- English

- 中文版

Market Insights: US Nonfarm Payrolls, Commodities, and Bond Market Trends

US cash Treasuries did remain open, but few have really moved positioning around, and partly because of the lack of data seen out through trade. The USD finds buyers on the day vs the CLP, GBP, MXN and GBP, but with limited moves in USTs (through US hours), and with any volatility seen through UK/EU hours soon settling, tighter ranges have been the theme in EURUSD and GBPUSD and AUDUSD.

We see a gentle sea of green in commodity markets, with gold up smalls but printing another higher low with the buyers seemingly increasing their control to potentially push the yellow metal towards $2700 and the Nov/Dec range highs of $2721/25, Crude sits up 1.1%, with front month futures pushing into $74.20 where we see the upside capped on the day, with sellers kicking in. Copper sits +1.4%, with Dalian iron ore +0.3% in the night session.

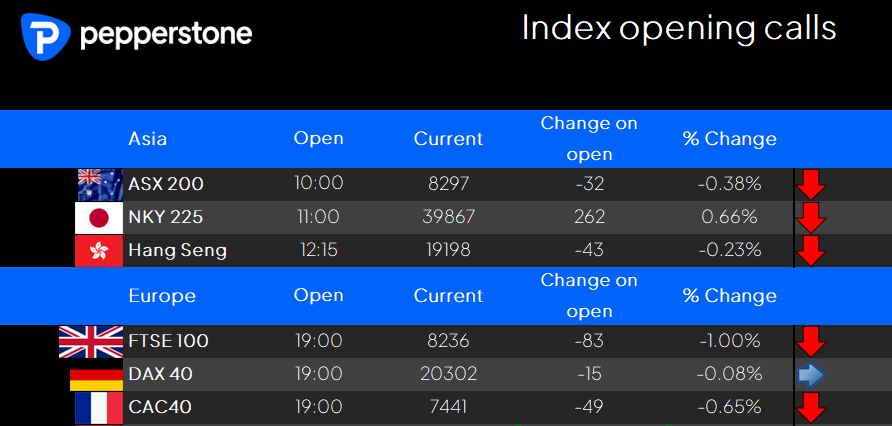

As we turn to the reopen of US equity futures and the ASX200 at 10am AEDT, which precede the NKY225 cash index open (at 11am AEDT) and HK50 and CSI300 open (12:15 AEDT), our current calls – which are priced off moves in the respective index futures move – suggest a mixed open. The NKY225 looks to lead Asia higher, with modest downside eyed for the open in HK and Australia.

However, any sign of calm conditions seen in the price action in recent hours looks to kick back into gear, with traders refocused on getting their exposures on point ahead of US nonfarm payrolls (NFP - 00:30 AEDT), and for those with CAD positions, Canadian employment numbers (also 00:30 AEDT). Coming in after NFP we see the University of Michigan Sentiment survey.

A calm descents on the UK gilt market but next week the event risk ramps up

We’ve seen some temporary settling of nerves stemming from moves in the UK gilt market, with the yield on the UK 10yr rising to 4.92% on the open before the buyers stepped back and pulling it down to 4.80% - this resulted in calmer conditions in both GBPUSD spot FX and 1-week and 1-month implied volatility pricing. However, one swallow does not make a Summer and both UK bond and GBP traders will now look to see how US Treasury yields (USTs) fare on the NFP print, as renewed selling in USTs will likely see gilts and bund yields rise in sympathy.

Traders will also be looking to get set for a big week ahead for global event risk. Notably focus will be placed on event risk in the UK, where the risk is dialed up from mid-week with UK CPI due out 3 hours before UK Treasury Department issue GBP4b in 10-year bonds. We then get retail sales on Friday and that could also get increased attention.

If inflation doesn’t show some serious signs of settling, and demand in the 10yr auction is poor – just as we saw on Tuesday’s UK 30yr auction – then we could feasibly be looking at another sell-off in the UK bond market, with the sellers targeting a move through 5% (in the 10yr gilt). GBP will react hard should on that development, as confidence in the government’s control of its fiscal destiny and where the options to really manage the situation are comparatively poor – the bond market has already shown that it has limited faith in Rachel Reeves, but this could deteriorate further in the week ahead and especially if the CPI print doesn’t come to the party – as the word ‘stagflation’ is also being thrown around increasingly liberally.

GBPUSD held the April lows of 1.2293 in UK trade, but next week is key, and a closing break of 1.2293 could get the shorts really fired up.

A playbook for US nonfarm payrolls - Do all road lead to US equity weakness?

It’s the US nonfarm payrolls (NFP) that we now prepare for in the session ahead, and the risk manager in all traders/investors will need be myopically focused on how the jobs data could play into risk.

As always, we need to consider how the unemployment rate, the level of jobs created, and the average hourly earnings are digested and how markets could react on the various potential outcomes.

Making a call on how US Treasuries and the USD react is fairly straightforward – if the U/E rate remains unchanged at 4.2%, and we see the number of payrolls come in above 200k+ then we will likely see Treasury yields rise and the USD finding good buyers. However, given we saw US equity sold in reaction to this week's hotter ISM Services and JOLTS print, the possible reaction in US equity to a better NFP print is now less clear – in theory, a solid NFP outcome should lift stocks, but with concerns of rising term premium, a higher discount rate and an early rise in inflation expectations, we could feasibly see a re-run of the ISM services move. That being good data resulting in sellers of equity risk. Clearly, the US Treasury market holds the answers.

Conversely, a scenario where we see a weaker-than-expected NFP print (say below 130k), with a rise in the U/E rate would typically result in Treasury yields, the USD and equity all moving lower. I suspect this will also be the case this time around, and equity will unlikely rally just because Treasury yields are falling. So, does this mean all roads from the NFP print lead to sellers in US equity? It seems that most paths do take us towards that outcome, and we’d need to see an outcome that is almost perfectly aligned to consensus expectations – not too hot, not too cold – and one that limits the movement in 10- and 30-year Treasuries.

We then move onto positioning for the following week ahead, with US CPI, retails sales, the start of US Q424 earnings and preparing for Trump’s inauguration, with Scott Bessant’s hearing for the position of US Treasury Secretary due on Thursday.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.