- English

- 中文版

It was a tough day at the office for US equity traders, with the S&P500 cash index closing at 1.9% and the NAS100 cash index at 2.4%, with heavyweight MAG7 basket -3.6%. Intraday, we can see S&P500 futures trading heavy through European trade, with sellers stating their case more emphatically as the US cash session got underway. Volumes in the S&P500 futures kicked in hard at 5802 and through 5800, with sellers taking the futures into 5747, before consolidating and tracking a range for most of US cash trade.

Apple’s Q4 earnings got the lion’s share of attention, where we see the actuals coming in modestly above the street’s expectations on Q4 sales, with iPhone revenue coming in a $46.22b vs $45.04b. Sales to China were a tad under expectations and maybe the market was looking for more in the full result, as shares trade 1.4% lower after hours, and we can see the negative reaction in our Apple 24hr CFD.

The USD has seen a mixed reaction across the G10/EM FX complex, with GBPUSD -0.5%, and trading through 1.2900 and to new run lows in the trend that started in late September. The fact we’re seeing broad GBP sellers despite a sharp sell-off in UK gilts speaks volumes as to the markets view on Chancellor Reeve’s budget and a potential hit to UK business confidence – and despite Reeve’s best efforts to reassure the markets, the market sees a renewed sense that front-loaded investment and spending may result in inflation resurfacing, with worries that policy doesn’t address the government’s fiscal balance.

USDJPY has been consolidating at the 61.8% fibo of the July to August selloff at 153.48, and while we’ve seen a modest 2bp decline in US 10yr Treasury yields, the exchange rate sits at session lows. US data aside, yesterday’s BoJ meeting and Gov Ueda’s presser offered an increased view that the December BoJ may well be a ‘live’ affair, with Japan swaps pricing 8bp of hikes for this meeting - In turn, this has been supportive of JPY appreciation on the day, with short GBPJPY the play of the day.

One can also think that US election positioning has been heavily considered as we stare down on the big day. USDJPY longs have recently benefited from Trump’s perceived prospects, but that position has been called into question, and traders have reviewed at how overexposed they’d be should Kamala Harris get the gig - a factor that is seemingly underappreciated by the betting markets. It feels reasonable to go into the US election long of USDs, but in the art of risk management that length is being dialled down, and while today’s US nonfarm payrolls report offers two-way risk for USD positioning, the adjustment into the election may have further to go.

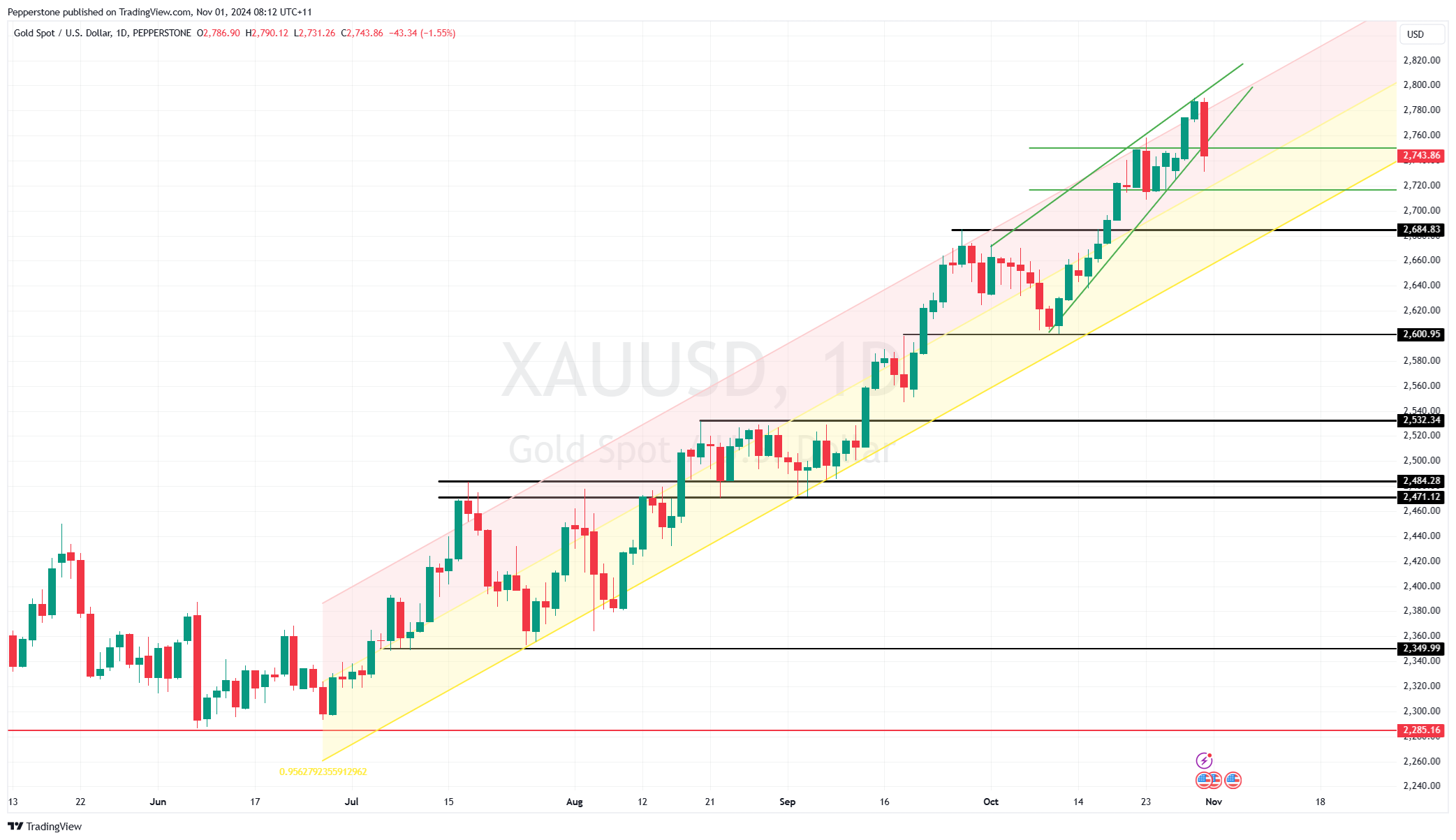

Gold and Bitcoin have been well subscribed Trump trades lately, and positioning is rich. While momentum has been a factor positively impacting both markets, we’ve seen longs taking chips off the table as we head into what is arguably an incredible period ahead of tier 1 event risk.

If gold is seen a hedge against geopolitical news flow, we didn’t see that on display in the price action on the day, and while crude has gained 3% on news (which was later denied) that Iran is preparing for a major retaliation within days, gold saw one-way selling in early US trade, moving in lockstep with S&P500 futures.

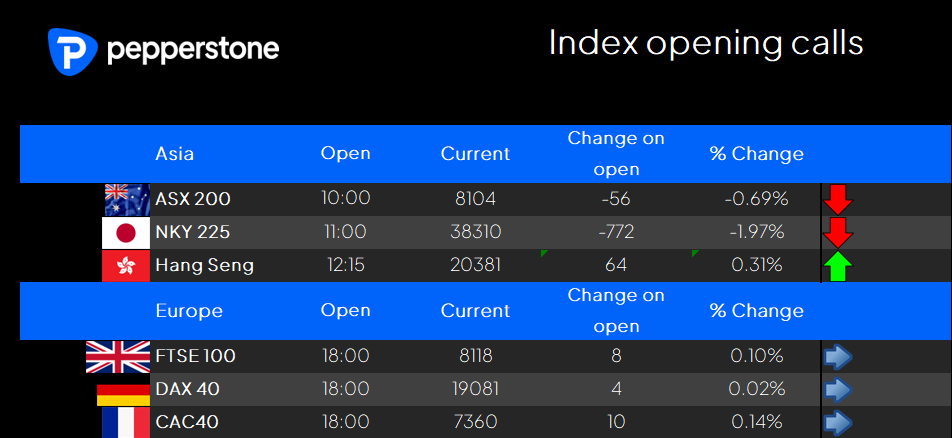

Looking ahead, our calls for the Asia equity suggest the various indices tread different paths on open. The NKY225 looks to open 2% lower, with tech sellers and JPY strength likely to impact. The ASX200 looks to open the final trading session of the week 0.7% lower on open, with the HK50 eyed modestly firmer. Traders absorb the sentiment from US equity, and the post market move in Apple, Amazon and to a lesser extent Intel.

With little data to trouble through Asia, the focus shifts towards upcoming US trade, and the risks to positioning that come from the US NFP and ISM manufacturing prints. With the US NFP data so distorted by weather-related incidents and port strikes, it may be harder to get a true signal from the data, but the unemployment rate, payrolls print, and revisions and average hourly earnings still has the capacity to move the dial – it remains a risk to markets.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.