- English

- 中文版

Week Ahead Playbook: Resurgent Trade Risks Roil Markets But TACO Time May Return

The Week That Was – Themes

For a time, last week was shaping up to be one where no obvious theme stood out, as markets meandered amid a continued US data vacuum stemming from the ongoing government shutdown. That all changed, though, late on Friday, after a ‘bolt from the blue’ post from President Trump on ‘Truth Social’ suddenly saw trade risks make a significant, and unwelcome resurgence.

This latest round of tariff threats stemmed from what Trump called ‘very hostile’ Chinese actions, which had ramped up in recent days, including the implementation of export controls on rare earths, as well as probes into US ‘big tech’ firms such as Qualcomm and Nvidia. Clearly, all of this was akin to ‘poking the bear’, with Trump’s response being to announce an additional 100% tariff on Chinese imports into the US, as well as export controls on ‘all critical software’, effective from 1st November. In addition, Trump noted that he now sees ‘no reason’ to meet Chinese President Xi at the APEC Summit, as had previously been announced.

Quite clearly, all of this was a rather unwelcome development for financial markets which had, by and large, moved on from the trade and tariff story, operating on the assumption that calmer tones would now prevail, and that the US-China truce would remain intact for some time. Assumptions that, now, need to be questioned.

Chiefly, the question that every man and his dog are attempting to answer is whether this is a credible threat, that the Trump Admin might follow through on, or whether this is another example of the ‘escalate to de-escalate’ strategy that Trump used so frequently earlier in the year. A strategy where outlandish and ridiculous tariff figures are threatened, in an attempt to focus minds, extract concessions from the other party, and ultimately come to agreement faster than otherwise might’ve been possible.

Given that none of those announced measures are due to come into place for another three weeks, it seems plausible to me that this time will not be different, and that another ‘TACO’ moment could soon be on the cards. That said, the resurgence of trade uncertainty will now make it more difficult for participants to accurately price risk, likely resulting in a pick-up in both implied and realised vols, along with choppier trading conditions, at least in the short-term.

Uncertainty, however, doesn’t just abound on the trade front, but on the political front as well.

Fallout from last weekend’s LDP leadership election in Japan continues, after Takaichi’s surprise victory sent shockwaves not only through Japanese markets, but also through the domestic political backdrop as well. In fact, those shockwaves have seen the Komeito party decide to end their 26-year long coalition with the LDP, thus making it significantly more difficult for Takaichi to pass legislation in the Diet, while also casting some doubt on whether she will even obtain enough votes to take up her post as Prime Minister.

In any case, in contrast to expectations at the start of the week that a return to the days of ‘Abenomics’, and massive fiscal bazookas, could be on the cards, any stimulus packages now delivered are likely to be much more modest in nature, given the delicate balance of power in the Japanese parliament. Some relief for the long-end of the JGB curve, at least, while the ‘Takaichi Trade’ (short JPY, short JGBs, long Nikkei) will probably now take a pause for breath, at least for the time being.

Japan isn’t alone in operating with an unstable political environment, however, with France also continuing to descend ever deeper into farcical territory.

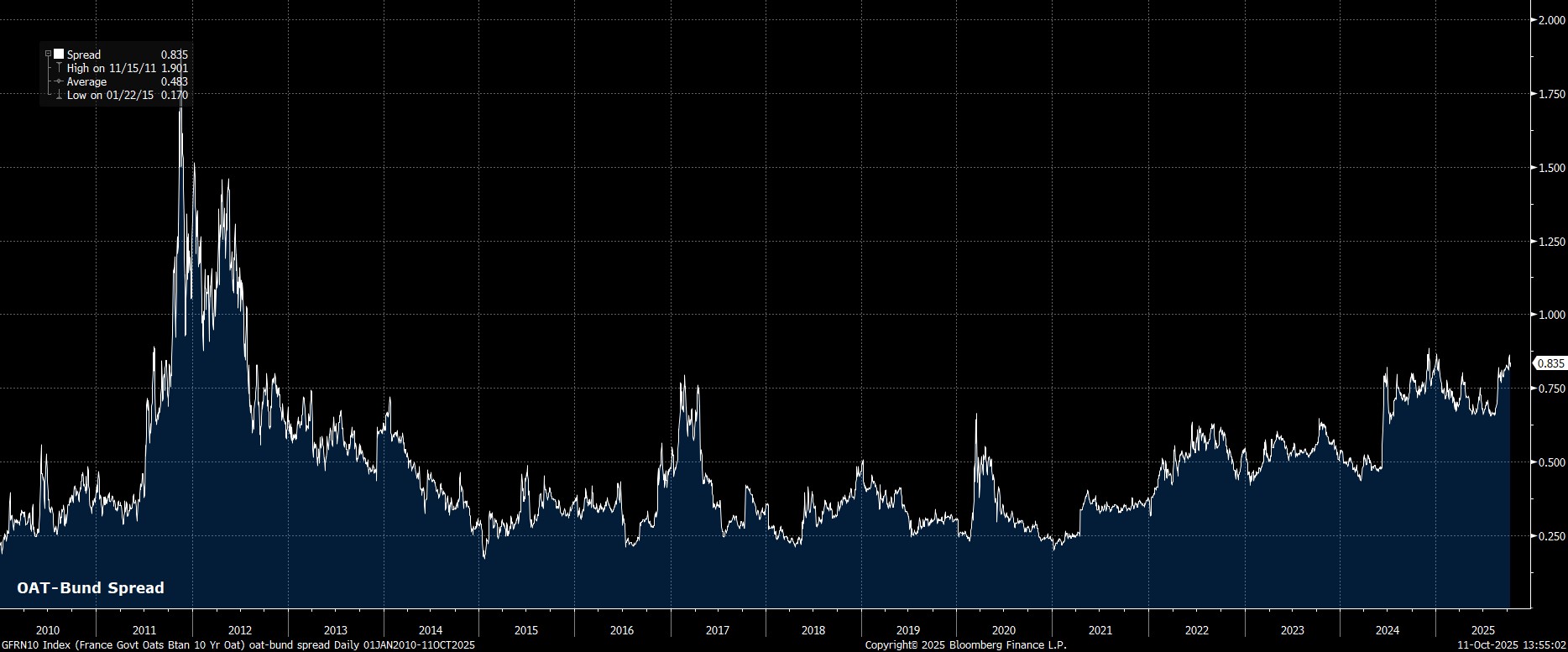

PM Lecornu announced his surprise resignation on Monday, only to then be re-appointed to the same job by President Macron as the week came to an end, being tasked once again with forming a government that can garner the support of a majority of lawmakers, in an attempt to prevent the need for fresh legislative elections, which themselves would likely only fragment the political landscape even further.

Not only is the new PM the same man, but the same man also faces the same issues, namely the apparent impossibility of passing a budget which not only obtains the necessary number of votes, but also one which makes the necessary spending cuts to restore even a semblance of stability to France’s fiscal footing. A further widening of the OAT-Bund spread feels inevitable, even if the imminent risk of fresh elections seems to have subsided for the time being.

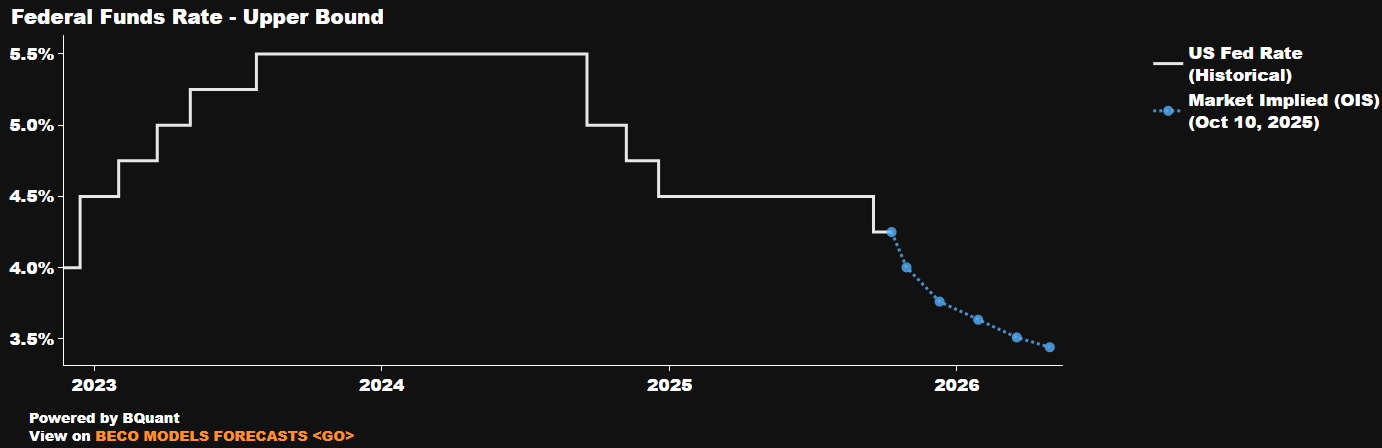

Meanwhile, on the monetary side of things, we received further news on the race to succeed Jerome Powell as Fed Chair. Reports now indicate that the ‘shortlist’ of candidates to get the gig next May has been whittled down to 5 names – current Governors Bowman and Waller, former Governor Warsh, NEC Director Hassett, and BlackRock FI CIO Rick Rieder.

While, personally speaking, I’m a little downbeat not to see Jefferies’ David Zervos make the cut, mainly as I’d had a friendly wager on that one, the names in the mix aren’t especially surprising. Furthermore, barring NEC Director Hassett, one would imagine that market participants would be able to live with any of those names being nominated to the top job.

Interestingly, though, it seems that we are unlikely to get clarity on the new Chair’s identity for some time, with sources indicating that the process may not wrap up until after Thanksgiving, still over six weeks away. That said, it is becoming increasingly clear that Powell’s successor is likely to take over from Governor Miran at the end of January, before then being elevated to Chair in May.

Such a plan reinforces a view I outlined last week that Powell is, essentially, ‘yesterday’s man’, considering that 25bp cuts at each of the October and December meetings are nailed-on, and that his successor will not only be known, but also sat around the FOMC meeting table, for Powell’s final three meetings as Chair in early-2026.

Though the Fed policy outlook seems unlikely to spring any surprises for the time being, and minutes from the September FOMC meeting were about as interesting as watching paint dry, we did get one monetary policy surprise last week.

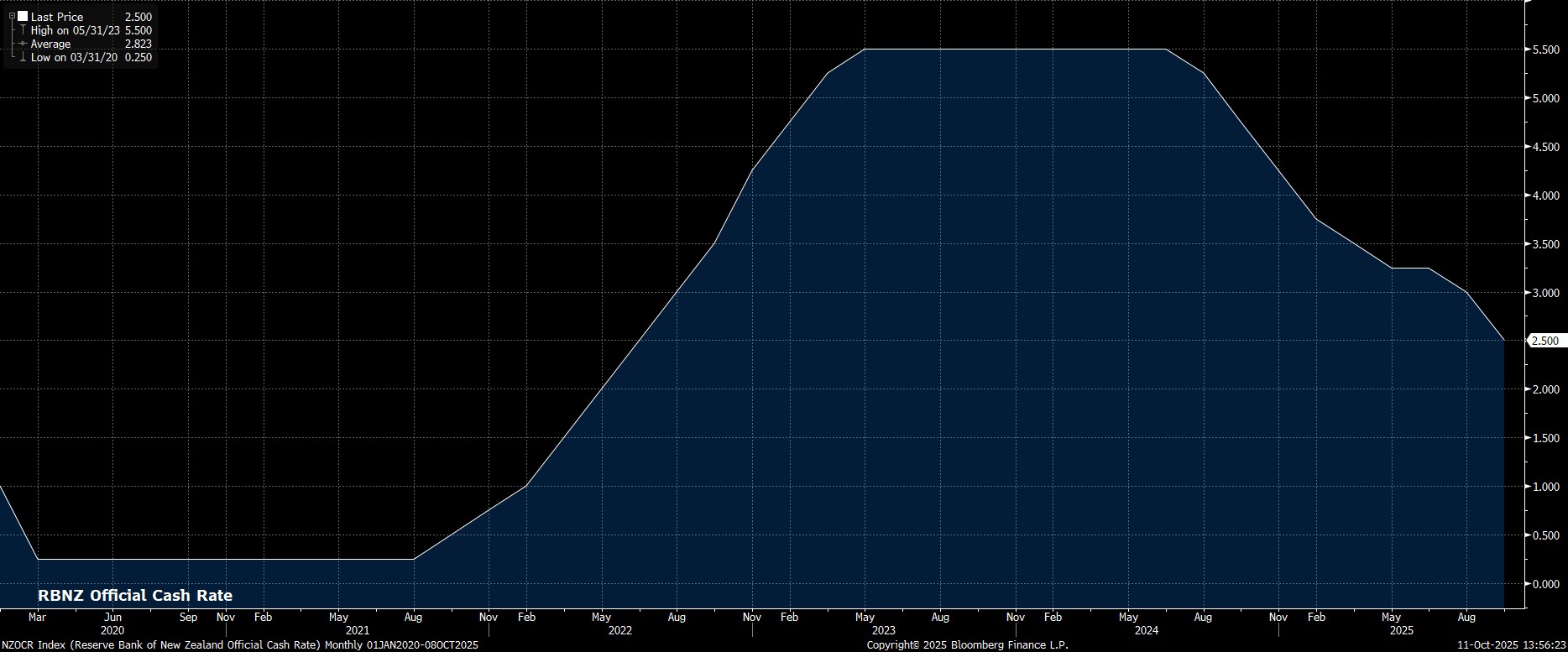

Said surprise came from the RBNZ, who delivered a jumbo 50bp rate cut, lowering the OCR to 2.50%, while also flagging an openness to consider further rate reductions in the months ahead. That decision comes as the Kiwi economy continues to stall, and the risk of inflation sustainably undershooting the midpoint of the RBNZ’s target range continues to mount.

Even though the OCR is now back at something resembling a neutral level, it seems that the RBNZ will need to do more in order to embed a sustainable recovery, likely leading to another 25bp cut at this year’s final meeting in late-November, before a ‘wait and see’ approach persists over the ridiculously long gap to the following meeting in mid-February 2026.

The Week That Was – Markets

As alluded to earlier on, it was something of a ‘week of two halves’ for financial markets last week, with somewhat calmer tones prevailing for the most part, before a violent and ugly end to proceedings on Friday afternoon.

That ugly end to the week saw capital preservation take precedence for the majority of market participants, amid a broad-based de-risking of portfolios, and rush into haven assets, after Trump’s tariff surprise. Consequently, both the S&P 500 and Nasdaq 100 notched their biggest one-day declines since the aftermath of ‘Liberation Day’ in mid-April, while also wrapping up their worst weeks since May.

Naturally, as the new trading week gets underway, heavy focus will fall on whether participants do err on the side of the ‘TACO trade’ once more, and view Friday’s downside as a dip buying opportunity, or whether the de-risking may have further room to run. While, as mentioned, my working assumption remains that this is all setting up for yet another U-turn, participants’ conviction on that front could well be capped for the time being. Holding above the 50-day moving averages in both spoos and the NQ, both of which are now just a whisker away, will be pivotal for ensuring that the short-term trend remains a bullish one.

Amid that rush into safe havens late last week, precious metals continued to shine, with gold clearing $4,000/oz for the first time, and silver also rallying to fresh record highs, above $50/oz. Even without renewed trade risks, the bull case for each of those remains a solid one, amid the ongoing risk of un-anchoring inflation expectations, runaway government spending, and in the case of gold ongoing demand from reserve allocators seeking diversification. For silver, a surge in physical demand, which has seen lease rates soar to a record high, and resulted in a massive backwardation of the curve, also underpins the case for additional upside.

_Da_2025-10-11_13-58-30.jpg)

Elsewhere, Treasuries also benefitted from haven demand in the aftermath of Friday’s tariff bombshell, with the long-end leading gains on the week as benchmark 10-year yields tested 4.00% to the downside, and benchmark 30-year yields tested 4.60% to the downside. While a chunk of this will have been a knee-jerk reaction to Friday’s headlines, it was nonetheless interesting to see Treasuries trading in their ‘textbook’ defensive manner, as opposed to selling-off violently as had been seen amid earlier tariff-induced market tantrums, and as part of the ‘sell America’ trade that was so in vogue back in Q2.

Though Treasuries firmed, the dollar failed to do so, with the buck coming under pressure as the week wrapped up. That said, while the buck ended Friday in the red against all G10 peers, the dollar index (DXY) did nonetheless manage to chalk up a gain on the week, and notch its highest weekly close since the summer. Assuming that the latest trade headlines are largely another Trump negotiating ploy, and that uncertainty soon clears once more, the Fed’s ‘run it hot’ approach, tilting risks to the US economy to the upside, should continue to boost the buck as well.

_d_2025-10-11_13-58-41.jpg)

The Week Ahead

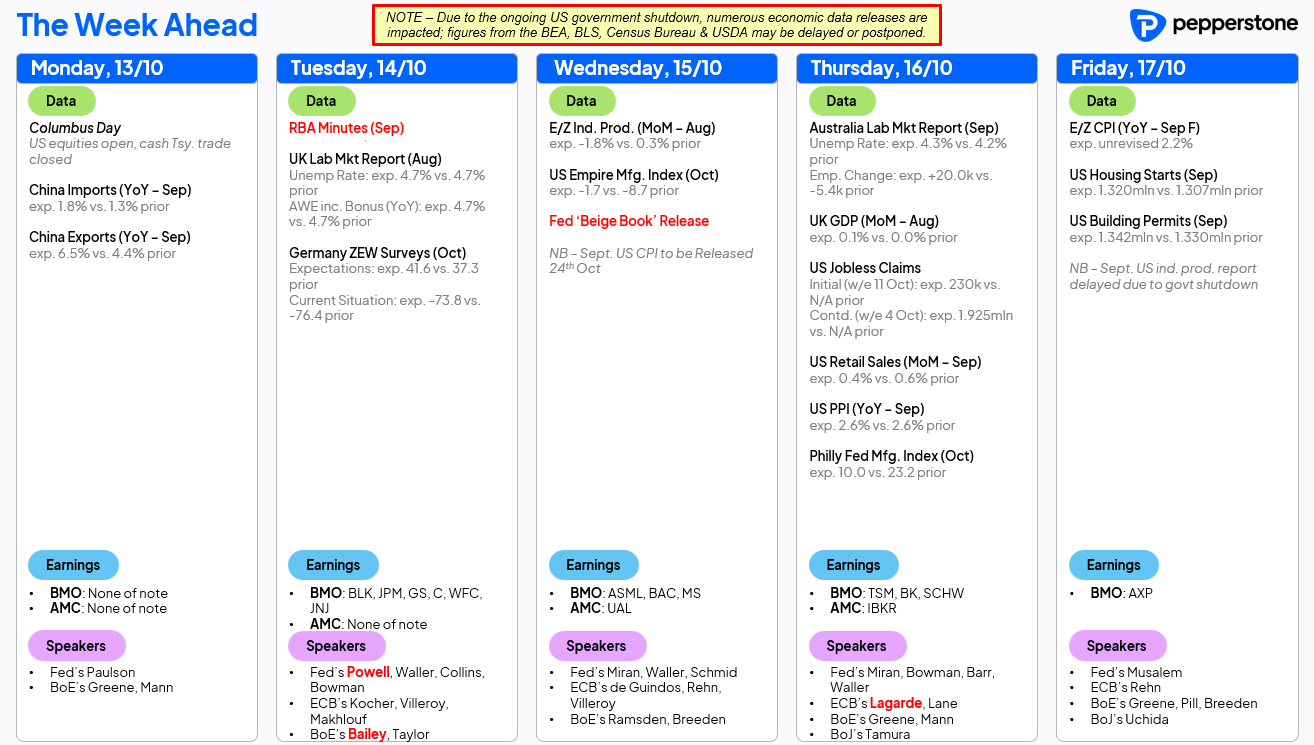

By and large, the week ahead looks set to be dominated by trade and tariff developments, as the ongoing US government shutdown means markets will continue to operate in something of a data vacuum, with no end in sight on that front for the time being.

While the above docket may look rather busy, barring some sort of miracle, the only US release we’ll be getting next week will be the October manufacturing survey from the Philadelphia Fed, which is hardly likely to be much of a market-mover on its own. There are some notable prints due elsewhere, however, including the latest jobs and GDP data from here in the UK, as well as the monthly round of trade figures out of China.

All of that, though, will need to be taken with a bit of a ‘pinch of salt’, given that the ONS and China’s NBS seem to be engaged in a game of ‘who can release the ropiest data’ these days. Last week, incidentally, saw the ONS admit to an error in UK borrowing stats, which by my reckoning means it’s now labour market, inflation, growth, retail sales, trade, and public finance figures with which the folk in Newport have had difficulty producing accurately in the last couple of years.

The data void is, perhaps, more than made up for by a deluge of scheduled remarks from G10 policymakers, including the ‘big three’ of Fed Chair Powell, ECB President Lagarde, and BoE Governor Bailey. Those three, plus others on this week’s docket, are unlikely to offer anything particularly explicit in terms of the policy outlook, and are instead much more likely to simply offer a repeat of recent remarks.

In addition to that, this week also marks the start of Q3 earnings season on Wall Street, with the major banks kicking things off on Tuesday. Per Factset, overall S&P 500 earnings growth is seen at 8.0% YoY in the third quarter, which would mark the ninth consecutive quarter of growth for the index, reinforcing one leg of the three-pronged equity bull case (solid earnings growth + resilient economic growth + a looser monetary backdrop) that I’ve been working with for some time now. Looking ahead, the week of 27th October stands as the busiest of the season, with 41% of the S&P by market cap set to report that week, though retail favourite – and according to some the ‘most important stock in the world’ – Nvidia shan’t report until mid-November.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.