- English

- 中文版

For the upcoming report, consensus expects adjusted EPS of $0.50, an improvement on the $0.40 delivered in Q2, though some way off the $0.72 delivered this time a year ago. Relatively stagnant YoY revenues certainly aren’t likely to help matters here, with Q3 25 revenues seen at $25.3bln, little changed from the $25.2bln delivered in Q3 24. Despite this, over the last 12 months, TSLA has rallied almost 90%, even if the stock has come off recent highs a touch.

As noted, delivery figures for fiscal Q3 came in substantially ahead of expectations, at 497k vs. the street estimate of 443k, with the firm also seeing sales outpace production for the first time since the tail end of 2024. Context is key here, however, given that this boost to sales in Q3 largely stems from stateside EV demand being pulled forward considerably, across the auto industry, ahead of the expiration of $7,500 tax credits at the start of Q4. Quite obviously, this will act as a stiff headwind to TSLA sales figures as the yar draws to a close. Furthermore, though Q3 sales figures beat consensus expectations, those expectations had been massaged significantly lower as the quarter progressed, having stood at around 500k earlier in the year.

In any case, TSLA are attempting to get ahead of this potential deterioration in demand with the recent launch of a ‘affordable’ versions of the Model Y and Model 3, though the price of both models remains above the $30,000 that CEO Musk flagged last year as being a key ‘line in the sand’ in terms of generating fresh demand. In fact, with these new models only around $5,000 cheaper than the next model up in terms of trim, and with the aforementioned EV tax credits having now expired, it remains somewhat doubtful as to whether these model launches ill have the desired impact.

This is especially true considering increased competition in the EV marketplace, most notably from lower cost Chinese competitors in markets outside of the US. Given this more competitive market, TSLA may need to do more than simply compete on price in order to steal a march on other EV makers. On that note, participants will pay close attention to the Q3 FCF metrics, where street expects a relatively lacklustre $1.1bln, as a gauge of how prepared the firm is for such a battle.

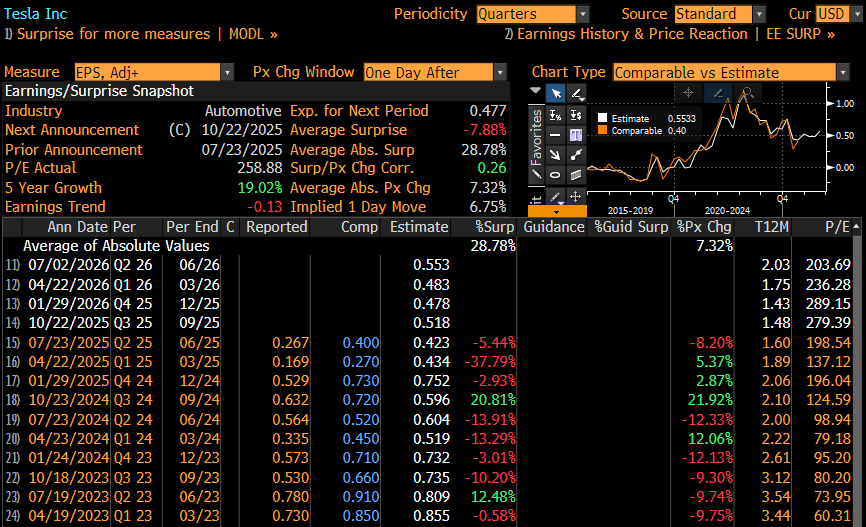

As for the upcoming earnings release, options tied to TSLA stock imply a move of around +/-6.75% in the 24 hours following the print, though it’s important to recall that the immediate post-earnings reaction in TSLA shares tends to bear relatively little resemblance to the figures that the firm delivers. Q1 25 was a prime example of this, where a 40% downside EPS surprise was greeted with a 6% after hours rally in the stock. On that note, TSLA has surprised to the downside of consensus EPS expectations in every quarter bar one since the third quarter of 2023, though as always past performance is no guarantee of future results.

TSLA, at the time of writing, looks set to come into the Q3 report around 12% off the recent highs set in the aftermath of the release of Q3 delivery stats, and below what had proved notable support at 425. To the downside, the mid-September gap higher, and psychological support around the 400 figure is the next notable level, before one looks to the 50-day moving average at 375. To the upside, that 425 figure now stands as resistance, before the October highs at 470, followed by the YTD high/ATH at 485.

_tsla_2025-10-12_09-19-34.jpg)

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.