- English

- 中文版

The Daily Fix: Risk coming off and the JPY looks very attractive

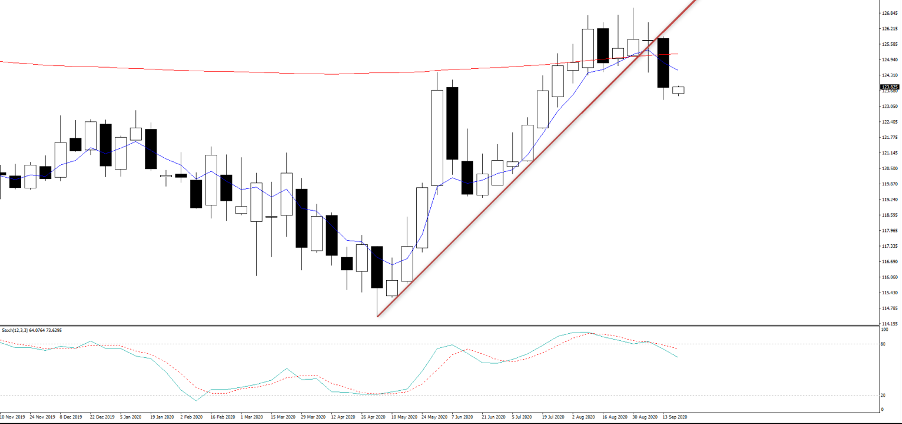

Tech once again underperformed and unlike the S&P 500, the NAS100 (-1.3%) closed below its recent low and looks the weaker of the various US indices.

Where is the inspiration for the equity bulls I ask? We have diminishing prospects of fiscal stimulus, crazy valuations, a firm focus on an ugly US election, and COVID shutdowns. Which suggest ST risks for equities.

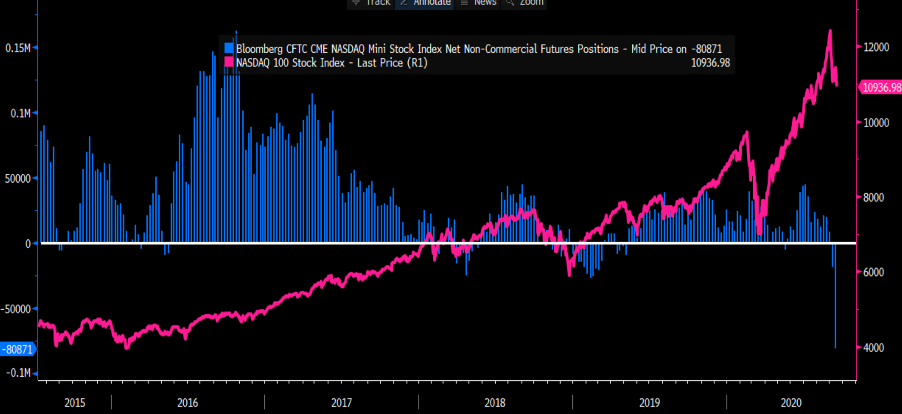

There's been some focus on the sizeable change in the net short position held by non-commercial accounts, although this was solely down to a group labelled “other reportable’s” and not leveraged accounts, which would have made me take notice. Either way, someone is hedging through futures, while NAS100 implied volatility trades at a huge 11 vol premium to S&P 500 volatility. If you like movement, the NAS100 remains the vehicle of choice here.

We’ve seen a quiet open this morning in FX markets and US equity futures have opened down smalls. Of course, the lack of early movement may be a red herring as the news, perhaps the Oracle and TikTok deal aside, can hardly be perceived as positive. But, there's been no risk aversion expressed in FX through this illiquid period.

US election risk

News of Judge Ginsburg’s passing is an incredibly important political factor in the US election, especially if we see the conservative Amy Coney Barrett getting the job. However, while if anything, this is likely to weigh on risk and the markets may struggle to price this accordingly, and cleanly understand whether this plays into a greater prospect for Trump. Or simply brings out more votes for the Democrats as many of the more moderate swing voters change to prior allegiances. Either way, the USD continues to push the upside of its recent range and if risk comes out of the market this week then the USD should firm.

GBP was in full focus from clients last week and I expect to remain so given the mix of shutdowns and political angst that will always divide opinions. There has been a sizeable pick up in GBP put volatility (relative to calls), but is this a sign that too much pessimism is now in the price and the market has swung to a consensus view of a full no-deal Brexit by year-end? I still sit in the camp that some sort of deal is more likely than not, but I am no expert, who is? I just feel with everything else going on the last thing Boris needs in the months ahead are even more, self-induced headaches. Timing this is always the hard part.

GBPJPY was on the radar last week and the pair is breaking to the downside. EU-UK Brexit discussions continue from tomorrow and we’ll see further amendments to the Internal Markets Bill. Also on the data docket, Markit manufacturing (eyed at 54.0 from 55.2) and services PMI (55.8) will be out Wednesday (18:30 AEST) and that could influence the GBP. So if you like movement then GBP could be the place to be this week. In terms of probabilities we see the options market putting a near 70% chance GBPUSD stays within a 1.2781 to 1.3092 range.

The fear of fresh lockdowns is also a factor for EUR exposures too, as will the outcome of manufacturing and services PMI (also out Wednesday). Whether this rocks EURUSD too hard is yet to be seen, even if EURUSD is ‘cheap’ if I look at relative real rate differentials (between German and US 10-yr bonds). EURJPY is the opposite and looks ‘expensive’ if we use real rates differentials (German bunds vs JGBs) as a very basic model, however, on the technicals we’ve also seen price close through uptrend support on the weekly. At this juncture, it feels like there are downside risks to EURJPY.

Blue - EURJPY

White – German 10yr real bunds - 10yr Japan govt bonds (JGB)

EURJPY weekly

NOKJPY has also come onto the radar and price needs to hold and bounce off 11.471 or this will warrant a short exposure – and I would be simple holding until price closes above the 5-day EMA. Much will rest of the moves in Brent crude, but if risk sours then this should crack the level and the flow of capital is only going one way. USDJPY may also drive the JPY crosses and is possibly one of the most interesting pairs to watch this week, as moves sub-104.50 have been met with a wall of buyers for years.

The JPY holds many attractions

The JPY is an attractive currency, I see no reason to sell it, other than periods of BoJ jawboning, which is now the great risk for holding JPY longs this week. Should this play out I will be buying JPY weakness. It would not surprise to see Kuroda or one of the BoJ saying “we’re watching FX rates closely” and try some method of jawboning the JPY lower. But in a world where real rate differentials increasingly drive capital flows, in DM FX Japan has highest and positive real yields and even more so when adjusting for hedging costs. This makes the JPY very attractive, especially against the GBP and USD, where real rates are not just negative but in the case of the Fed, they are actively seeking lower rates out.

This, to me, is why the focus for me is not so much about who gets the White House, but the overall make-up of Congress and the ability to pass legislation is just so key. If the DEM’s get both chambers then the ability for the Fed to drive real rates towards 2% increases markedly – as would a full REP chamber, but this seems less likely.

Related articles

Ready to trade?

It's quick and easy to get started. Apply in minutes with our simple application process.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.