- English

- 中文版

WHERE WE STAND – I suppose we’ll have to chalk that up as another weekend lost, at least partially, to the whims of President Trump, and another barrage of ‘Truth Social’ posts.

Friday had, in fact, been a relatively subdued day, with external catalysts lacking, and markets meandering about in relatively aimless fashion. Something, I must admit, I wasn’t too bothered about, given the rather enjoyable long lunch that filled most of my day!

Still, that relative calm has been rather ruined by weekend developments, with Trump announcing another round of tariffs. This time, a 30% levy on imports from both Mexico, and the EU, effective 1st August. Once again, this rather obviously smacks of an ‘escalate to de-escalate’ negotiating gambit, though the letter sent to the EU does fly in the face of last week’s consensus, that the lack of a letter to the EU indicated a deal could be close.

Anyway, for the time being the logical bet is that all of this is simply a way to get other parties to hurry along, extracting more significant concessions in shorter order, and getting a deal done much more quickly. That said, I suppose with markets trading at record highs, Trump could be somewhat more emboldened to push things too far this time, though that certainly isn’t my base case. The logical bet remains that the punchy tariff levels announced in recent days will, by and large, not actually come into effect, with deals (or some kind of agreements) being made before the end of the month.

This supports the bull case for equities, with dips still buying opportunities in my mind, even if the benchmark S&P did notch its first weekly decline in three last week. That bull case, though, will be put to the test in the next couple of weeks – not from a trade perspective, but as we move into second quarter earnings season, with a solid clip of earnings growth having been, and still being, one of the main factors to have supported sentiment over the last few months.

Elsewhere, the greenback ended the week firmer against most major peers, seeing cable pullback below the 1.35 mark, though gains in the DXY remain capped around the 98 figure. I see this as a dollar rally to be sold into, with the idea of ‘US exceptionalism’ prett much dead at this stage, and with capital outflows set to persist for a prolonged period, particularly as monetary policy independence remains under threat, and as various folk within Trump’s ‘inner circle’ ramp up their baseless and nonsensical attacks on Fed Chair Powell.

This, along with higher inflation expectations induced by the recent tariff barrage, saw Treasuries sell-off as the week wrapped up, with benchmark 10- and 30-year yields rising over 5bp apiece on the day. That sell-off, though, in 30s at least, has taken us back towards the 5% handle, where dip buyers have been lurking many times in recent months. I’d imagine those very same dip buyers are indeed still present, with locking in that sort of yield still an attractive proposition.

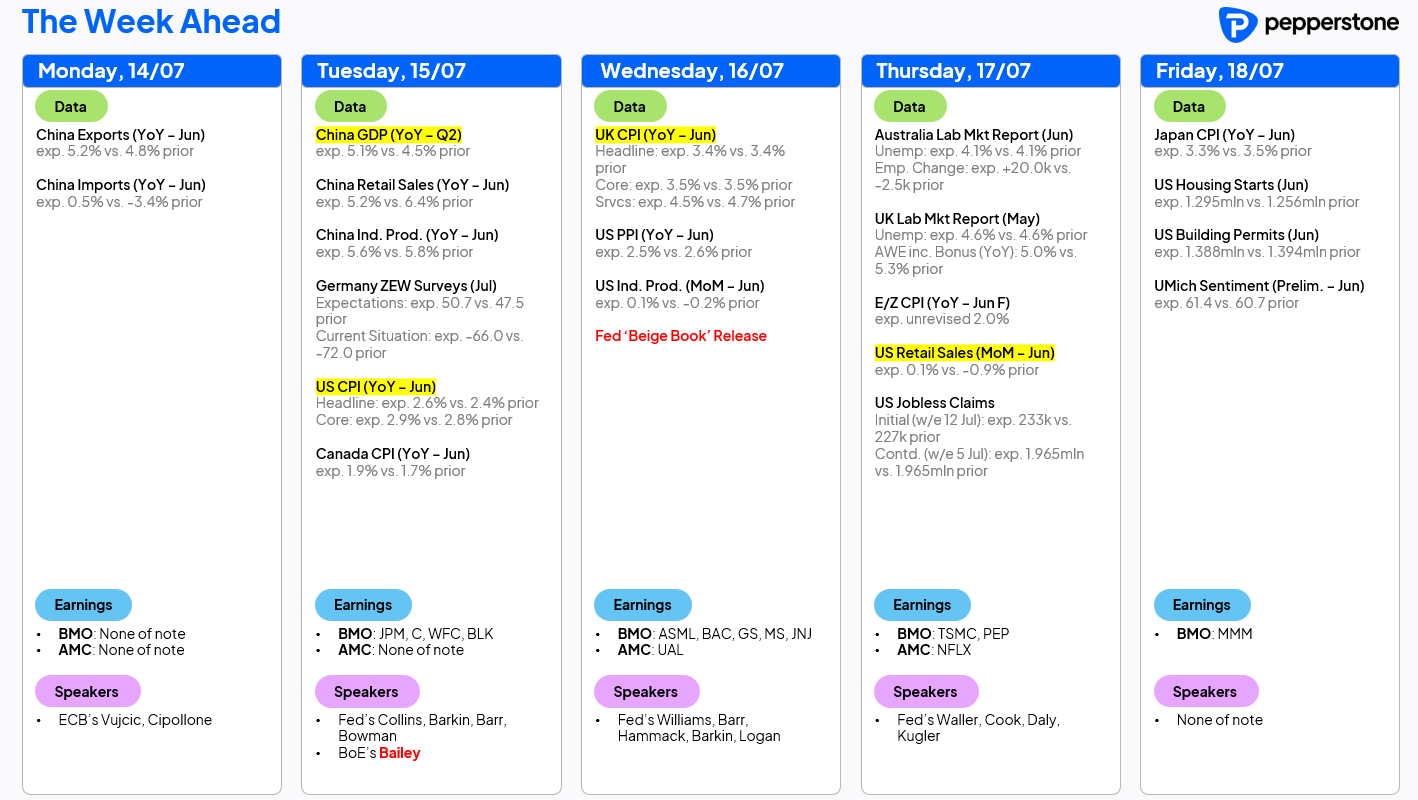

LOOK AHEAD – A busy week awaits.

Headlining things, in terms of scheduled events at least, will be the latest US CPI figures, which should show the first signs of tariff-induced price pressures having emerged last month. The headline metric is set to have risen 2.6% YoY, with core prices seen rising 2.9% YoY over the same period, providing further reinforcement to the Fed’s ‘wait and see’ approach. Also due from the US this week will be the latest retail sales, industrial production, and consumer sentiment figures.

Elsewhere, here in the UK, June’s CPI report is also due. Headline prices are seen having held steady at 3.4% YoY, though services CPI should dip 0.2pp to 4.5% YoY, likely further lessening the BoE’s worries over the potential for price pressures to become persistent. We also get the latest UK labour market figures this week, though they remain incredibly unreliable owing to the ongoing shambles at the ONS.

Speaking of unreliable data, China drop a deluge of figures this week, most notably Q2 GDP. The economy is seen growing 5.1% YoY in the second three months of the year, though risks are probably tilted to the downside here, as the impacts of tariff front-running continue to fade.

Besides data, trade headlines will of course remain in focus, while plenty of Fed speakers, plus the ‘Beige Book’ release, will also be eyed. Earnings season, lastly, gets underway tomorrow, with the major Wall Street banks kicking things off, before attention shifts to Netflix (NFLX) after the close on Thursday, and classic bellwether 3M (MMM) on Friday.

As always, the full week ahead docket is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.