- English

- 中文版

WHERE WE STAND – A rather famous old market adage is ‘there’s nothing like price to change sentiment’. I might change that a bid, to ‘there’s nothing like a TACO to change sentiment’.

Yes, that’s right, after participants spent the back end of Thursday brushing up on funding markets and fretting (unnecessarily) about the state of US regional banks, a couple of positive trade-related snippets from ‘The Donald’, and signs of easing money market stress stateside, were good to spark a bout of optimism as we moved into the weekend.

Fine, conditions were still incredibly choppy, and yes it wasn’t as if the risk-on vibe that took hold was the most convincing of things that you’re ever going to see, but at least participants appear to no longer be pointlessly worrying about insignificant financial institutions that nobody has ever heard of, and re-focusing on what remains a constructive setup for risk assets as we move towards year-end.

I’ll get to that in a second, but first just want to touch on the banking sector. Last week’s jitters appeared to stem from a couple of relatively small banks writing off bad loans – one of these was Zions Bancorp, who took a $50mln write-down on a fraudulent loan, but have a $90bln (with a ‘B’!) balance sheet, which at best makes that seem ‘small beer’.

In many ways, those jitters last week were a bit of a ‘perfect storm’, with idiosyncratic loan write-downs coinciding with sizeable funding pressures stemming from the California tax filing deadline, as well as Treasury auction settlements, thus creating notable tightness in funding markets. Said tightness subsided on Friday, with no institutions tapping the Fed’s SRF, while in any case the Fed are alert to the lack of ‘wriggle room’ that they now have, with RRP usage basically zero, and Chair Powell having already flagged that balance sheet run-off will probably wrap up sooner rather than later. December is the base case on that front, though risks skew towards it happening sooner.

Anyway, markets already appeared on surer footing as those fears subsided, before we got a ‘TACO’ for lunch to help steady things up even more. That, of course, came by virtue of comments from President Trump, who continued to dial down the rhetoric in terms of US-China trade tensions, confirming that he will be meeting President Xi in a fortnight, that high tariffs on Chinese goods are ‘not sustainable’, and again noting that things will be ‘fine’ with China in due course. Treasury Sec Bessent confirming he’ll meet his Chinese counterpart this week provided a bit of a helping hand as well.

Given the above, equities on Wall St ended the week in the green, with this rally resulting in the major benchmarks notching a weekly gain, despite what was quite the rollercoaster ride over the last five days. Though conditions have clearly been turbulent, I remain an equity bull, with earnings growth solid, underlying economic growth resilient, the monetary backdrop becoming looser, the present round of trade tensions likely to soon be de-escalated, corporate buybacks being on the verge of resuming, as well as the typical FOMO/FOMU buying into year-end. All that feels like a very powerful force that I’d not want to fight.

Speaking of powerful forces, relentless selling pressure was felt across the precious metals complex as the week wrapped up, with spot gold falling back towards $4,200/oz, and spot silver notching its biggest one-day drop in half a year. It must be said that there wasn’t anything especially obvious to drive these moves, besides perhaps a combination of fading haven demand coupled with an unwind of relatively fresh momentum-based longs, in a market that had undoubtedly come a very long way, in a very short space of time.

I’m not going to sit here and call a ‘top’ in the complex, not least considering that the bull case which has underpinned a 60% YTD gain in gold, and near-80% YTD gain in silver, continues to hold water, amid the risk of inflation expectations un-anchoring, continued runaway DM fiscal spending and, most importantly, incredibly high levels of physical demand. That said, if Friday’s moves were to prove the start of a pullback in this uptrend, you’d initially be looking for support at $4,000/oz in gold, and $50/oz in silver, where I’d be keen to buy into any dips – one to keep on the radar for the week ahead.

Speaking of buying dips, I was reassured by the way in which the dollar not only snapped a 3-day losing run as the week wrapped up, but how the DXY held above both the 50- and 100-day moving averages as well. Although conditions in the G10 FX space have become akin to watching paint dry in recent weeks, the Fed’s ‘run it hot’ approach skews risks towards us returning to the RHS of the ‘dollar smile’ as risks to the US economic outlook increasingly tilt to the upside.

That same approach, though, should tilt risks to Treasuries, especially at the long-end, to the downside as well, however that’s not a call I’d have especially much conviction in for the time being, not least until we can be confident that sentiment is on much steadier footing.

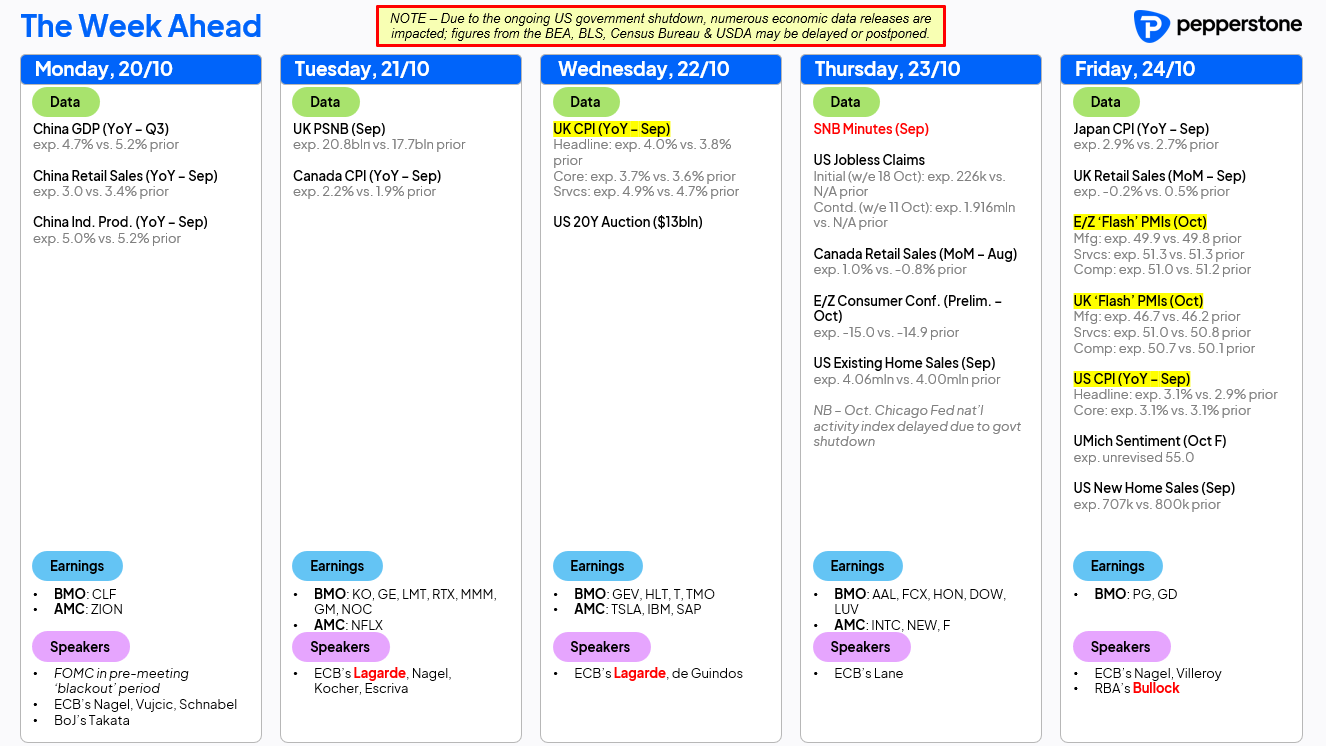

LOOK AHEAD – As the US government shutdown rolls on, the economic calendar remains something of a mess, with market participants continuing, by and large, to operate in a data vacuum.

That said, we will at least get the September US CPI figures this week, with that print on Friday highlighting the data docket. Both headline and core CPI are seen having risen by 3.1% YoY last month, as tariff-induced price pressures continue to make themselves known, though it’s very tough indeed to imagine the data materially altering the Fed policy outlook, with 25bp cuts this month, and in December, effectively locked in amid mounting downside labour market risks.

For those curious, the CPI data is being released due to it being required in calculating the annual Social Security cost of living adjustment, no other BLS-calculated figures will be released until the shutdown comes to an end.

Elsewhere, we also get inflation figures from here in the UK this week, with headline CPI seen having risen to 4.0% YoY in September, and services CPI pushing 5.0% YoY once more. The BoE expect that this will be the peak in price pressures this cycle, though are unlikely to take any more steps to remove policy restriction until they are sure of that fact, meaning my base case is now that the ‘Old Lady’ stands pat until delivering a 25bp cut next February. Meanwhile, ‘flash’ PMIs from pretty much every major economy, as well as Canadian inflation, and US consumer sentiment are also due.

From a policy perspective, the FOMC are now (mercifully!!) in the pre-meeting ‘blackout’ period, though plenty of ECB speakers will fill that particular void. We also receive the first ever set of minutes from an SNB decision this week, where comments on the valuation of the CHF are likely to be of particular interest.

Earnings season also steps up a gear this week, with 90 S&P 500 set to report this week, including notable releases from the likes of Netflix (NFLX), Tesla (TSLA), and Intel (INTC).

Finally, focus will of course also remain on incoming trade and tariff news flow, especially with Treasury Secretary Bessent meeting his Chinese opposite number in Malaysia at some point this week.

As always, the full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.