- English

- 中文版

Next Fed Chair: Key Candidates and What Powell’s Successor Means for Markets

Summary

- Names In The Frame: The shortlist of contenders is down to just 5 names, with Waller & Hassett the front-runners

- Factors To Watch: The new Chair will likely be a supply-sider, and result in closer co-operation with the Trump Admin

- Market Outlook: A more dovish & potentially pliant Fed strengthens the 'put' structure, leaving the path of least resistance for risk pointing to the upside

Who is in the running for the Fed Chair job?

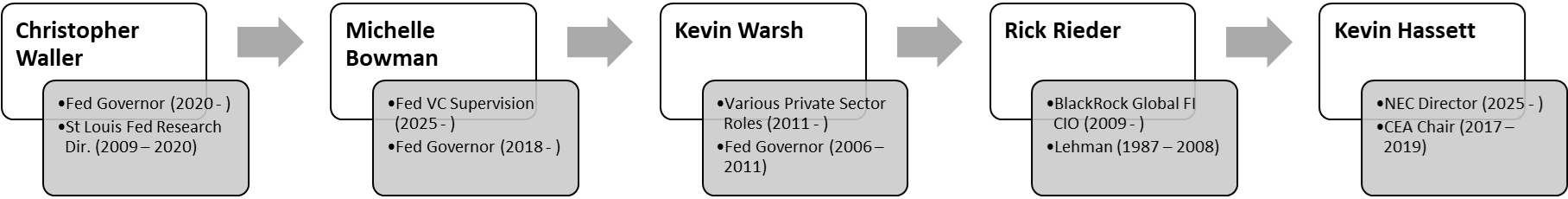

Numerous reports, as well as the White House themselves, have confirmed that the ‘long-list’ of as many as thirteen names has now been whittled down to a ‘final five’, comprising current Fed Governors Waller and Bowman, former Governor Warsh, BlackRock Global FI CIO Rieder, and NEC Director Hassett.

The order that those names are in is no accident, and broadly reflects a spectrum from ‘most orthodox’ to ‘least orthodox’ in terms of the candidates in question. That orthodoxy pertains not only to recent precedent, with Bernanke being the last Chair not to be a sitting Governor at the time of his elevation, but also to how positively, or otherwise, market participants are likely to react to the appointment.

Quite clearly, Governor Waller would represent the ‘status quo’ choice, not only having been a Governor since 2020, but also given how Waller has tended to lead the remainder of the Committee in policy pivots during his tenure, most recently this summer, in positing that a more dovish stance is required, and that any tariff-induced inflation can be ‘looked through’. Governor Bowman would also be a ‘status quo’ appointment, though her recent elevation to Vice Chair for Supervision perhaps lessens her chances of becoming the second female Fed Chair, after Janet Yellen.

The other names in question would, clearly, be somewhat more left-field choices. Former Governor Warsh has undergone something of a damascene conversion in recent years, from uber-hawk at the height of the GFC, to now espousing as dovish a stance as possible. Rick Rieder, meanwhile, has also made numerous dovish overtures of late, though has worked in the private sector for his entire career. Undoubtedly the pick most likely to be poorly received by markets, though, is NEC Director Hassett, who has made no secret of his loyalty to President Trump over the last decade, and who would obviously be seen as a pick that substantially erodes the policy independence of the Fed.

When might the next Fed Chair be announced?

While names in the running for the top job are well known, the precise timing of an announcement as to who will be given the gig is unclear.

Numerous potential deadlines have already slipped – Powell was named Chair in early-November, before his term began the following February; while, Treasury Sec. Bessent’s prior remarks that a nomination would come prior to Thanksgiving now seem unlikely to ring true. Bessent’s latest deadline, that a name will be known before Christmas, could well suffer the same fate as the deadlines that have already slipped, even if President Trump claims he already knows who he will appoint to the job.

What factors may drive Trump’s decision?

Given Trump’s background, it should perhaps be unsurprising that the race for Fed Chair is being run as if it were a real-life version of ‘The Apprentice’. As for determining who receives the famous ‘you’re hired’ message, and how that decision is made, there are a few factors that will likely feature, based off Trump’s prior federal appointments.

The first, and probably most important, factor that will feature in the decision-making will be loyalty, to Trump of course. Clearly, Kevin Hassett holds the proverbial trump cards on this front, having been a member of ‘Team Trump’ since the first presidential campaign in 2016. Waller and Bowman also stand in relatively good stead here, with both being Trump appointments to the Board.

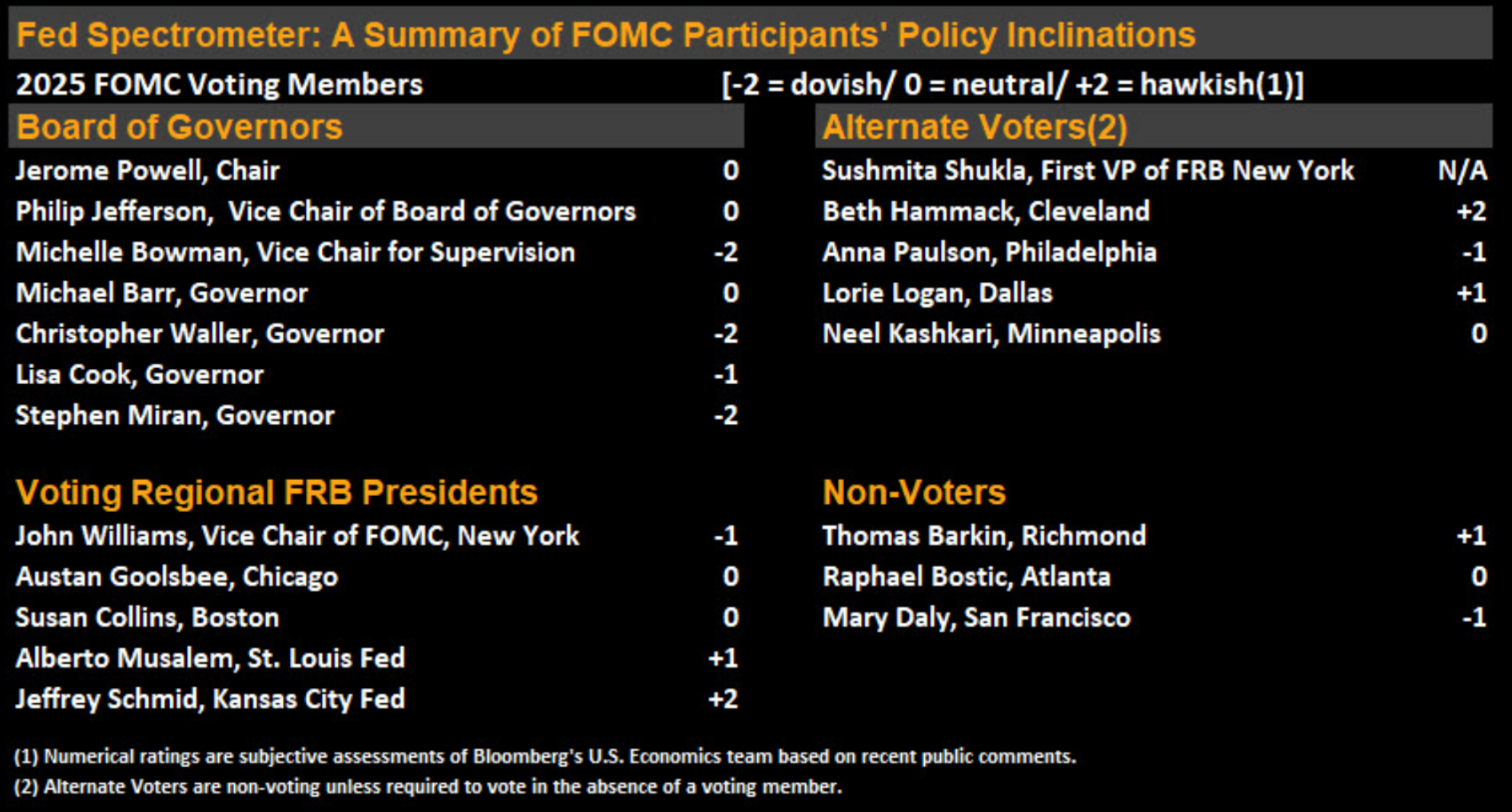

Secondly, is the matter of the Candidate’s policy stance, especially considering President Trump’s long-standing, and rather economically skewed, view that the better the US economy is performing, the lower its interest rate should be. This goes quite a long way to explaining why all names in the fray for the job, even back to the 13-contender ‘long-list’, have upped the dovish ante in recent months.

Finally, there is the question of overall economic acumen, and suitability for the job. Perhaps more than acumen in isolation, though, will be the question of whether the candidate’s overall economic views mesh well with the supply-side policies that the Trump Admin are pursuing, something which has quite clearly been a significant bone of contention with Chair Powell in recent months.

Which other factors should traders watch?

The race for Fed Chair is not the only factor to watch when it comes to the world’s most important central bank as we move into 2026.

In January, the Supreme Court will begin to hear arguments pertaining to Trump’s attempts to fire Governor Cook ‘for cause’, relating to allegations of mortgage fraud, made by FHFA Director Pulte; Cook has denied those allegations, while also arguing that Trump lacks the authority to dismiss her from her post. Though the case will not be heard until January, initial indications appear to lean in Cook’s favour, with SCOTUS having rejected, in October, an emergency request from Trump to remove Cook with immediate effect, though there remains the possibility that the final ruling may see Cook forced to leave her post, giving Trump another opportunity to fill a Board seat.

A month later, what is usually a formality, could turn into something much more significant. Every 5 years, the Board must vote in favour of reappointing the 12 regional bank presidents, a process that is typically routine, and attracts little attention. However, with there already being three Trump nominees on the Board (Waller, Bowman & Miran), plus there potentially being a fourth by then were Cook ousted, the Trump Admin may spy an opportunity to exert significant influence over the regional banks as well. Atlanta Fed President Bostic has already announced his retirement, effective next-February, which has cast fresh doubt on the reappointment process in recent weeks.

Then, in May, there is the huge question of what Jerome Powell does next. Though Powell’s term as Chair expires, his term as a Governor runs through to January 2028, and he remains well within his rights to serve out that term if he chooses to do so. However, precedent suggests that Powell will leave the Fed entirely next May which would allow Trump another Board pick, potentially leaving just VC Jefferson & Governor Barr as the lone members he hasn’t nominated, pending the outcome of the Cook case.

What’s the trade?

Putting all these moving parts together, it becomes relatively clear that 2026 will likely bring with it a Fed that works, to a much closer degree, in harmony with the Trump Administration. While the merits of such close co-operation are debateable, to say the least, such degree of closeness is likely, on balance, to result in a considerably more dovish policy stance, providing that the new Chair is able to bring the remainder of the FOMC with them.

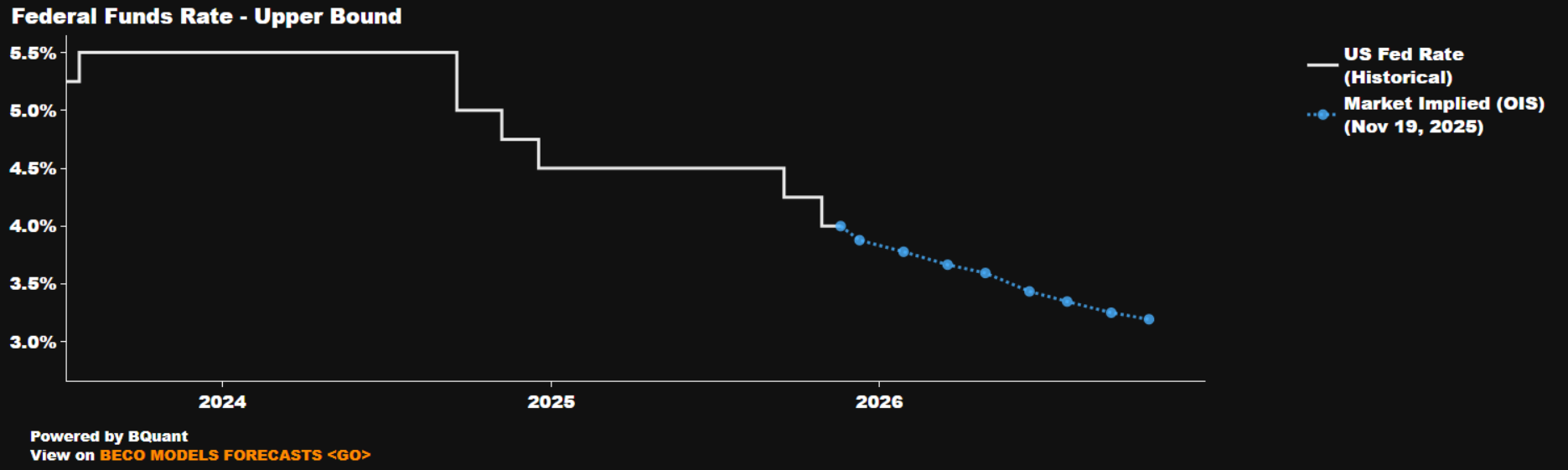

As a result, the ‘Fed put’ structure is likely to become an even stronger one, particularly with the fed funds rate already on its way back to neutral (3ish%), and the balance sheet set to bottom-out at a neutral level (roughly 20% of GDP). This structure, in turn, helps to reinforce the idea that the ‘path of least resistance’ continues to lead to the upside, particularly with there potentially also being a ‘Trump put’, in the run-up to next year’s mid-terms.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.