- English

- 中文版

Traders’ Week Ahead: Navigating Key Market Events and Opportunities

Those coming back with refreshed minds will have their skills, patience and discipline put to the test once again as the cogs of the financial markets crank into life for another year.

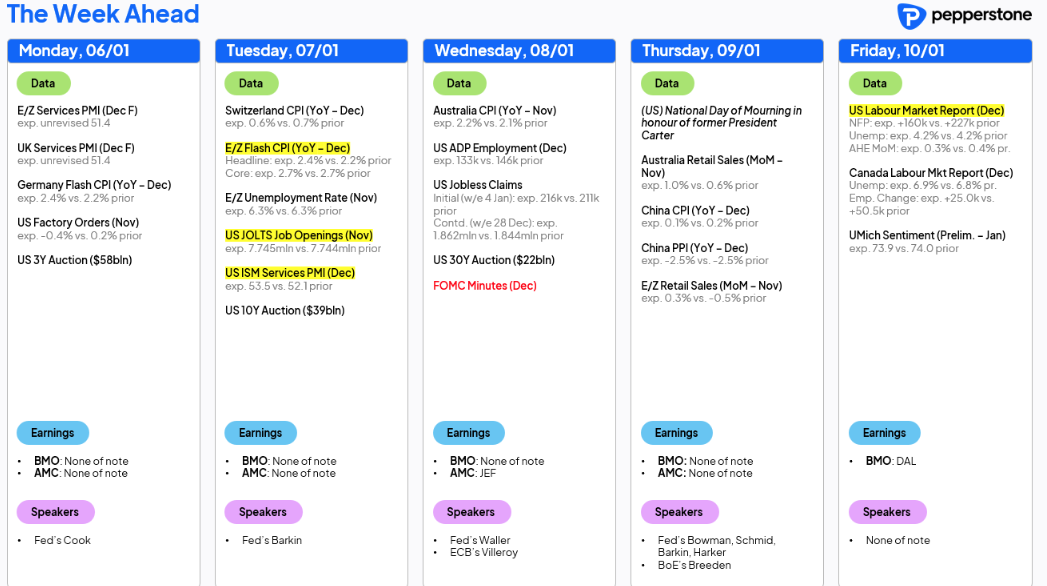

The marquee event risk for traders to navigate in the week ahead will be Friday’s US nonfarm payrolls, with inflation reads in Europe, China and Australia. Also on the US data docket, we see the US JOLTS job opening report, ISM services and December FOMC minutes. We also hear from 8 Fed speakers due through the week, where Governor Christopher Waller (Wednesday) will be of most interest to market participants.

Can US equity build on Friday’s rally?

It’s been a lively few days in markets, but we come into the week with the S&P500 +1.3% & NAS100 +1.7% on Friday, to which we’ll see if this positive flow can build. The risk for longs would be a daily close back below 5850 (US500) and 20,900 (NAS100), technical developments which naturally increase the prospect of a deeper drawdown into US Q4 earnings (commencing on 15 Jan). US cash equity markets will be closed on Thursday in remembrance of former president Jimmy Carter.

CES2025: Nvidia CEO Jensen Huang takes centre stage

Nvidia also gets renewed attention, where CEO Jensen Huang will be the keynote speaker at the CES Conference in Las Vegas (Huang speaks today at 18:30 PT). Jensen Huang is expected to raise shareholders excitement levels, detailing trends in customer demand, and upcoming product rollouts, with notable interest on the launch date for its GeForce RTX 5000 series of graphics cards.

The market has been building long positions in Nvidia into the CES Conference, and with 82k contracts of call open interest at the $149 strike (10 Jan expiry) – subsequently, any further upside in the share price could see options dealers (who sold the calls) looking to hedge their delta risk – a factor which could push the stock towards all-time highs of $152.89.

China/HK equity indices remain the weak link, with the CN50 index -4% on the week and tests 4-month range lows. A close through 12,900 (China CN50) would therefore be a further bearish development, although being short China comes with the risk that calls are made to state-owned domestic banks to support equity prices.

The bull case in the USD remains

The USD Index (DXY) gained 0.8% on the week, breaking above 109, with GBP the notable underperformer in G10 FX on the week. EURUSD traded into 1.0224 but saw an element of short covering on Friday, and while all the talk remains on the timing for the spot rate to hit parity, the risk of a further squeeze higher this week looks possible. That said, I am skewed to sell rallies in EURUSD and would look to see how price reacts into 1.0345 (18 Dec low), where a more outsized rally should see rallies capped into 1.0425, which is where I’d preferably reengage with shorts.

USDCAD kicks onto the radar, where an upside break of 1.4450 would suggest an extension of the bull trend that has been in place since 25 September and would appeal to trend and momentum accounts. USDJPY consolidates between 158.00 and 156.00, and while the pair is at the mercy of the US data and the direction of travel of US interest rate pricing and US Treasury yields, an upside break of 158 would also be worth aligning too.

Finally some life in the Crude Market

In commodity markets, the gas markets have come alive curtesy of the cold snap that is plaguing much of the Northern Hemisphere. Client interest has been better seen in SpotCrude, with price gaining 6% w/w and breaking out from its multi-month consolidation and finally showing some life. Outside of those who are fully rules-based or automated in their approach, I’m not sure many feel confident in chasing the upside in crude and will be looking to fade any further move into the 200-day MA at $75.67 (front-month crude futures).

Gold frustrates traders holding both longs and shorts, with sellers actively working orders into the 50-day MA on Friday. It’s hard to say what fundamental drivers will move gold this week, but I suspect better US data that further prices out the level of expected Fed cuts over 2025 would be a headwind. Currently, we see 35bp of implied Fed easing in SOFR futures for 2025, so a US ISM services print above 55.0, and nonfarm payrolls print above 200k, with an unemployment rate at or below 4.2% would likely attract gold sellers.

Gold longs will naturally want to see price close firmly above the 50-day MA ($2657.78) for any chance of a re-run into the Nov/Dec range highs of $2725. Those short need to see a close through recent lows of $2600 and $2583 – a factor which could open the possibility of a run to the 200-day MA at $2490, although I am sceptical of such downside.

Crypto Finding the Love – Can Bitcoin regain a footing above $100k?

Crypto put in some solid work last week, with some big percentage changes across our suite of coins – naturally, for those trading crypto the question is whether the move has legs and whether to chase. Bitcoin looks to re-test the $100k level which has capped the rallies since 21 Dec, and while we need to be open-minded that sellers may once again work orders into the big number, the $899m of aggregate inflows in the BTC ETFs on Friday - the most since 21 Nov – suggests the pullbacks could be shallow.

Key data to navigate for the week ahead

Reviewing the marquee data points that could move markets this week.

- US Nonfarm Payrolls (Friday 13:30 UK / Saturday 00:30 AEDT) – the median estimate is for 160k jobs to have been added in December, with the economist’s estimates ranging from 200k to 120k. Subsequently, any jobs print above 200k would be considered a ‘surprise’, where both US 10-year yields and the USD would rise strongly. US equity would likely rally despite a rise in rates, as a strong economy should trump reduced Fed easing expectations. Conversely, a jobs outcome below 140k would work against risk and the USD. The unemployment rate is also key, and with the market eyeing an unchanged read at 4.2%, USD and equity bulls would want to see a U/E print at or below 4.2%. Conversely, a lift above 4.3% and certainly at 4.4% would likely lead to some selling of equity risk and the USD.

- US ISM Services (Tuesday 15:00 UK / Wednesday 02:00 AEDT) – the markets will most likely be impacted by an outlier outcome that deviates from the consensus for 53.5 on the index. USD and equity bulls would want to see a print above 55.0.

- Fed Gov Waller speech on the US economic Outlook (Wednesday 13:30 UK / Thursday 00:30 AEDT) – While Waller speaks before the NFP print is known to the markets, there is a fair chance he will offer a more cautious and gradualist approach to future cuts – a factor that is well discounted into US interest rates pricing. This same message should be heard in the FOMC minutes which are released 5 hours after he finishes speaking.

- Australia November CPI (Tuesday 00:30 UK / Wednesday 11:30 AEDT) – With Aussie interest rate swaps pricing 17bp of implied cuts (a 67% chance) for the 18 Feb RBA meeting, the monthly CPI data could impact expectations for the all-important Q4 CPI print (due 29 Jan) and could move the implied rates pricing sharply. The market looks for headline CPI to rise to 2.2% (from 2.1%), so any upside surprise to that median estimate may have the market questioning if a cut in February is too premature, especially with such a tight labour market. Those calling for a February RBA cut would want to see inflation fall below 2%.

- Eurozone CPI (Tuesday 10:00 UK / 21:00 AEDT) – The consensus is for EU headline CPI to rise to 2.4% y/y (from 2.2%) and core CPI to remain unchanged at 2.7%. A 25bp cut from the ECB at its meeting on 30 Jan is fully priced into EU swaps, however, the market’s pricing for the ECB’s terminal rate (the perceived low point in the ECB’s cutting cycle) has risen from 1.58% to 1.96% - implying just 4 more 25bp cuts to come. This has helped support the EUR to a small extent, but it now offers tactical opportunities for those who feel the ECB could cut by more.

- China CPI & PPI (Wed 12:30 AEDT) – The median estimate is for China's CPI rate to moderate again to 0.1% y/y (from 0.2%), with PPI inflation eyed at -2.4% y/y. With China’s 10-year govt bond yield falling sharply to 1.60% - largely as a result of its deflation spiral and looser monetary policy stance – we’ve seen a weaker yuan in response, with the PBoC seemingly tolerating a gradual depreciation. Further deflationary/disinflation pressures will only keep the upside pressure on USDCNH.

So, with some clear event risk in play and as market participants come back to their desks it promises to be another lively week in markets. Respect the price action, know your risk and keep position sizing in fitting with the volatility.

Good luck to all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.