- English

- 中文版

The Fed’s balancing act: inequality, markets, and the K-shaped US economy

Summary

- K-shaped recovery: The US economy is splitting between thriving high earners and struggling lower-income groups, as asset prices lift the wealthy while inflation erodes lower-tier wages.

- Spending concentration: The top 10% of earners now account for around half of US consumption, driven by the wealth effect from rising equities and property values.

- Policy implications: With spending tied to market performance, both the Fed and government have strong incentives to support risk assets and maintain economic momentum.

‘It’s not right, but it’s ok’ was not only a number one hit in the 90s, but is also a pretty solid way of describing how the US economy looks right now.

What shape is the US economy really taking?

During the pandemic, much time and many column inches were devoted to what shape the eventual economic recovery may take – a ‘V’ (rebounding rapidly to pre-pandemic output), a ‘U’ (a slower and steadier recovery), or even an ‘L’ (where the economy bumbles along the bottom and never really recovers).

Increasingly, though, it’s becoming clearer that the US economy is actually taking on more of a ‘K’ shape – some sectors have rebounded strongly, some haven’t; white-collar workers carry on as if things have never been better, while blue-collar workers face greater struggles. Wherever one looks, significant gaps continue to emerge between income quartiles, and between wealth quartiles. Hence, while a glance at incoming data suggests that all is ok with the economy at large, things appear somewhat less optimistic under the surface.

Who’s winning and who’s falling behind in a K-shaped recovery?

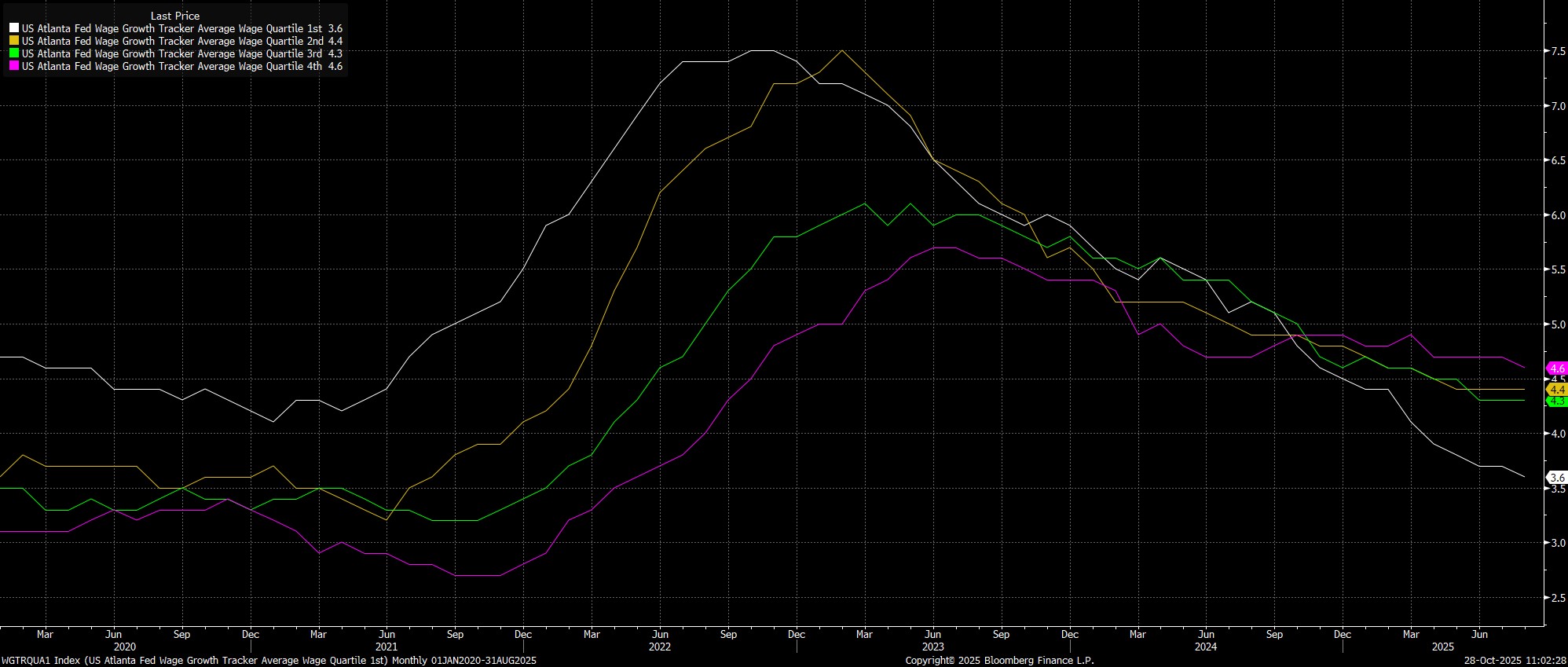

The top quartile of US earners, for instance, have probably never had things much better. Real estate values have increased significantly in recent years, the equity market prints new record highs on a seemingly daily basis, while earnings growth among this cohort has outpaced that of the lowest quartile for the last year, something that was basically unheard of in the decade beforehand.

Meanwhile, earnings growth in the lowest quartile was barely positive in real terms in August, the last month for which data is available, while elevated inflation – be it from tariffs, higher food prices, or another source – clearly hits this group to a disproportionately greater extent.

The effect of all this is clear from a breakdown of consumer spending, which remains the engine of the US economy at large. Per Moody’s, the top 10% of US earners accounted for roughly half of spending in Q2, the highest ever level since records began in the late-80s.

This is not only a reflection of the divergence in income growth alluded to above, but also a reflection of the ‘wealth effect’, whereby gains in equity markets, coupled with higher real estate prices, drive a subsequent increase in household net worth, thus giving those households in question a significantly greater degree of confidence to ‘splash the cash’ to a greater degree.

Quantifying this effect is difficult, though most studies estimate that an extra dollar of equity market wealth can raise consumption by as much as 15 cents. Even if that boost is somewhat smaller in reality, it’s undeniable that stock market performance plays a significant part in determining the elasticity of spending, especially among higher-income groups, where the bulk of equity holdings are typically concentrated.

Tying all this together produces two things – an economy increasingly reliant on discretionary spending among higher earners, and higher earners whose discretionary spending is reliant on risk assets remaining buoyant.

In turn, this creates an even stronger incentive for both monetary, and fiscal policymakers to underpin equity market performance, especially considering that the ‘wealth effect’ works in reverse as well – i.e., falling equity/house prices triggering a pullback in spending, and potentially a broader slowdown in the economy. Consequently, this disproportionate skew of spending results in a much stronger ‘Fed put’, and a considerably stronger ‘Trump put’ as well, as both seek to keep the virtuous cycle spinning for as long as possible.

_Daily_2025-10-28_11-03-53.jpg)

Why does inequality matter for Fed policy and markets?

It's against that backdrop that we can reasonably say ‘it’s ok’ when looking at a K-shaped economy. Of course, in an ideal world, economic fruits would be enjoyed equally by all, though it’s rather obviously not an ideal world. Still, additional Fed easing will provide a ‘helping hand’ to those lower-income groups that have been relatively struggling thus far, with those groups likely to also benefit from a re-acceleration in the US economy, as the adjustment to the initial tariff shock in April wraps up.

How closely are markets and spending now tied together?

What we have, then, is an economy that’s tied increasingly closely to the fortunes of the equity market, and an equity market that’s increasingly tied to overall consumer spending, which coupled together result in stronger ‘put’ structure to backstop risk assets, with fiscal stimulus continuing, and monetary backdrops becoming looser.

What does this mean for the outlook on risk assets?

Stocks already trade at record highs, with the bull case still a very solid one, and policymakers having every incentive to ensure that it remains so. The ‘path of least resistance’, then, should continue to lead to the upside for the foreseeable future.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.