- English

- 中文版

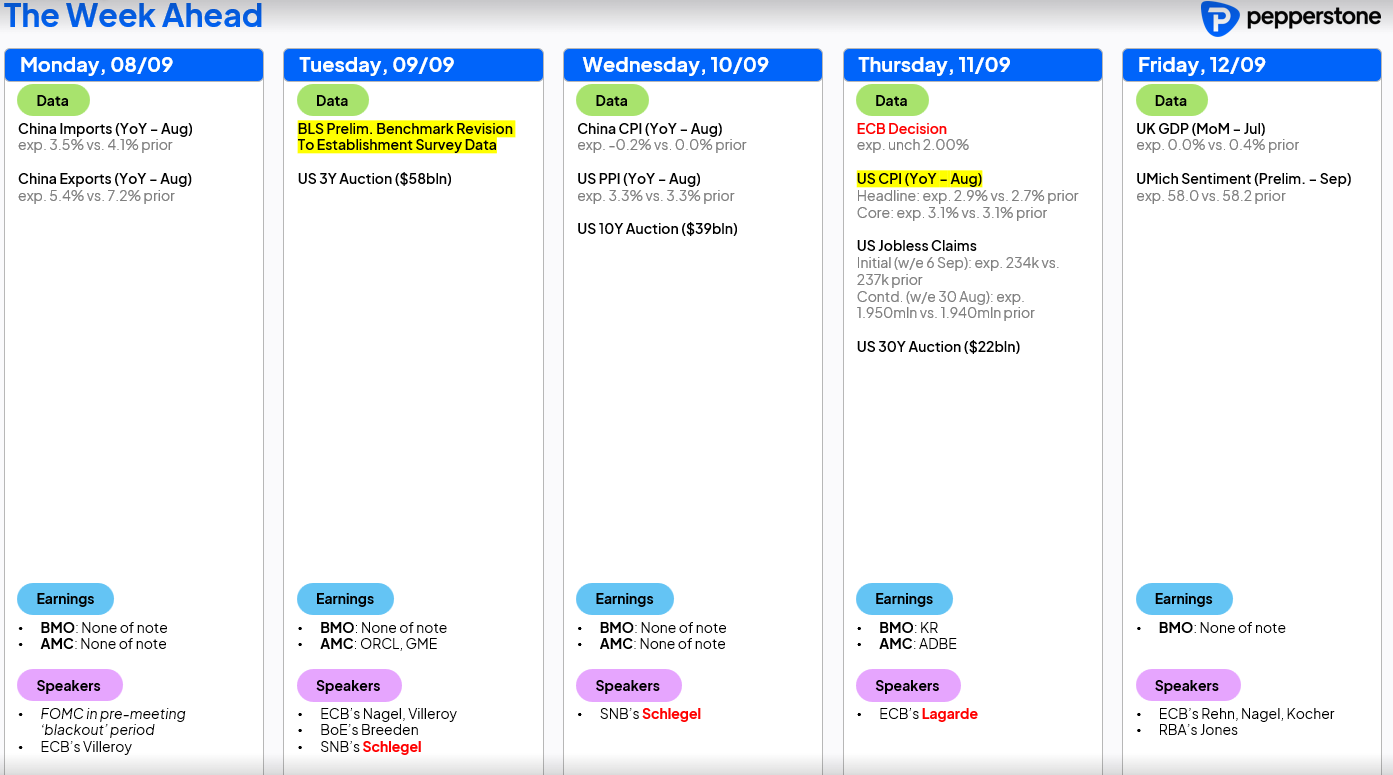

A Traders’ Week Ahead Playbook: Political Developments, US Inflation Data & Central Bank Easing

- Asia reacts to Friday's weak US payrolls – will Asia equity outperform US equity indices in the near term?

- Crude set to react to OPEC+ agreement in principle to increase output in October by 137k barrels – will Brent crude futures close below $65?

- Japan’s PM Ishiba steps down and the LDP looks for new leadership – BoJ hike expectations pushed out even further; hard to find any clear reasons to own the JPY.

- French PM Bayrou faces a confidence vote today, with President Macron potentially set to announce a new PM (who will be subject to a confidence vote), alternatively opening a path to snap legislative elections. Fitch set to announce the outcome of its review on France’s sovereign rating (Friday) – a downgrade is possible but unlikely.

- US CPI & PPI are the key data risks for the week – a benign inflation report could open the prospect of a 50bp cut in September. Thursday’s ECB meeting set to be a low-risk, low-volatility affair – rates to stay unchanged at 2%.

- China releases its August trade data, credit data and CPI. China’s NPC meeting could also present headline risk.

- US Treasury supply – the US Treasury is set to issue (through a reopening) $119b in 3-, 10- & 30-year Treasuries. Will this supply curb the falls in UST yields?

- Fed independence and credibility – we watch for developments in Trump’s quest to remove Fed Gov Cook.

Few Reasons to Be Long the JPY

We start the Weekly Playbook with the Japanese political development, where PM Ishiba has taken the pragmatic step of resigning ahead of an impending snap LDP election. This outcome isn’t necessarily surprising, but the focus now shifts to who could be the replacement, and what—if anything—that means for political stability in Japan and a potential coalition partner for the LDP.

The market will also consider the extent of additional fiscal measures and budgets under a new leadership, as the degree of fiscal impulse will be important in containing upside in long-end JGBs. These developments will likely be seen as yet another reason to push the timing of the next 25bp BoJ hike into 2026. That expectation is already in play, with swaps traders pricing just 12bp of hikes by December, with the implied pricing set to be reduced further when trading resumes.

This is yet another reason why few want to own the JPY at present. Look for JPY weakness in Asia to become broad-based, although USDJPY has daily limits, so AUDJPY and EURJPY longs make more sense here.

The Aftermath of US Nonfarm Payrolls

Whilst the topic has been well debated, Friday’s US nonfarm payrolls (NFP) report was significant in several ways. The US jobs report was poor, though it compares favourably to the deterioration seen in Canadian employment data (-65k, unemployment rate at 7.1%). The CAD swaps market has subsequently raised its expectation that the Bank of Canada will cut rates at the 17 September meeting to 73%. With the BoC and FOMC meetings both scheduled that day, 17 September now stands out as a key date in the risk diary.

After 53 consecutive positive monthly jobs prints, the revision to June’s payrolls (to -13k) formally ended that impressive streak. Taken holistically, it epitomises the challenges faced by central banks and corporate entities alike: the accuracy and reliability of data that drive critical decisions are essential to maintaining confidence in policy and strategic direction.

Revisions to prior payrolls reports are not new, but had the Fed initially known June payrolls growth was -13k instead of +147k, it is highly likely they would have cut rates at the July FOMC meeting – a classic case study of poor data resulting in a (probable) different policy outcome.

Slack Building in the US Labour Market – a 25bp Cut in September Is a Done Deal

Perhaps Trump was on to something with his persistent claims that Powell and the Fed are behind the curve. The three-month average job growth now stands at a meagre 29k, while the unemployment rate has ticked up for a second consecutive month to 4.3%. Slack is clearly building in the US labour market. While widespread layoffs are limited, the Fed will likely take a pre-emptive stance to prevent deterioration.

Another factor unlikely to have gone unnoticed is deterioration in the compensation channels – notably, average earnings for all employees slowed on a year-on-year basis, while average hours worked also edged lower to 34.2.

Payrolls revisions return to the spotlight on Tuesday, when the BLS reports its preliminary revisions for the Establishment Payrolls Survey, adjusting data for the 12 months up to March 2025. Expectations are for some punchy revisions lower.

As expected after a weak NFP outcome, the interest rate swaps market has moved to price a small 7% premium for a 50bp cut in September. A 25bp cut at the September FOMC meeting is now seen as a done deal, with no dissent expected among any of the voting Fed members.

US Core CPI and PPI – the Key Economic Event Risks

The implied pricing for a 50bp cut in September could increase if US core PPI and CPI prints come in more benign than expected. The median expectation is for US core CPI to rise +0.3% m/m, leaving the y/y rate unchanged at 3.1%. The market will closely assess tariff pass-through into core goods inflation, while core services inflation is expected to ease.

Should core CPI come in at 3% or even with a 2-handle, US swaps pricing could price the implied probability of a 50bp cut in September at 30–40%. In this scenario, it’s fair to assume the USD would break and close below the range lows of 97.60, with pro-cyclical risk currencies (AUD, NZD, SEK, and ZAR) outperforming. AUDUSD should trade to new YTD highs, with AUD longs looking attractive tactically given the rising likelihood that the RBA may have only one cut—or perhaps none—left in the cycle.

US equities should push firmly higher, breaking to new highs in the S&P500 and NAS100 – partly because falling UST yields would lift the NPV of duration equity. The increased prospect of a 50bp cut, combined with a less concerning inflation print, would coincide with Q3 GDP tracking around 2.5–3%, strong earnings, and a weaker USD providing tailwinds for the US listed multinationals.

Gauging a Market Reaction to a Hotter US CPI Print

Alternatively, should US core CPI surprise to the upside—say 3.2%+ y/y—the outcome would likely bring modest USD strength, driven by a 5–10bp sell-off in 2yr USTs. While bond investors are also tasked to take down $119b in Treasury supply this week, limits remain on how far shorter maturity UST selling could extend, given that a 25bp September cut seems all but assured.

However, assumed rate cuts further out the curve would be pared back, and the assumed terminal Fed funds rate (currently 2.87%) - which now trades below the Fed's assumed neutral rate - would rise. US equities would likely react poorly, and while buyers stepped in to support intraday weakness last week, that support may fade if stagflationary dynamics intensify.

While USTs continue to find buyers, the real winner remains gold. The intraday chart of the past five days is a thing of beauty, with price moving bottom left to top right. Pick any fundamental reason for gold’s recent strength—any could be true—but the fact that it is rallying strongly, with no statistical correlation to the S&P500 or USTs, makes it incredibly attractive to multi-asset managers seeking to lower portfolio variance through diversification.

Event Risk ex-US

Outside of incoming US economic data, Thursday’s ECB meeting should be a low-impact event, with the ECB almost certain to keep rates at 2% and unlikely to signal urgency to change policy. Meanwhile, China delivers a heavy data week, with August trade data (imports/exports), August credit data (new loans and aggregate financing), and CPI all due.

Political developments in France are also worth monitoring. Traders will focus on any widening in the France 10yr OAT vs German 10yr bund spread. The political saga could overshadow the ECB meeting in market focus, and while many retail traders may avoid this, if markets see a rising prospect of a snap legislative election, it could feed into EUR volatility and raise the likelihood of Fitch downgrading France’s sovereign rating.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.