- English

- 中文版

Trading Nvidia: Can the AI Giant Become the First $5 Trillion Company?

As we look ahead to Q3 2026 earnings on 19 November, and with tailwinds from Jensen Huang’s keynote at GTC, the key question is whether that period of underperformance is now behind the AI giant, with the share price building firmly above $200.

The Setup: A Rally into GTC

Nvidia’s shares were already rising into CEO Jensen Huang’s GTC Conference presentation on Tuesday, buoyed by reports of progress in US–China trade talks. While some expected a modest reaction, few anticipated the 5% gain that followed.

Historically, GTC events have produced volatile swings in Nvidia’s share price, but investors are now far more familiar with the company’s story and its dominant role in driving the AI revolution. As such, expectations for a major new revelation or an outsized move were initially quite low.

The Catalyst: What CEO Jensen Huang Said to Move the Share Price

Jensen Huang was always going to deliver an energetic presentation and speak confidently about Nvidia’s pipeline and outlook — and he didn’t disappoint.

While unsurprisingly downplaying concerns of an AI bubble, he announced new strategic deals with Palantir, Samsung, and Hyundai. However, the real catalyst behind the 5% gain and the close above $200 came from his declaration that Blackwell is now in “full production” and that Nvidia expects “$500 billion of business in the next six quarters.”

Importantly, this revenue projection excludes any sales to China.

The Numbers Behind the Target

To reach $500 billion in sales over six quarters, Nvidia would need to ship roughly 20 million GPUs. With Blackwell now fully ramped, that figure is feasible — though ambitious. Nvidia has already shipped around 6 million GPUs, implying roughly $350 billion in additional sales between calendar years 2025 and 2026. By comparison, sell-side bank analysts had been modelling $313 billion in data centre revenue over the same period. If Huang’s comments are indeed interpreted as guidance, they suggest consensus sales estimates are around 12% too low — a significant potential upgrade catalyst and a clear positive for the share price.

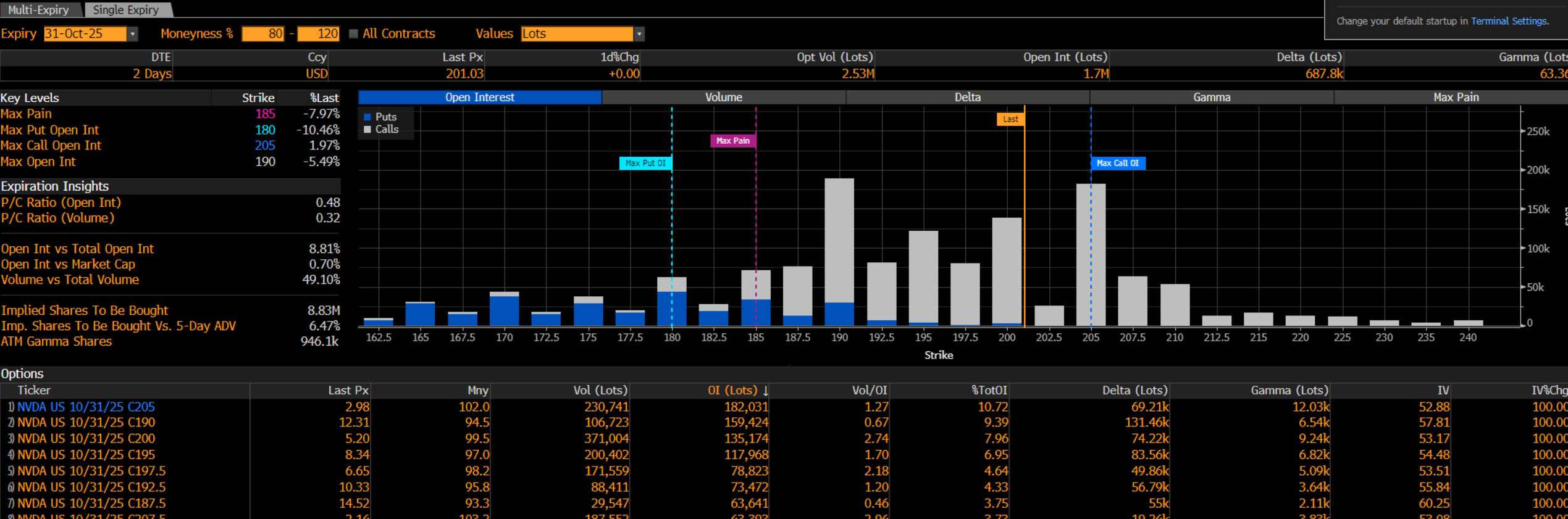

Flow Dynamics: How Options Activity Amplified the Rally

On the day, Nvidia traded 297 million shares, well above the 15-day average of 174 million — though perhaps lighter than expected for a 5% rally.

The real driver was the options market. Traders bought 3.89 million short-dated call options, with 3.1 calls for every put. Most of the volume was clustered between $187 and $200 strikes. As the share price climbed, market makers who had sold those calls were forced to hedge by buying the underlying stock to remain delta-neutral.

This flow-driven buying, combined with traders front-running end-of-day ETF and leveraged ETF rebalancing, fuelled the rally even further.

When strong fundamental catalysts align with technical and flow-based momentum, the resulting moves can be outsized and self-reinforcing — and that was precisely the case here.

Summary and Outlook

The question now is whether the market fully buys into Jensen Huang’s $500 billion sales projection, and if it prompts analysts to re-rate revenue expectations ahead of Nvidia’s 19 November earnings.

If that happens — and if macro conditions remain supportive for equity markets — Nvidia could easily push higher from here and potentially become the first $5 trillion market-cap company.

Whether it can outpace AMD and close the recent performance gap remains open for debate, but few would doubt that momentum has clearly shifted back in Nvidia’s favour.

Traders can trade Nvidia 24/5, capturing price movements around the clock. For more information, please visit our website.The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.