S&P500 and US Treasuries remaining very low – and with the hedge itself (long gold) working so well and trending with such strong momentum – it’s not hard to see why few are refraining from taking out portfolio insurance through the options/volatility channels, even if vol is cheap and premium not overly costly... but for now, the diversifier is of choice is the yellow metal, and this makes sense given its low correlation to other major asset classes and that fact everyone can see it ripping higher.

The USD set to track a sideways choppy path?

After showing better form late last week the USD has given back some of that move, and recently initiated USD longs have been part cut back despite a modest sell-off in USTs and yields 2–3bp higher across the curve. Traders have navigated a legion of Fed speakers, but it’s hard to put the USD flows down to them. I’d look more at technical factors: positive risk dynamics in equity markets, and traders defending Friday’s lows (1.1728 in EURUSD and 1.3463 in GBPUSD), and selling above 148.28 in USDJPY. Aggregating this through the DXY, we saw price trade into 97.82, modestly above Friday’s high, but then failing to build on the upside break, and sellers pushed it back towards Friday’s low – albeit failing to close below the lows for a bearish reversal. The setups in USD pairs do offer an increased probability that consolidation and sideways chop could be the near-term trading environment on higher timeframes.

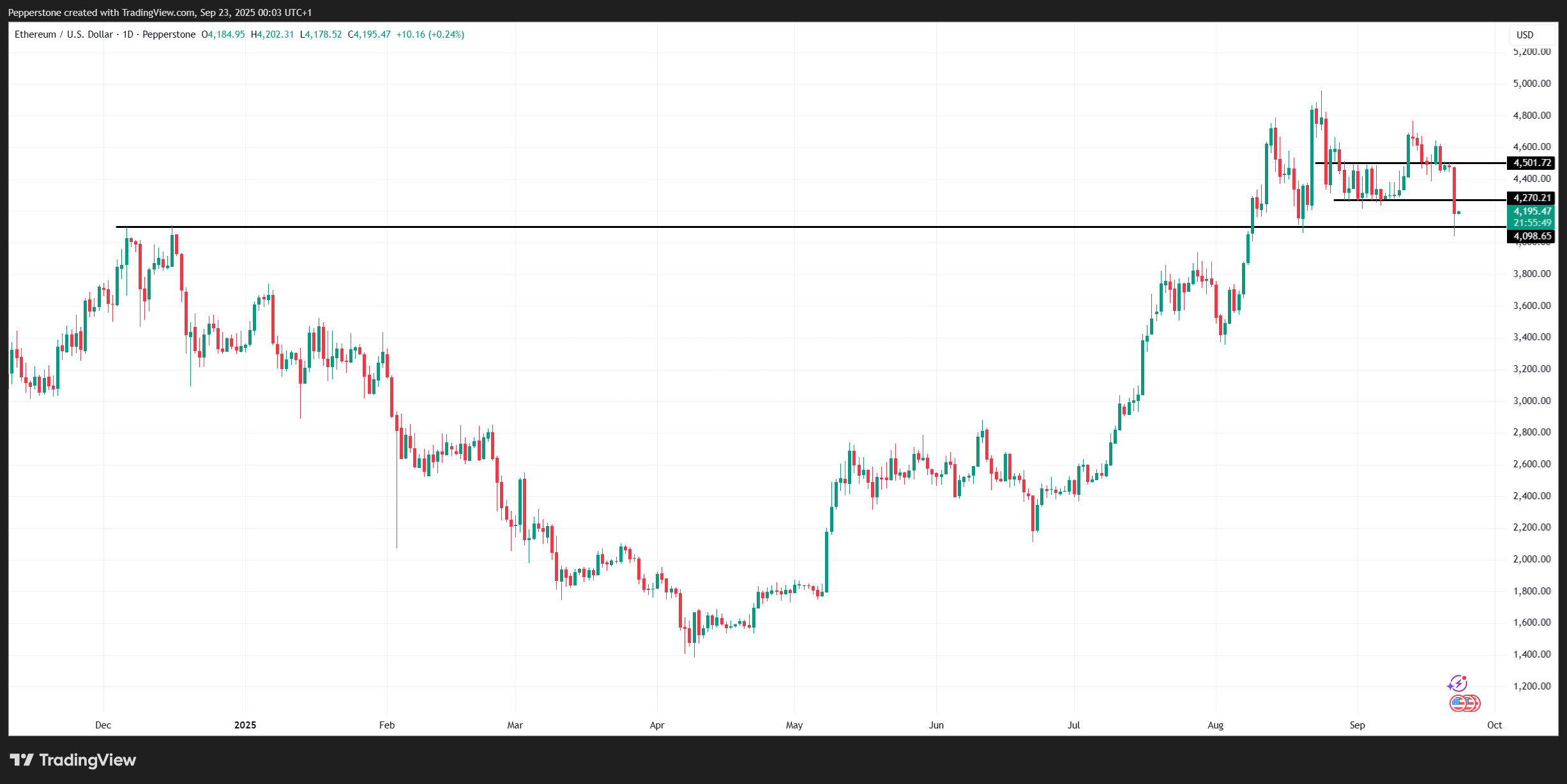

A solid flush out of long positioning driving moves in crypto

Crypto has seen a solid run from clients, with a varied mix of executed order flow and an increased dispersion in near-term directional views. The primary fundamental trigger behind the selling is unclear, so we largely attribute the move lower in Bitcoin and crypto more broadly to a $1.6b liquidation of longs, some forced, while many fast-money players becoming frustrated by crypto’s failure to perform when other markets are working well.

The silver lining for bulls is that the moves lacked a fundamental catalyst that therefore changes the investment case, and the flush-out leaves positioning in a much cleaner state. We’ve also seen Bitcoin and Ethereum hold important technical support levels. When price is the biggest influence on sentiment, those long will be cautious but encouraged by the buying support seen at the former breakout point of 4100 in Ethereum, and $112k for Bitcoin. Let’s see what happens next – the liquidation heatmap (as reported in exchange holdings) suggests leveraged longs could be squeezed on a run lower for Bitcoin to $110k, but shorts could also be hurt if prices reverse and push back to $114k.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.