- English

- 中文版

A Traders’ Week Ahead: U.S.–China Trade Talks, Mega-Cap Earnings, and Global Central Bank Decisions

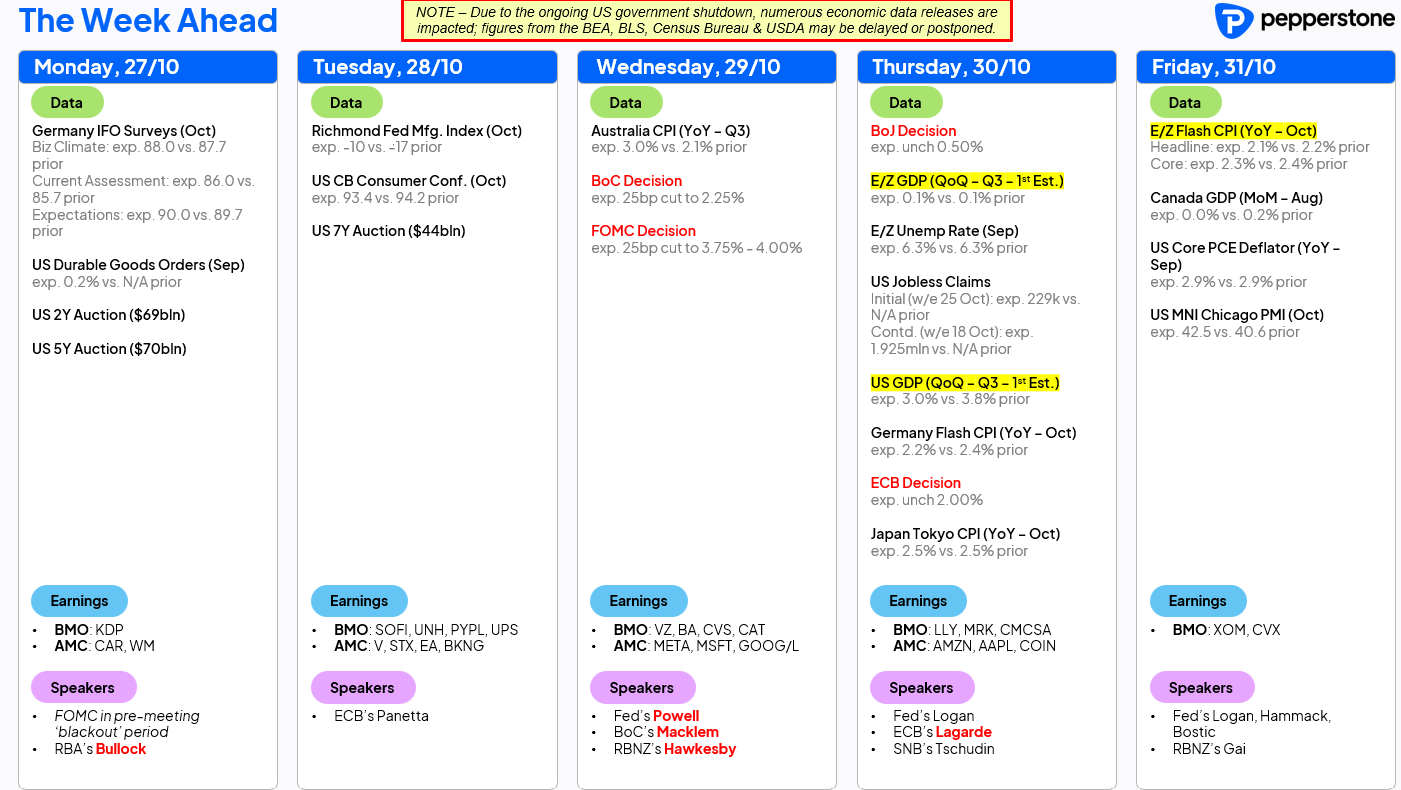

Beyond U.S.–China trade, it’s a big week ahead, with the calendar packed with scheduled event risk. We break down the main events below.

Top Risk Events for Traders This Week

U.S.–China Trade Relations: Trump–Xi Meeting Dominates Market Focus

Donald Trump’s Asia tour takes centre stage this week, with global markets fixated on his highly anticipated meeting with Chinese President Xi Jinping on Thursday.

Trump has signalled he’s open to extending the 90-day tariff truce and removing the threat of 100% additional tariffs, if China makes concessions, including:

- Relaxing restrictions on U.S. firms exporting products containing China-sourced rare earths

- Resuming large-scale purchases of U.S. soybeans

- Demonstrating stronger enforcement on fentanyl supply chains

Reports from the weekend meeting between Scott Bessent and the Chinese Vice President indicate that a deal has been finalised, with the conditions outlined above met and set to be formally announced following the Trump–Xi meeting on Thursday. Markets had largely viewed this as the higher-probability outcome, so the news won’t come as a major surprise and is partly priced. That said, relief buying could still put upside risk into the CN50, NAS100, AUD, and other risk-sensitive assets through the trading week.

Central Bank Meeting Bonanza: Fed, BoC, ECB, and BoJ

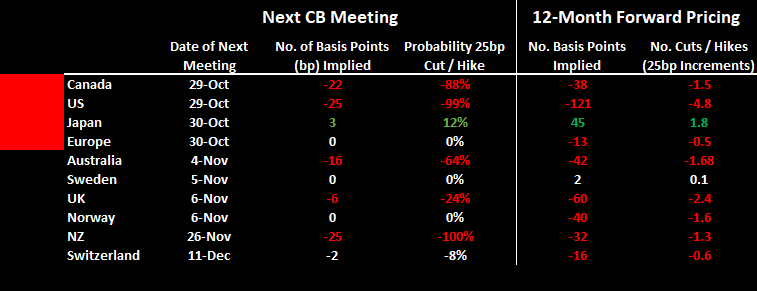

A huge week for global monetary policy as four major G10 central banks — the Federal Reserve, Bank of Canada, European Central Bank, and Bank of Japan — hold meetings. Fed & BoC: Interest-rate swaps imply a 25bp rate cut from each. ECB & BoJ: Both are expected to hold policy steady. The BoC meeting offers the greatest potential surprise versus market pricing, though the FOMC meeting will command global trader attention.

Interest Rate Review: the table shows Interest rate swaps pricing (as of Friday's close) and what's implied for the respective upcoming central bank meeting. We also look to 12-month forward IR swaps and view the number of basis points of implied cuts/hikes priced for the 12-months ahead.

FOMC Meeting Preview: 25bp Cut Fully Expected

The Federal Reserve is widely expected to cut the Fed funds rate by 25 basis points, with almost no market pricing for an alternative outcome.

- Governor Stephen Miran is likely to dissent in favour of a 50bp cut, but all other voters should align behind 25bp.

- The focus will also be on whether the Fed formally ends its Quantitative Tightening (QT) program or signals it will wind it down in coming months.

- In his press conference, Chair Jerome Powell will likely avoid committing to another 25bp cut at the December meeting, given the Fed would essentially have three months of new data to consider by that meeting, as well as potentially important developments on the trade front.

🌎 Emerging Markets: Chile’s BCCh Meeting (Tuesday)

In the EM space, the Central Bank of Chile (BCCh) meets on Tuesday. After a hotter-than-expected September CPI print, policymakers are widely expected to hold rates at 4.75%. With the Chilean election looming in November, traders remain constructive on the Chilean peso (CLP) — the USDCLP fell 1.7% last week and momentum offers a probability that the pair could drift lower into the meeting.

💵 U.S. Q3 Corporate Earnings: Mega-Cap Tech Takes the Stage

It’s the busiest week of the quarter for U.S. earnings, with around 45% of S&P 500 market cap reporting.

- Five of the “Magnificent 7” companies report: Meta, Microsoft, Alphabet, Amazon, and Apple.

- A point of note, Meta, Microsoft, and Alphabet release results two hours after the FOMC meeting — setting up a higher-volatility period for equities in the after-market period, and the NAS100 and US500.

- Retail-trader favourites Coinbase, Reddit, and Riot Platforms also report Thursday.

US Q3 Earnings: The State of Play so far

29% of S&P500 companies have reported quarterly earnings. 85% of the S&P500 companies have beaten expectations on EPS by an average of 7.7%, whilst 69% of co’’s has beaten consensus expectations on revenue. The average % change on the day of reporting earnings is +0.9%, which is impressive relative to prior quarters.

🏛️ U.S. Government Shutdown – Approaching some key Dates in the Standoff

Negotiations between Republicans and Democrats remain deadlocked, with no clear path yet to re-open the government. Rising health-insurance premiums under the Affordable Care Act (ACA) on 1 November are adding urgency, as Democrats aim to avoid further cost pressures.

Australia Q3 CPI (Wednesday): RBA Policy in Play

A critical data point for AUD and AUS200 traders — Wednesday’s Q3 CPI will shape expectations ahead of the RBA’s 4 November meeting (cash rate currently 3.6%).

Economists’ Consensus Expectations:

- Headline CPI +1.1% q/q, 3% y/y

- Trimmed Mean CPI: +0.8% q/q, +2.7% y/y

Possible Scenarios:

- +0.7% q/q or lower: Strengthens the case for the RBA to cut rates by 25bp in November. AUD

- +0.9% q/q: The market likely prices a 50% probability of a 25bp cut in November.

- 1.0% q/q or higher: RBA likely holds rates steady at 3.6% in November.

The pain trade is for Aussie Q3 TM CPI come in at 0.9%+, which would result in the AUD staging a solid rally (notably vs the cross rates) and the AUS200 lower by 0.8%+.

🤖 Nvidia GPU Technology Conference (GTC) – Tuesday

Nvidia hosts its annual AI developers’ conference this week, with CEO Jensen Huang delivering his keynote on Tuesday (12 p.m. ET). Historically, GTC has been a catalyst for AI stocks and semiconductor optimism, as investors react to innovation themes and forward-looking product announcements.

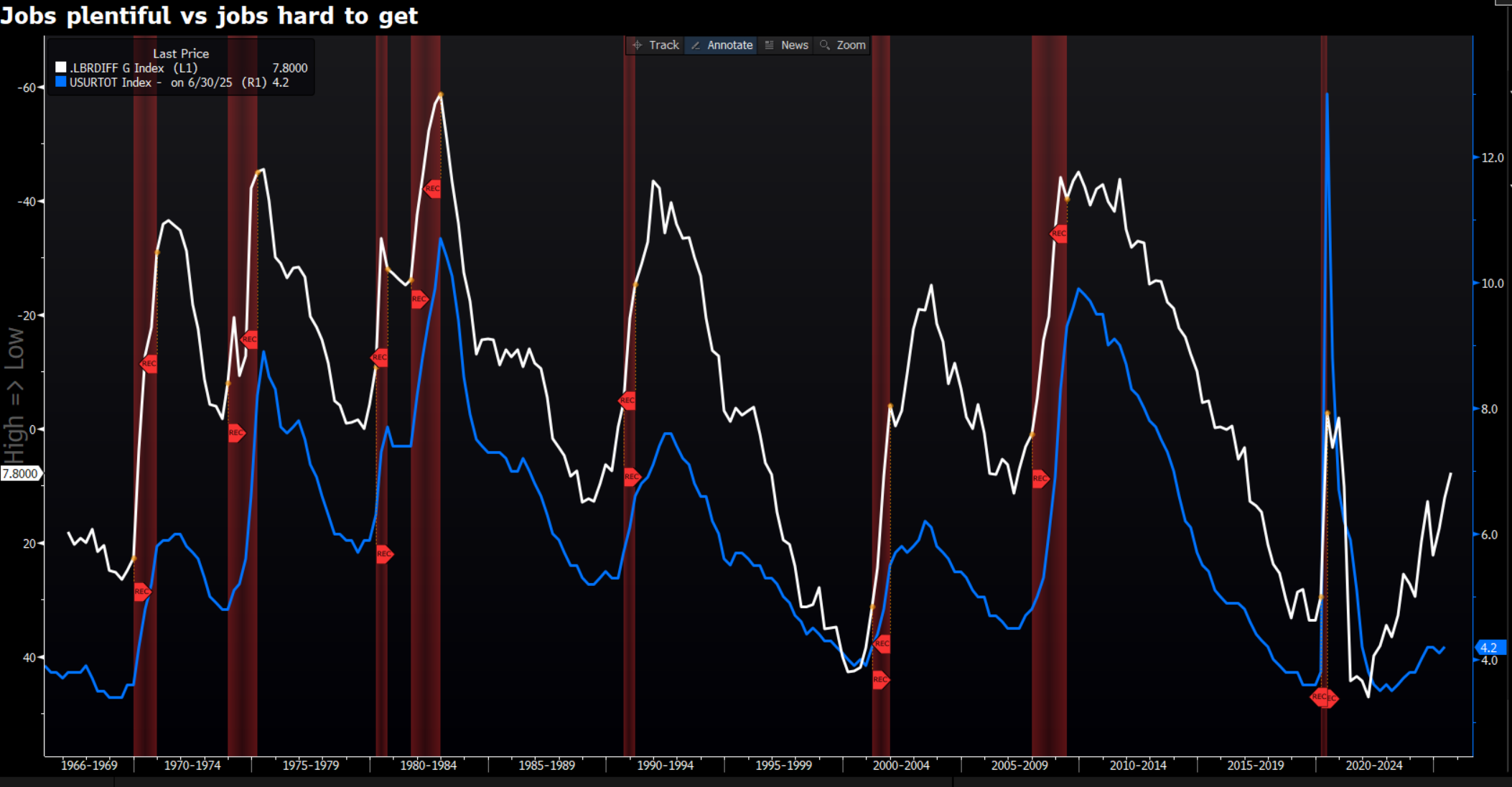

🧠 U.S. Consumer Confidence (Tuesday):

Labour Market Signal While not typically a volatility driver, the Conference Board Consumer Confidence Index offers a crucial insight — the “Jobs Plentiful vs. Jobs Hard to Get” spread, also known as the Labour Market Differential. This metric has historically led trends in U.S. unemployment rate. With “Jobs Hard to Get” now at its highest level since Feb 2021, traders may interpret it as a leading indicator of rising unemployment — and potential dovish tilt in Fed expectations.

Trader Takeaways and a Summary for the Week Ahead

This week presents one of the most event-heavy line-ups for risk events of the year — where macro policy, tech earnings, and political risk all intersect.

Traders should:

• Manage exposure ahead of FOMC + Mega-Cap earnings. Traders can capture the reaction to earnings in US equity with Pepperstone’s US 24hr share CFDs, and for more information on these see the website.

• Watch AUD and AUS200 around Wednesday’s Q3 CPI release

• Track Trump–Xi headlines for risk sentiment and CN50, USD/CNH direction

• Stay alert to price action given month-end flows and AI equity given US-China trade talks and Nvidia’s GTC conference.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.