Analysis

The US Debt Ceiling: Volatility and Trading Opportunities

The United States Debt Ceiling and How to Trade It

It sounds like a Doomsday scenario – the richest country in the world by most standards running out of money – but that’s the scenario the U.S. Debt Ceiling has painted for the world in 2023. The United States is being constrained by legislation from borrowing, so that it’s using ‘extraordinary measures’ just to pay its bills. And very soon, it may no longer able to pay essential services, fund spending programs or even meet bond obligations.

But is it really so bad, or does it just seem that way to a frayed market, already on their last nerve after Covid-19, Russia’s Ukraine invasion in quick succession and now seemingly in the grips of a commercial banking crisis? And, if the United States will never technically default on a loan as everyone is insisting, what’s the big deal anyway? Find out in our cheat sheet below, where we discuss the what, the who, the where, the when, why it matters for traders and how to use the US debt ceiling in your trading strategy.

The What

So, what actually is this US debt ceiling? Simply put, it’s a cap on the borrowing capacity of the US federal government – currently set at $31.38 trillion. When breached, it would constrain the U.S. Treasury from issuing more debt and potentially result in them unable to repay existing loans, spend on services and welfare and other obligations.

It’s a law passed by Congress way back in 1917 as a ‘ceiling’ to limit how much debt the United States gets into. Currently, that limit is $31.38 trillion – an amount the US hit in January this year already - but it has since been raised or suspended a whopping 78 times. Since then, the country’s been using what’s called “extraordinary measures” to keep going… but those only last so long.

…If it’s been raised so often what then is the big deal? Why don’t they just raise it again? Keep reading to find out the real story.

The Who

The United States is in an interesting period politically, to say the least, with the Republicans and the Democrats having completely differing views on how to run America and its budget (to the surprise of no one.) While President Biden’s Democrats were all in favour of raising the debt limit or even doing away with it altogether, the Republican party are playing fiscal hardball and want to tie raising the debt ceiling with an agreement to pass a broad range of spending cuts in the Senate, seeming to basically use the debt limit as a trillion-dollar bargaining chip.

On 27 April, House speaker Kevin McCarthy’s bill was passed by the House which allowed the raising of the US debt limit - but as of yet the debt ceiling hasn’t actually been raised.

The When

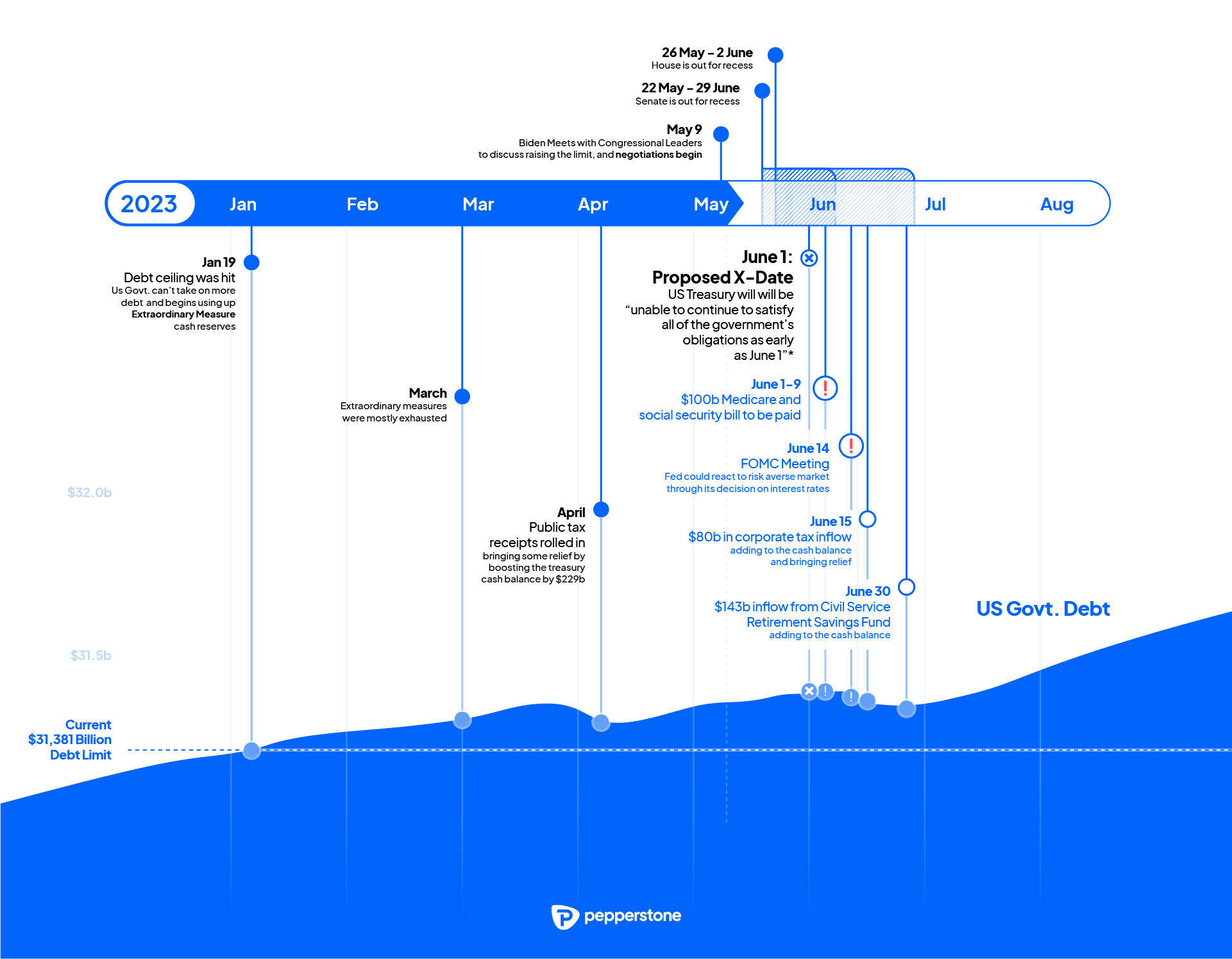

This is a problem, because the timeline for the US debt ceiling being reached appears to have accelerated rapidly and there is a tight window to find a bipartisan agreement. While we reported in 2021 that early December 2023 could be US debt ceiling crunch time, as was believed back then, it appears to be far nearer than anticipated.

On 1 May, US Treasury Secretary Janet Yellen said that the country had just a month’s grace left, stating that, if the debt ceiling wasn’t lifted, the country could default on loans and have no more room to borrow as early as June – and maybe even 1 June.

This precipitated action, unsurprisingly, with President Biden vowing to meet with the relevant Congress leaders on 9 May to talk it out. But the 9th came and went with no resolution announced.

The Where

Does this mean that the US debt limit will be lifted before 1 June? It’s anybody’s guess.

There is the possibility Biden could help push for a short-term suspension into September or October, but that would need agreement from both the Republicans and Democrats, who and at this point are miles apart.

The Why – why does the US Debt Ceiling matter to traders?

In a word: volatility. The constant back-and-forth between US parties, alarmist headlines and an increasingly harried-looking Yellen are a recipe for uncertainty when it comes to market sentiment. The closer we get to the X-date – the day when the Treasury run out of capital – the more volatile the moves could be. If we go over the X-date and hear that Treasury are having to prioritise payments for the likes of socials security, defense, veteran’s payments, Medicare, Medicaid and debt payments, then it could get very lively indeed.

There are currently many unknowns – it’s anybody’s guess when the debt limit will actually be raised, how much it’ll be raised to and if the country will run out of cash and miss a payment, or worse technically default on its debt obligations. And while unknowns mean volatility and volatility is generally not beloved by investors, it can be mean significant opportunity for traders.

The steeper the highs and lows of a market’s fluctuations, the more potential profit or loss there is to be made by someone speculating on that market’s underlying. This tends to attract speculators, unsurprisingly, and the more institutions, funds and traders there are speculating on a market, the more liquidity there is in the pot, so to speak.

The long and the short of it? This time around, the US debt ceiling could be a chance to make – or lose – a lot of money. Even if the United States doesn’t come near to actually defaulting. But for margin FX traders in particular, the US debt limit is an interesting scenario, with the value of the currency that backs all other foreign currencies hanging in the balance.

The How – How can I trade on the US Debt Ceiling?

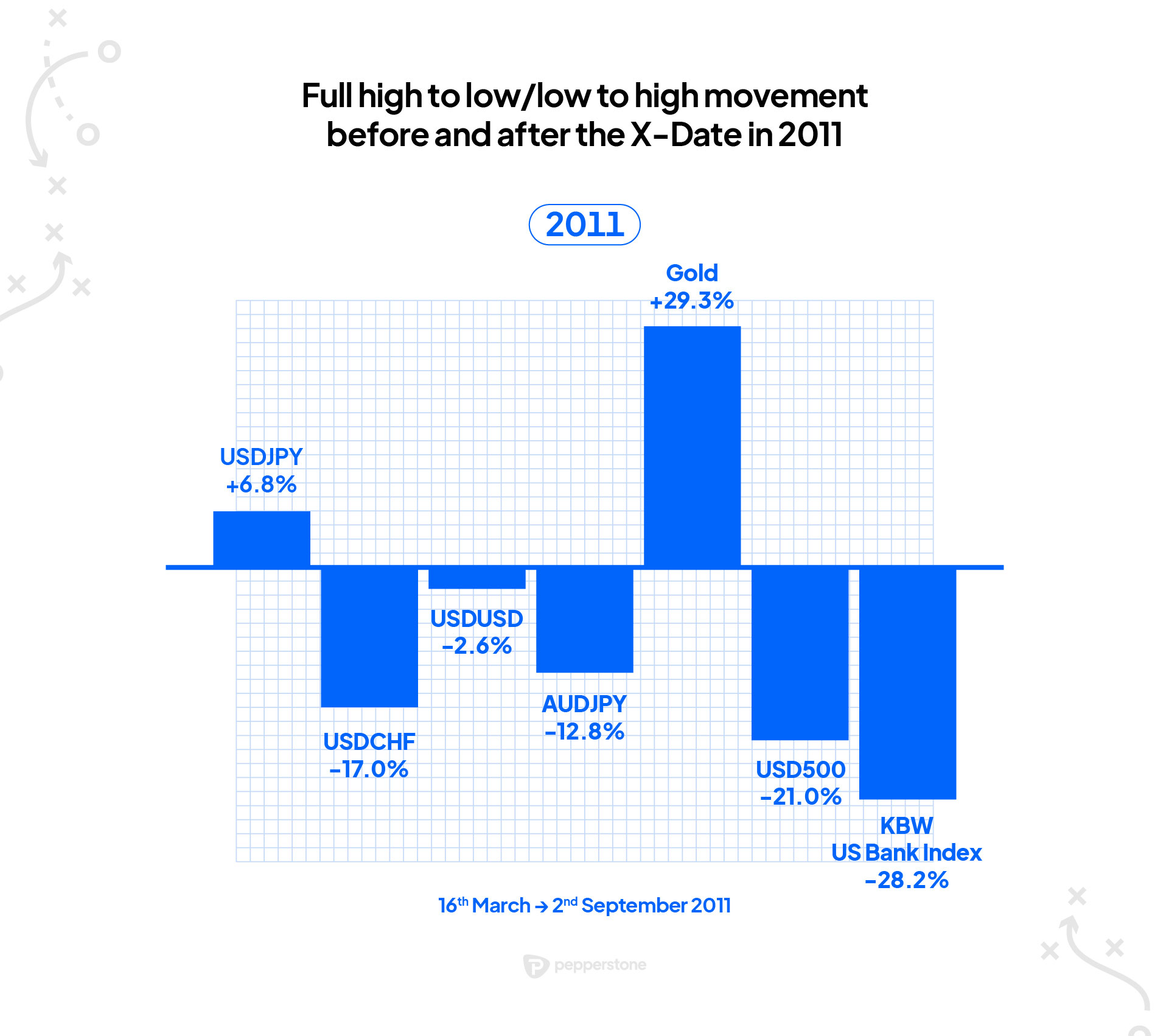

Despite what the headlines may tell you, the ‘US Debt Ceiling crisis’ has actually come up several times before, with plenty of traders making and losing a lot of money thanks to this unusual market event.

How you can trade on the US debt ceiling events as they take place vary, but here have been some of the more popular ways traders have used in the past:

- With the volatility that always surrounds US debt ceiling talk, a common safe haven to go long on is gold, as it tends to perform well when the dollar doesn’t – and during most forms of uncertainty.

- An obvious one? Short selling US Treasury bonds (known as T-bonds for short), or perhaps going long on them if you’re bullish about a speedy and heartening resolution to the debt limit debate.

- Another obvious way to trade the US debt ceiling would be to look at foreign currencies most likely to strengthen against the USD, for example the yen (JPY) and Swiss Franc (CHF), and trade margin FX based on that.

- If the United States does indeed have a technical default, it could play havoc and almost certainly lead to a credit rating downgrade. If there were to manifest, some traders are foreseeing a surge in cryptocurrency popularity, particularly those thought to be inversely correlated to the USD - for example Bitcoin.

A word on this, though – no one can tell you the exact strategy to use for your trading. How you trade on any financial event – which the US debt ceiling is, it’s unfortunately not a once-off – should be based on rigorous study of the movement of the underlying asset you plan to trade and thorough knowledge of the market. A sound understanding of how the US debt limit has historically affected financial markets is also a good idea – bearing in mind, of course, that past results do not predict a market’s future performance.

How you can trade on the US debt ceiling with Pepperstone

- Research all you can on the US debt ceiling. Understand the history, the politics and everything in between

- Develop a US debt ceiling trading plan. This should include specific trading goals you hope to achieve, the trading strategies you’ll be testing to get you there and analysis of the relevant financial markets

- Choose a reputable broker like Pepperstone that offers the markets and trading instruments you want to speculate on with your US debt ceiling trading strategy

- Create an account and fund it to get started

- Open your first live trade on the platform

- Set up stop loss and take profit orders to maximise your risk management

- Observe your trade’s progress and close the position when you’re ready

Related articles

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.