- English

- 中文版

Markets digest steady NFP as focus shifts to US CPI release

WHERE WE STAND – Friday proved to be a choppy end to a whirlwind week for financial markets, though most assets ended the day as near as makes no difference where they started it; some modest further USD downside, and a bit of a dead cat bounce in the equity space, though little to get especially excited about.

Of course, most attention fell on the February US labour market report, which was close enough to consensus expectations not to cause any particular concern. That said, it wasn’t exactly a blowout report, and certainly won’t be enough on its own to bring the ‘growth scare’ narrative to an end.

Headline nonfarm payrolls rose +151k last month, almost bang in the middle of the comically large +30k to +300k forecast range. Coupled with a modest -2k net revision to the prior two months’ figures, the 3-month moving average of job gains now stands at +200k, well above the breakeven pace, which is likely now around 100k, given the reduced immigration now being seen into the US. Meanwhile, average hourly earnings growth cooled, as expected, to 0.3% MoM, seeing the annual pace also cool a touch, to 4.0% YoY – clearly, the labour market still isn’t a source of considerable upside inflation risk.

The household survey, though, was weaker – unemployment unexpectedly rose to 4.1%, while labour force participation slumped to 62.4%, its lowest level since early-2023. Underemployment (U-6), meanwhile shot higher to 8.0%, from a prior 7.5%. I wouldn’t be over-reacting to these figures, though, as the HH survey has been very volatile this cycle, struggling with a declining survey response rate, and having difficulty in adjusting to the changing composition of the labour force.

Anyway, the jobs report was decent enough, but downside risks to the labour market obviously remain. ‘DOGE’ cuts will begin to negatively impact the payrolls data from the March report onwards, while the ongoing slump in business confidence, and uncertainty surrounding the Trump Administration’s trade policies, are hardly signs that an employment boon is around the corner. Slowdown averted, rather than avoided, it seems.

Speaking of trade, we were treated to another barrage of comments from President Trump on Friday, who noted that reciprocal tariffs on Canada may come as soon as the start of this week, as opposed to the beginning of April, as previously flagged. For those struggling to keep up, that means that Canadian tariffs were imposed on Tuesday, tweaked on Wednesday, delayed on Thursday, then expanded again on Friday.

In that sort of an environment, it is frankly impossible for any market participant to price risk, or to be accurately discounting a future policy path. No surprise, then, that nobody seems to be wanting to touch USD-denominated assets right now, with the S&P 500 having notched a 3-week losing run for the first time since last August, and the DXY having just chalked up its worst week in two-and-a-half years.

Selling rallies in both remains my preferred strategy, particularly with Europe now a viable investable option once more, with governments finally getting their act together on the fiscal front. Incidentally, the common currency last week notched its best week since the GFC, and your scribe is becoming increasingly confident in his “1.10 before parity” view (& bet!) that I took in mid-December.

In any case, the big issue for financial markets right now is not necessarily the Trump Admin’s policies themselves, but the degree of uncertainty associated with them, and the fact that the policies in question change almost as often as the direction of the wind does.

The real ‘Trump put’ would, at this point, be to take the President’s microphone away, throw his phone in the Potomac, and pack him off to play golf for a couple of weeks to let businesses, consumers, and markets, adjust to the new policy regime.

That seems about as likely as pigs flying, though, in all honesty, meaning that headwinds facing the US equity market are only likely to intensify, with the bears retaining the upper hand.

At least, I guess, we don’t have to worry about monetary policy uncertainty for the time being. Fed Chair Powell spoke on Friday, just before the ‘blackout’ period begun, noting that the FOMC “don’t need to hurry”, and that policymakers can wait for greater clarity, with the economy “still in a good place”. Any cuts in the first half of the year seem distinctly unlikely, even if the USD OIS curve does fully discount the next 25bp cut by June.

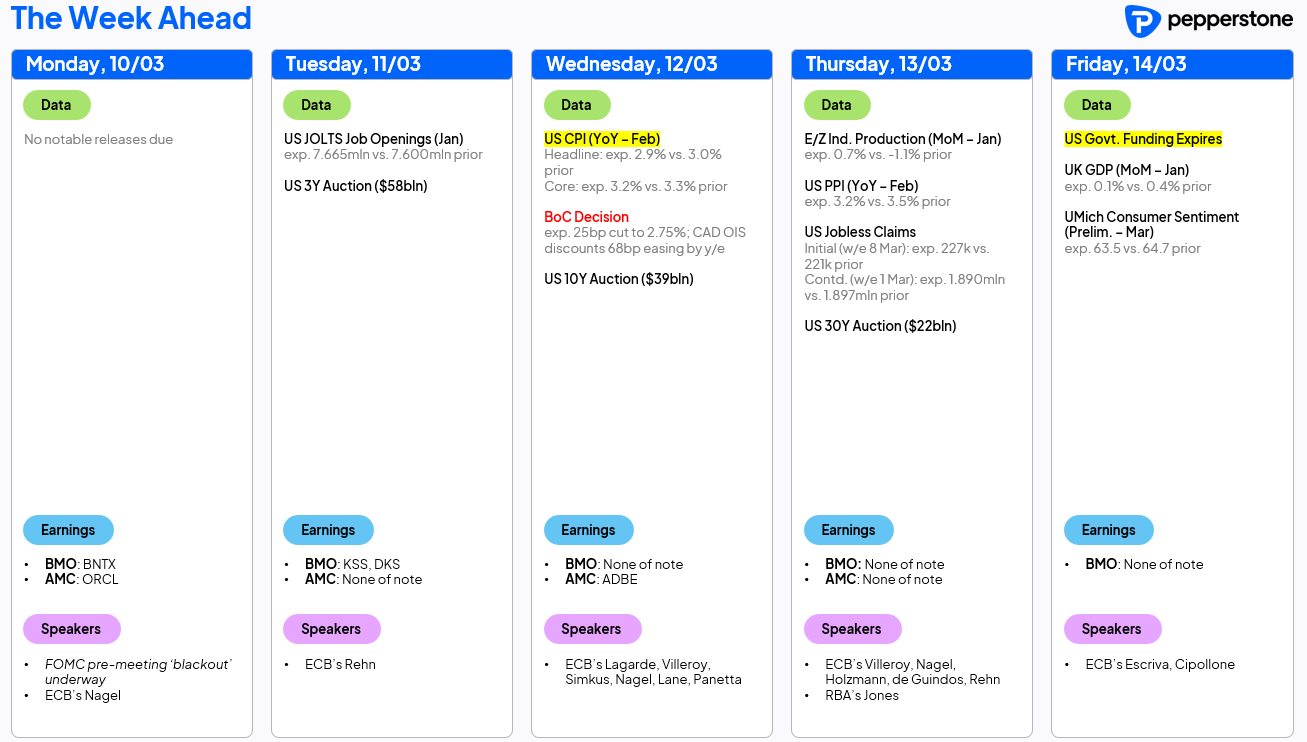

LOOK AHEAD – We’re feeding off scraps a bit this week, at least in terms of scheduled events.

Wednesday’s US CPI print is the obvious data highlight, with both headline and core inflation set to cool a touch, though it’s difficult to envisage the figures materially impacting the FOMC policy outlook.

Besides that, there’s little to get our teeth into. The BoC will probably deliver a 25bp cut on Wednesday, though trade and tariffs remain a much bigger issue for the loonie, than anything that Macklem & Co. might get up to. A busy week of US supply awaits, while there’s also the potential for a government shutdown on Friday if Congress fail to pass a fresh spending bill.

On this side of the pond, some second-tier eurozone data will likely be ignored, while ECB speakers will try their hardest to keep their options open for the April meeting, where a pause in the easing cycle is increasingly likely with the deposit rate having now reached the top end of the range within which neutral might lie. Here in the UK, Friday’s GDP data is set to show a meagre pace of growth having been eked out in January.

Lastly, a housekeeping note – US clocks shifted forwards this weekend, leaving the London-NY time difference as 4 hours for the next three weeks, until our own clocks go forwards at the end of the month. Spring is, finally, on its way, and even the London weather is playing ball!

The full week ahead calendar is below.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.