- English

- 中文版

US-EU Trade Deal Done As Markets Move Into A Monster Week

WHERE WE STAND – Well, folks, TACO time is here once more!

Seems to come around quicker every time, and it’s all just one big negotiating game that markets have, rightly, now wised up to.

Exhibit A – the US-EU trade deal agreed over the weekend. The EU have agreed to purchase $750bln in US energy, up investments in the US by $600bln, and drop tariffs on imports from the US to 0%. In return, the US will levy a 15% tariff on imports from the bloc. While such a levy remains sizeable, it is half the 30% tariff that had been threatened to go into place on Friday, and well below the 50% tariff threat that President Trump had made at the start of the month.

Exhibit B – reports that the US and China, who embark on another round of trade talks in Stockholm today, are set to extend their current trade truce by a further 90 days. Not especially surprising on its own, but again confirmation that the two have no desire, or ability, to stomach super-high tariffs of the like seen early in Q2.

Exhibit C – Trump noting that ‘3 or 4’ further deals may come this week, and that ‘confirmation’ tariff letters will be sent before Friday. That last point is important as it strongly, strongly implies the levies noted in the letters sent at the start of the month are unlikely to be the ones that actually end up being charged, while also leaving yet another deadline extension as a possibility too.

Exhibit D – Trump floating, on Friday, the possibility of ‘rebate payments’ being provided to lower income Americans, funded by the revenue collected by tariffs that have been imposed. While it would be easier just to can the tariffs, given that the US consumer is paying them anyway, this may perhaps just be a nod towards the pain that some of Trump’s trade policies are inflicting on the lower quartile or so of the economy.

Where does all this leave markets?

Well, it certainly helps to firm up the bull case for equities, which was already a pretty resilient one anyway. Clearly, the direction of travel remains towards a cooler and calmer tone on trade, with deals continuing to be done, and the tail risk of ‘no deal’ outcomes now being priced out. All this, of course, as the underlying US economy remains robust, and as earnings season continues in strong fashion. Frankly, it’s tough to bet against the market continuing to print record highs for the time being, though this week’s megacap earnings are, of course, a risk on that front.

Meanwhile, in fixed income, trade deals being struck should, to some extent at least, keep a lid on any inflation jitters, subsequently capping downside as well, even as the fiscal trajectory remains unsustainable across DM. nevertheless, dip buyers stepped in around 5% on the benchmark 30-year Treasury on Friday, and I’d expect that such a level continues to prove too tempting to ignore for now.

For G10 FX, finally, all of this should continue to pose headwinds to the greenback, as agreement of trade deals gives participants confidence to once again take on longs elsewhere, most notably in the EUR, where a hawkish repricing of ECB expectations is likely to give proceedings a further helping hand.

There are, though, a few more idiosyncratic stories starting to emerge in the FX space. For instance, short GBP remains attractive, albeit more so in the crosses, especially after Friday’s dismal retail sales report, and as growth risks continue to tilt clearly to the downside, ahead of near-certain further tax hikes in the autumn. EURGBP is probably the purest play, here, now that we’ve broken above the April highs, and I wouldn’t entirely rule out a move back towards the 0.90 mark.

The JPY is also one that continues to catch the eye, even if shorts there appear very crowded indeed. Though the US-Japan trade deal alleviated some uncertainty, another dollop of potential upheaval has emerged in the form of PM Ishiba’s potential resignation. That should keep the BoJ on hold for the time being, probably in turn posing some further headwinds for the yen.

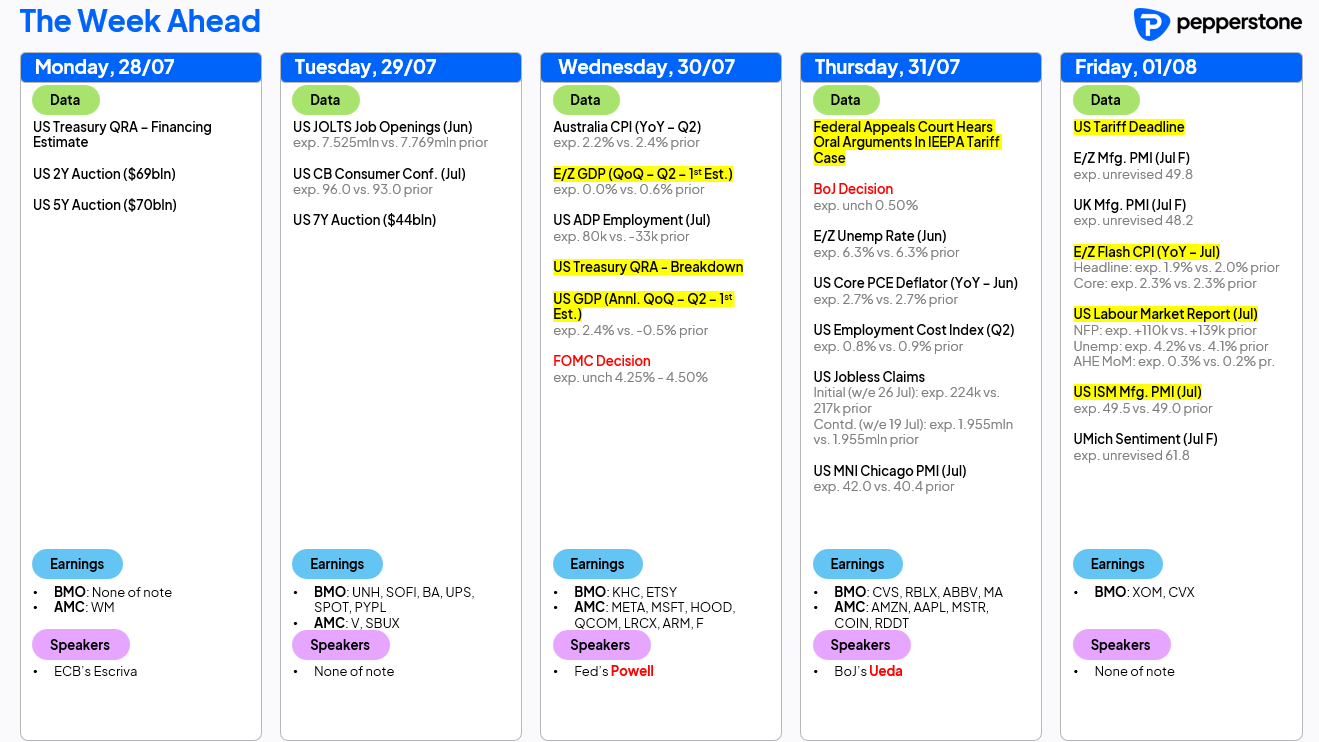

LOOK AHEAD – A bumper week ahead in terms of event risk, and arguably the last ‘proper’ week before summer markets well and truly set in, until things get back up and running around Labor Day. Anyway, that’s a long way off, and there’s plenty to deal with in the ‘here and now’.

On the trade front, Friday’s tariff deadline is of course the biggest risk, though the base, as noted, for now is that will again prove a TACO moment, with the can kicked down the road, probably to Labor Day. Elsewhere, on tariffs, this week, US-China talks are set to take place in Stockholm today, likely resulting in an extension of the present trade truce, while Thursday sees arguments made in the IEEPA tariff case, though this will almost inevitably end up in the Supreme Court at some stage.

Meanwhile, the FOMC will stand pat on Wednesday, holding the target range for the fed funds rate steady at 4.25% - 4.50%, though Governor Waller, and possibly Governor Bowman too, will dissent in favour of an immediate 25bp reduction. Following that, the Bank of Japan will keep all policy settings on hold on Thursday, amid ongoing political uncertainty in the ‘land of the rising sun’.

In terms of data, Friday’s US labour market report highlights the docket, with the pace of job creation set to have slowed modestly in July, in turn nudging the unemployment rate higher to 4.2%, though still pointing to overall labour market resilience. Also on the slate this week are the first reads on Q2 GDP from both the eurozone & the US, manufacturing PMI figures from most DM economies, and the latest ‘flash’ inflation figures from the eurozone.

Elsewhere, focus in the fixed income complex will fall on the Treasury’s quarterly refunding announcement, with the financing estimate to come today, followed by the issuance breakdown on Wednesday. Here, attention will be paid to whether the Treasury increase T-bill issuance as Bessent has hinted, with forward guidance as to future auction sizes also of note, amid a likely sizeable funding gap in FY26 onwards.

Finally, a huge week of corporate earnings lies ahead, the busiest of Q2 reporting season in fact. Megacap tech names highlight proceedings, with Meta (META) and Microsoft (MSFT) to report after the close on Wednesday, followed by Amazon (AMZN) and Apple (AAPL) after the close on Thursday.

As always, the full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.