- English

- 中文版

The FOMC’s Next Move Won’t Be A Hike Despite Hawkish January Minutes

Summary

- Hawkish Minutes: The January FOMC minutes leaned hawkish, with several policymakers suggesting a preference for more 'two-sided' policy guidance

- Dual Mandate Signals Further Easing: Downside labour market risks, coupled with continued disinflationary progress, continue to tilt the balance of risks in favour of further easing

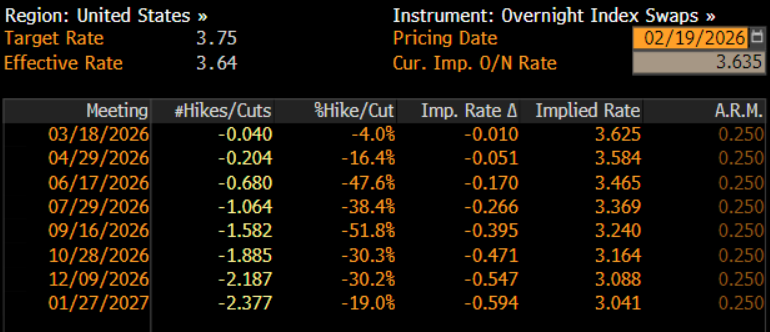

- Markets Mispriced: In fact, money markets may well be pricing too little easing, amid the fragile state of the labour market, and just two 25bp cuts fully priced by year-end

January Minutes Lean Hawkish

The FOMC minutes are typically a pretty staid affair, not only being somewhat stale with the release coming three weeks after the meeting itself, but with the minutes also tending to provide little by way of fresh information. Generally speaking, that description holds true for the January minutes, which noted that ‘almost all’ participants supported holding rates steady at the first meeting of the year, and that ‘several’ believed further rate cuts would be appropriate pending further disinflationary process.

The line that appears to have caused some degree of hullabaloo, however, is as follows – ‘several participants indicated that they would have supported a two-sided description of the Committee's future interest rate decisions reflecting the possibility that upward adjustments to the target range for the federal funds rate could be appropriate if inflation remains at above-target levels’.

This has led some to believe that the Fed’s next move could be a rate hike; in my opinion, it’s more likely that we see pigs flying, than that scenario playing out. Let’s examine why.

Labour Market Fragility

Despite headline unemployment having dipped 0.1pp to 4.3% in January, and labour force participation having risen 0.1pp to 62.5%, the employment backdrop remains a fragile one, under the surface.

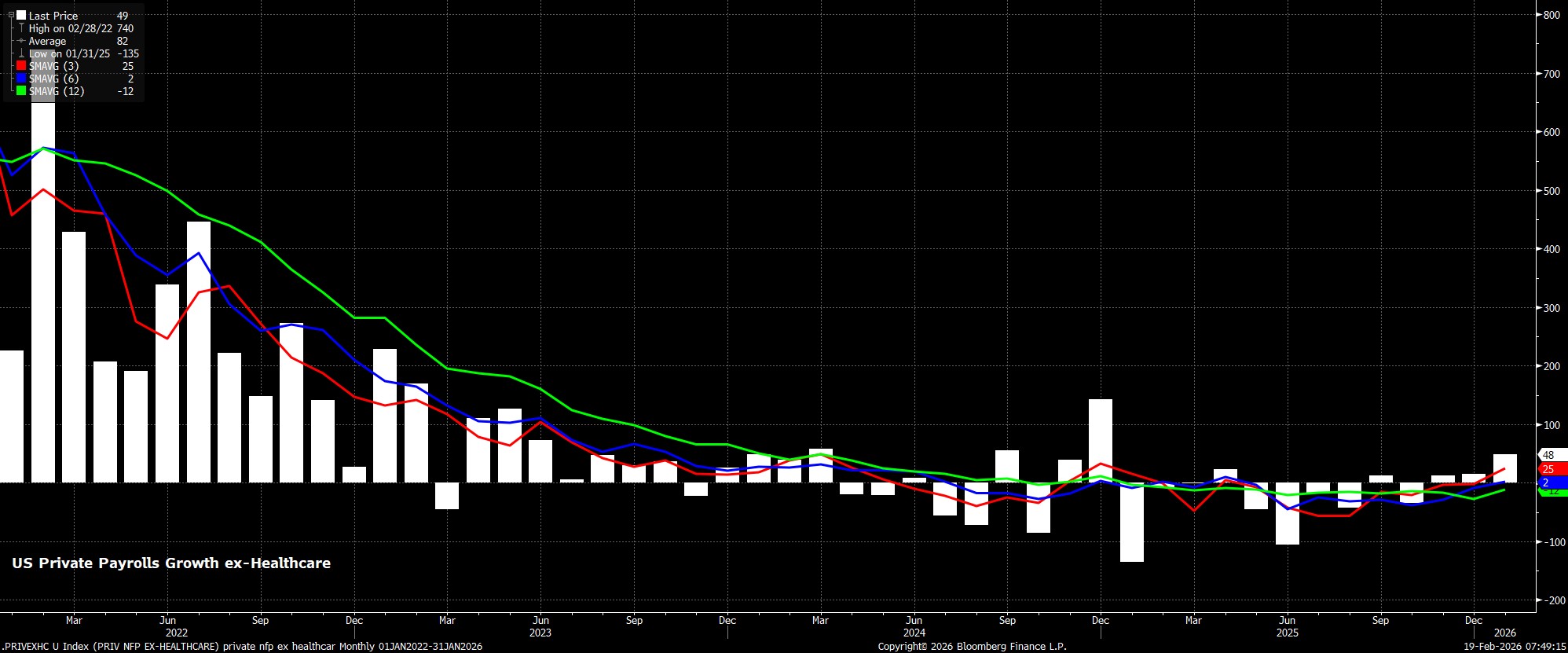

From a payrolls perspective, jobs growth remains highly concentrated in a handful of sectors, primarily healthcare, with the 6-month average of private payrolls growth excluding healthcare essentially zero. In other words, if the healthcare sector weren’t mechanically adding jobs as the population ages, the private sector would be creating no jobs whatsoever.

This narrow degree of hiring is not the only concerning labour market signal, corporate layoff announcements have increased in recent weeks, raising the risk of a non-linear increase in the unemployment rate, while consumers are increasingly downbeat on their employment prospects, with the Conference Board’s ‘jobs hard to get’ metric now at its most pessimistic level since the pandemic. All of this suggests downside labour risks remain, despite the FOMC having taken out 75bp of ‘insurance’ cuts at the back end of last year.

Disinflation

Turning to the other side of the dual mandate, the disinflation process continues at a relatively rapid clip.

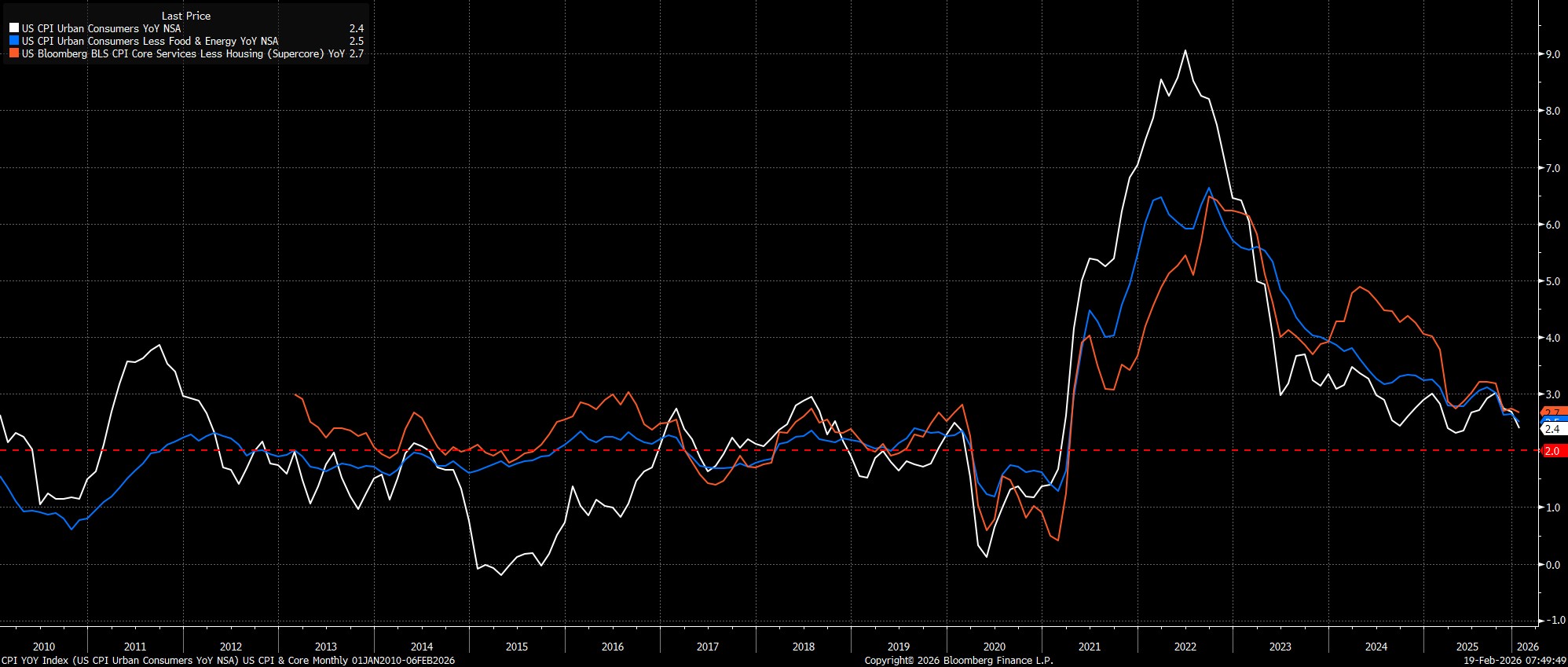

Headline CPI rose 2.4% YoY last month, the slowest pace since May 2025, while core CPI printed a cycle low 2.5% YoY. Underlying price metrics also paint a relatively positive picture, with core goods prices having risen just 1.1% YoY, a six-month low which suggests the bulk of tariff pass-through is probably in the rear-view mirror, and core services prices having risen 2.9% YoY, beneath the 3% mark for the first time since September 2021, and implying that the risks of inflation persistence continue to ease.

Though some degree of caution is required here, owing to the BLS’ inability to collect data during last year’s government shutdown, which in turn presents the risk of an inflation ‘hump’ in Q2 when the October panel falls out of the survey, the overall direction of travel is back towards the 2% inflation aim, with upside inflation risks at this stage relatively minimal.

Market Pricing

While the FOMC don’t blindly follow the path that money markets discount, and would certainly never admit publicly to doing so, it is undeniable that market-based rate expectations play a significant role in policymaking.

This, simply, relates to policy transmission, whereby the Fed more concretely guiding towards a rate hike, or even indicating that such a move was under serious consideration, would likely result in a significant tightening of financial conditions, in turn amplifying the aforementioned downside labour market risks. Quite obviously, this is the opposite of the outcome that the Committee would be seeking to achieve at this stage.

The Warsh Effect

Lastly, the ‘elephant in the room’ here is that of incoming Chair Kevin Warsh. Assuming that Warsh is confirmed in post by the Senate, it seems highly likely that one of his first monetary policy actions in the role will be to push for a more dovish approach, as opposed to a more hawkish one. In fact, it’s highly unlikely that he would’ve ever been nominated to the position unless he had assured President Trump that he is seeking a lower fed funds rate, given the President’s countless statements in favour of significant rate reductions over the last year or so.

Although the Chair is ‘first among equals’, and would require a majority of Committee members to vote in favour of any policy proposals in order for them to be enacted, there is almost no chance whatsoever that Warsh, at this juncture anyway, proposes a higher fed funds rate. It also seems highly unlikely that, given how the data is likely to evolve, any of the Committee would vote in favour of tighter policy, even the most hawkish policymakers.

Conclusion

Summing up, it’s rather clear that many market participants have over-interpreted a line in the January minutes, which itself has little by way of significant policy implications.

In fact, short of there being hawkish risks to the Fed outlook, I’d argue that risks currently tilt in the opposite direction, with money markets fully discounting just two 25bp cuts by year-end, despite relatively rapid disinflationary progress being made, and in spite of notable downside labour risks, both of which tilt the balance of risks in favour of the FOMC delivering more rate cuts than markets currently price.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.