Analysis

Navigate This Week’s Markets: Top Data Events, Central Bank Policies, and Trading Opportunities

The US Thanksgiving holiday will see US equity and bond markets close on Thursday, followed by partial trade on Friday. With reduced participation, market players may look to pack orders before the extended break.

From a top-down big, picture perspective, we consider the key themes driving sentiment, cross-asset flows and price action - where we review:

- Another week of significant inflows into the various BTC ETFs, amid a general chase for upside in crypto – However, after a pullback through weekend trade to $96k, the Bitcoin bulls will need to find a significant wave of new buyers to break $100k.

- Continued focus on trading Trump 2.0 – News that Scott Bessent has been confirmed as the incoming US Treasury Secretary should be taken positively by US markets, but the appointment won't come as a surprise.

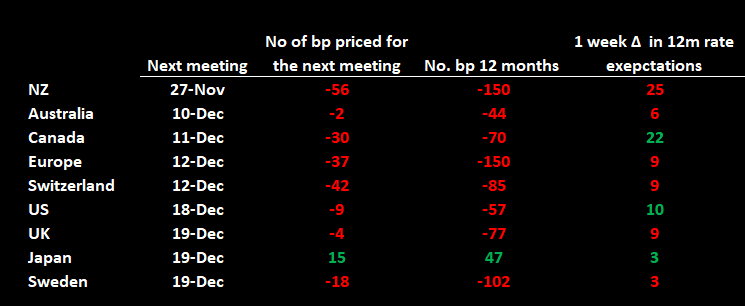

- Euro area economic fragility – we assess the probability that the ECB step up to 50bp cut increments. Many also question how far the ECB can take down interest rates and the probability of EURUSD reaching parity in Q125. We’re seeing Increasing expectations of diverging G10 central bank policy settings that offers increasing opportunity but also higher implied FX volatility.

- Selectively long USDs - The USD remains fundamentally attractive, but positioning for further USD upside should now be considered on a selective basis.

- An unwelcomed increase in the geopolitical news flow – Many consider this a reason why gold rallied 6% last week, although there is little evidence of de-risking in other markets.

- With measures of implied US equity and bond volatility falling, we ask whether lower volatility increases the potential for a risk-on rally into year-end.

The Playbook - Key data to navigate through the week ahead

Few trading in the crypto markets will pay attention to the economic data flow this week, with the price level, and the rate of change the greater considerations.

It’s been a tough weekend for crypto longs, with Bitcoin pulling back to $96k. The order book seen in Bitcoin on Friday showed a mountain of sell orders into and at $100k and that level of supply has proved to be tough wood to chop. Having traded $300 shy of $100k last week, one questions if this is now a case of so close, but yet so far – at least in the short term. Conversely, could this slight pullback offer better levels for would-be longs, with a cleaner position offering the bulls a platform for another run into the big number? The directional risk for the crypto scene this week seems far more balanced and two-way.

Heightened focus on EU and Japan (Toyko) CPI prints In the world of TradFi, many will look at event risk on the calendar this week and consider how it will play into respective central bank thinking. Coming on a day where most US heavy hitters will be off work and in the party mode, EU and Japan Tokyo CPI prints (both on Friday) should be firmly on the radar, as the outcomes could have big implications on respective BoJ and ECB policy settings – one which could increase the prospects for a BoJ hike, while the other the prospect that the ECB step up to a 50bp cut increment. Trading EURJPY, therefore, comes with inherent risk this week and the price action could get lively.

BoJ Gov Ueda told us last week that the December BoJ meeting is now ‘live’, with the near-term data flow set to influence their thinking. With the JP swaps market now implying 15bp of hikes for the December BoJ meeting, market expectations are sufficiently elevated. Given the re-focus on the prospects of a second BoJ hike and amid a strong trend higher in Japanese govt bond yields, traders may further look to cover JPY shorts and position for upside with EURJPY, GBPJPY, SEKJPY and CHFJPY on the radar.

Europe in the doghouse

Whether we review the relative performance of EU equity indices or the EUR currency, there is a broad migration away from EU risk, with EU govt bonds outperforming.

Last week’s Euro area November services and manufacturing PMIs fell back into contraction, taking EURUSD to 1.0335, before closing at 1.0418. EUR interest rate swaps have reacted, pricing 37bp of cuts for the 18 Dec ECB meeting, which implies a 53% chance the ECB step up to a larger 50bp increment. The EU CPI print will therefore go some way in influencing the 25bp vs 50bp debate and increases the risk for those trading EURUSD and the EUR cross rates this week, and traders will need to consider holding positions over the inflation data.

Expectations are for November headline EU CPI to come in at -0.2% m/m / 2.3% y/y, with core CPI eyed at 2.8% y/y (from 2.7%).

US data in view - can the USD kick further higher?

In the US the highlights from the economic data flow will be the November consumer confidence (Tuesday), FOMC meeting minutes (Tuesday) and core PCE inflation (Wednesday). The US consumer confidence report was compiled after the US election, so most economists expect a rise in consumer confidence. and therefore, it’s the extent of improvement that matters – the market expects the index to lift from 108.7 to 111.8. US Core PCE inflation is expected to lift 0.3% m/m taking the year-on-year clip to 2.3% (from 2.1%).

Equity bulls will want to see a healthy bounce in the consumer data, married with a below consensus read on PCE inflation. With US swaps now implying a 36% chance of a 25bp cut from the Fed on 18 Dec, weaker US data would see pricing for a 25bp cut rise back above 50%, which should support equity risk and be a headwind for the USD. Equity shorts and the USD longs would want to see a hotter PCE print.

The USD index (DXY) has rallied for 8 consecutive weeks (one of these was unchanged) – A 9th weekly gain seems a tall order given how rich positioning has become, but there is no doubt the trend higher in the USD is justified. USD longs will be looking to tighten up stops and even prepare to even square and reverse, should the price action warrant such action.

Aussie CPI could be a tailwind for the AUD

In Australia, the October monthly CPI is released on Wednesday. The median call is for headline CPI to increase 20bp to 2.3% y/y, which would certainly justify current swaps pricing, which prices the first 25bp cut from the RBA by May 2025. The AUD put in a solid performance last week, and there has been solid underlying support for the ‘Aussie’. EURAUD trades into 12-month range lows, with 1.6000 likely to get firm attention from FX traders. AUDCHF longs look interesting as well, and notably on a break of 0.5827. GBPAUD shorts remain compelling, with the October pivot lows of 1.9125 in sight.

The RBNZ fully expected to cut by 50bp

AUDNZD found sellers into the July highs on Friday, but for those holding exposures in the NZD, consider that trading the NZD comes with increased risk through the week. On Wednesday, the RBNZ should almost certainly cut rates by 50bp but that is now firmly priced, in fact, NZ swaps price a 25% chance of a 75bp cut, which seems unlikely. Subsequently, with such elevated expectations of RBNZ easing it seems prudent to hold off from chasing AUDNZD upside for now and look to reload at lower levels.

Elsewhere the US Treasury will auction over $200b in Treasuries across the 2yr, 5yr and 7yr maturities, where the level of the demand could result in increased movement in US Treasury yields. Naturally, the direction of travel in the US Treasury complex could spill over into the USD, US equity and gold. Gold has found a run of form, closing the week on session highs, and putting on its 2nd best week of the year – pullbacks should be well supported.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.