- English

- 中文版

Silver Surges to an All-Time High as Physical Shortages Deepen

Technically, silver has been overbought since September, and while the momentum has been relentless, sellers are starting to emerge, increasing the risk of broader profit-taking. Many traders are eyeing opportunities to buy into weakness, but the ongoing bull trend could face a setback if we see a daily close below $50.01 (Monday’s low) or $49.80 (the April 2011 high). A close below the 5-day EMA would also signal a potential shift in bullish momentum and could lead to more volatile, whippy price action.

From Central Banks to Momentum Traders What began as a move driven by central bank reserve accumulation and concerns over future U.S. deficits has evolved through several phases — from an institutional portfolio rotation to a momentum-driven rally, and now to mounting concerns about physical silver shortages. This progression reflects how silver’s narrative has broadened — from macro-thematic allocation to outright supply-demand tension, now dominating market psychology.

Liquidity Tightens as Policy and Demand Collide

Silver remains far less liquid than gold and continues to fall under Trump’s Section 232 review of critical minerals and potential import tariffs — a list from which gold has since been removed. At the same time, soaring demand from India has intensified the global rush to secure whatever physical supply remains available. Reports of a scarcity in India has seen Indian silver futures trade to a strong premium to other futures exchanges.

Exploding Lease Rates and a Self-Reinforcing Short Squeeze

One-month silver lease rates have surged to 33%, underscoring the escalating cost of borrowing physical silver. Traders rolling short positions are being squeezed aggressively, amplifying an already powerful short squeeze dynamic.

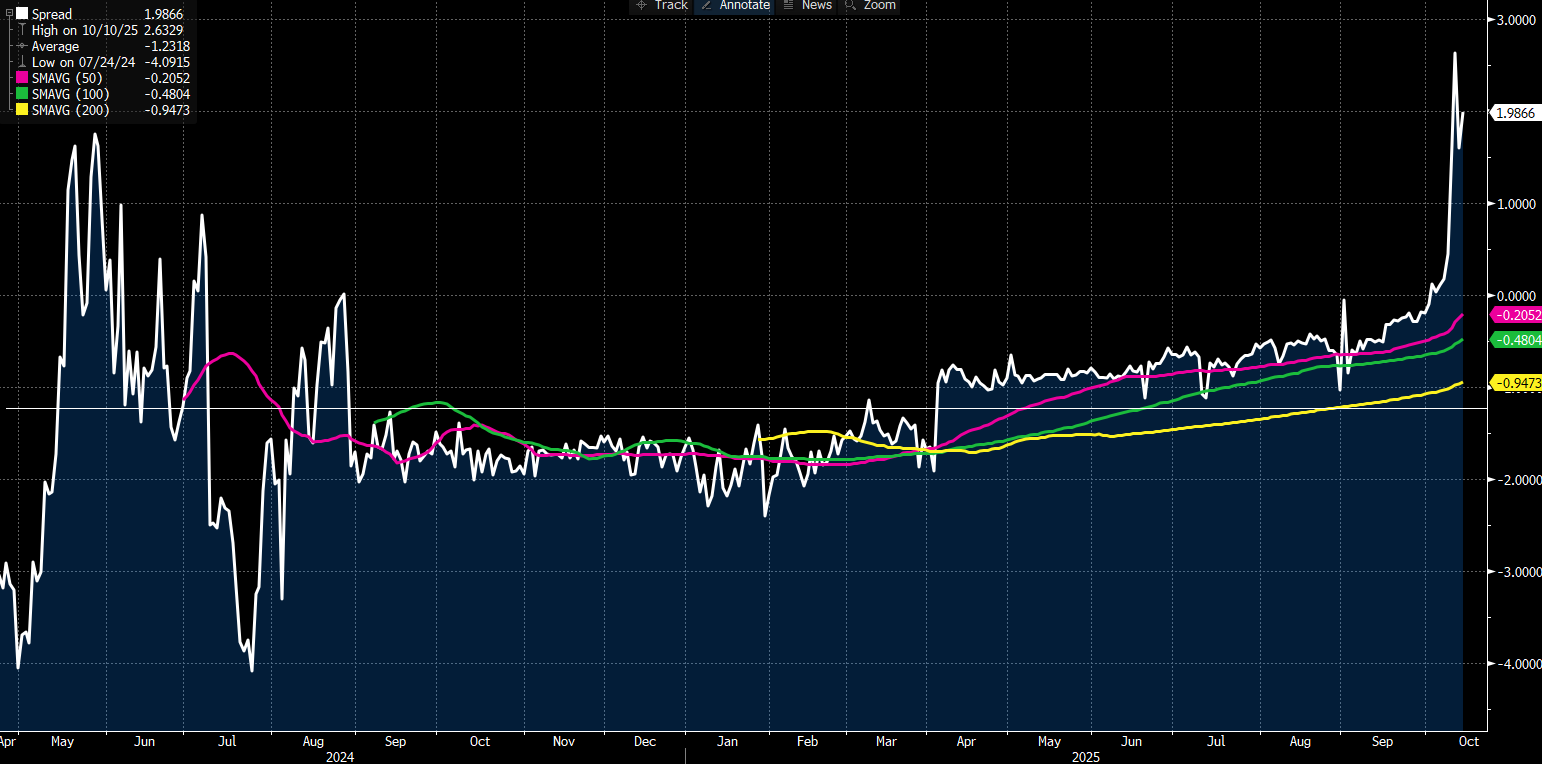

This shortage is also reflected in the premium between spot and COMEX futures. Last week, the spread blew out to $2.63, before narrowing to $1.98. While that retracement seems steep, it’s noteworthy that spot silver typically trades at a discount to front-month futures — highlighting just how extreme current supply stress has become.

Reports of Physical Supply Exhaustion

Adding to the strain, reports suggest that the Perth Mint in Western Australia has run dry of physical silver and temporarily suspended sales. This development has only deepened market anxiety about the true extent of available global inventory.

ETF Market Strains Amplify the Bullish Case

The silver ETF market is also showing cracks. Several ETF providers have halted new inflows, unable to source sufficient physical metal to keep their funds’ prices in line with net asset value (NAV). The SLV ETF reportedly had to purchase 15,000 tonnes of silver last week alone to meet investor demand. If concerns grow about the ability of ETFs to function efficiently, fear of limited accessibility — rather than speculation — could drive silver even higher.

In Summary:

A Rally Fueled by Scarcity and Sentiment Silver’s rally has evolved through multiple distinct phases and now appears driven by genuine supply scarcity. While it’s difficult to chase a market this hot — and positioning is clearly crowded — further upside remains plausible. Should lease rates continue to climb and inefficiencies expand across the futures and ETF markets, XAGUSD could enter a new, even more explosive leg higher — underscoring that in today’s environment, scarcity itself has become the most powerful catalyst of all.

The material provided here has not been prepared in accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.